Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c. Based on the findings in parts (a) and (b), which alternative is more attractive? (Select the best choice below.) A. The loan from the

c. Based on the findings in parts (a) and (b), which alternative is more attractive? (Select the best choice below.)

A. The loan from the bank at an APR of 13% compounded monthly. B. The loan from the finance company at an APR of 12% compounded annually.

Please solve step by step all the sections that need to be answered in the question.

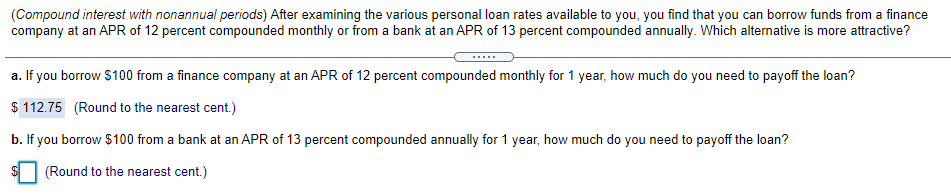

(Compound interest with nonannual periods) After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at an APR of 12 percent compounded monthly or from a bank at an APR of 13 percent compounded annually. Which alternative is more attractive? a. If you borrow $100 from a finance company at an APR of 12 percent compounded monthly for 1 year, how much do you need to payoff the loan? $ 112.75 (Round to the nearest cent.) b. If you borrow $100 from a bank at an APR of 13 percent compounded annually for 1 year, how much do you need to payoff the loan? (Round to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started