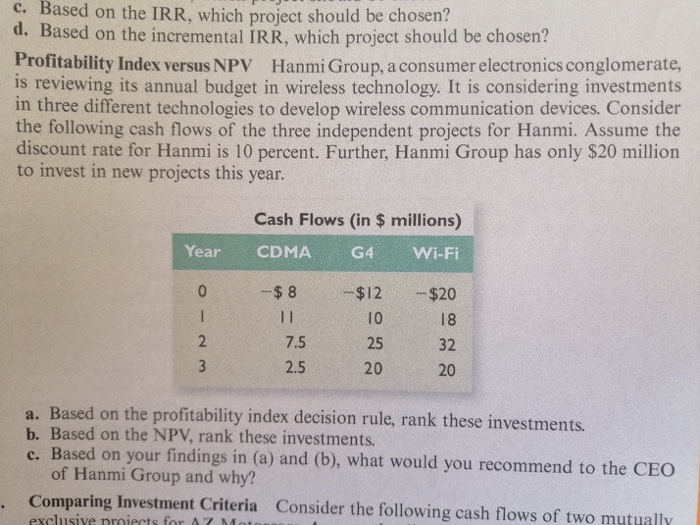

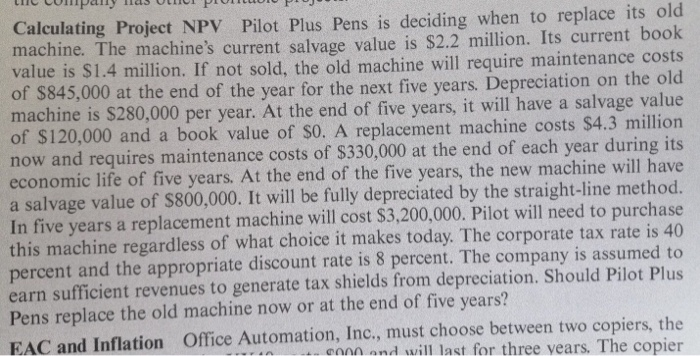

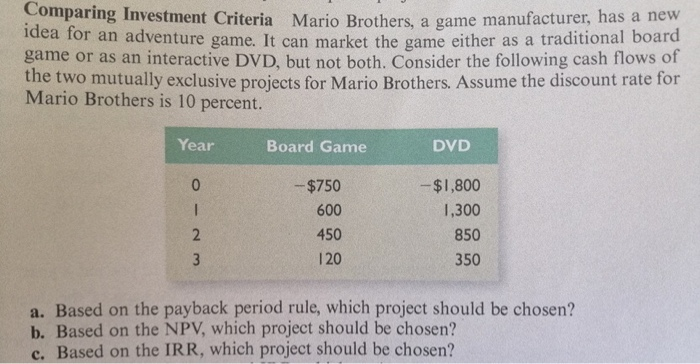

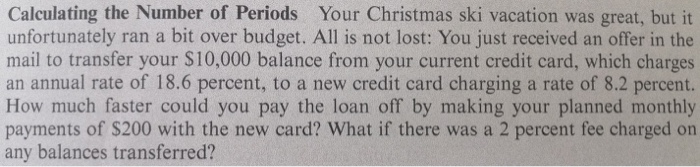

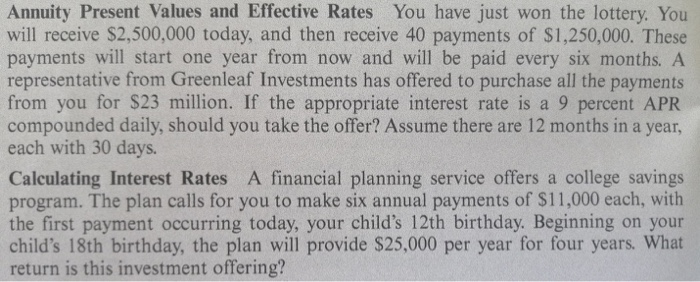

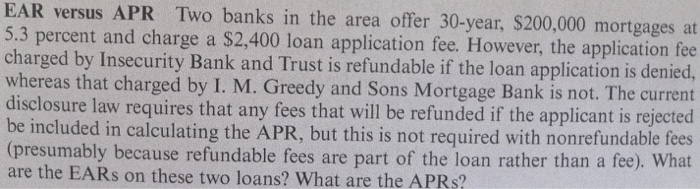

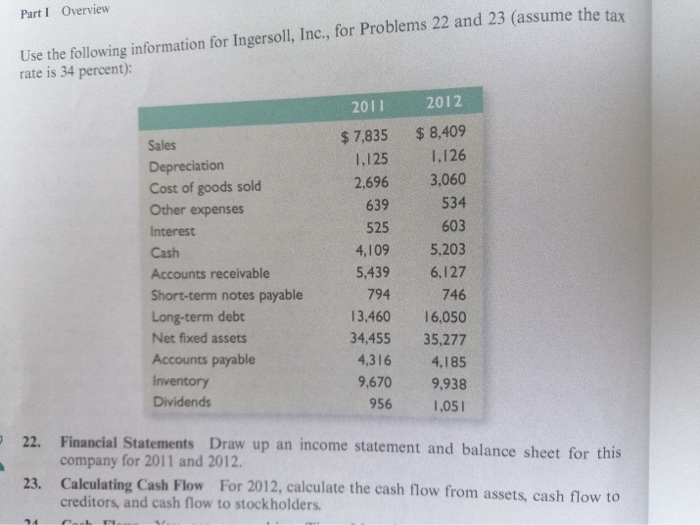

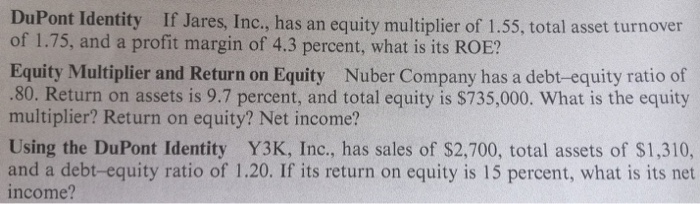

c. Based on the IRR, which project should be chosen? d. Based on the incremental IRR, which project should be chosen? Profitability Index versus NPV Hanmi Group, a consumer electronics conglomerate, is reviewing its annual budget in wireless technology. It is considering investments in three different technologies to develop wireless communication devices. Consider the following cash flows of the three independent projects for Hanmi. Assume the discount rate for Hanmi is 10 percent. Further, Hanmi Group has only $20 million to invest in new projects this year. Cash Flows (in $ millions) CDMA G4 Wi-Fi Year -$ 8 IV o-am $12 10 25 20 - $20 18 32 20 7.5 2.5 a. Based on the profitability index decision rule, rank these investments. b. Based on the NPV, rank these investments. c. Based on your findings in (a) and (b), what would you recommend to the CEO of Hanmi Group and why? Comparing Investment Criteria Consider the following cash flows of two mutually exclusive nroiects for A7 Mot Calculating Project NPV Pilot Plus Pens is deciding when to replace its old machine. The machine's current salvage value is $2.2 million. Its current book value is $1.4 million. If not sold, the old machine will require maintenance costs of $845,000 at the end of the year for the next five years. Depreciation on the old machine is $280,000 per year. At the end of five years, it will have a salvage value of $120,000 and a book value of $0. A replacement machine costs $4.3 million now and requires maintenance costs of $330,000 at the end of each year during its economic life of five years. At the end of the five years, the new machine will have a salvage value of $800,000. It will be fully depreciated by the straight-line method. In five years a replacement machine will cost $3,200,000. Pilot will need to purchase this machine regardless of what choice it makes today. The corporate tax rate is 40 percent and the appropriate discount rate is 8 percent. The company is assumed to earn sufficient revenues to generate tax shields from depreciation. Should Pilot Plus Pens replace the old machine now or at the end of five years? EAC and Inflation Office Automation, Inc., must choose between two copiers, the con and will last for three years The conier caring Investment Criteria Mario Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional game or as an interactive DVD, but not both. Consider the following cash flows of the two mutually exclusive projects for Mario Brothers. Assume the discount rate for Mario Brothers is 10 percent. Year Board Game e DVD $750 WN - o 600 450 -$1,800 1,300 850 350 120 a. Based on the payback period rule, which project should be chosen? b. Based on the NPV, which project should be chosen? c. Based on the IRR, which project should be chosen? Calculating the Number of Periods Your Christmas ski vacation was great, but it! unfortunately ran a bit over budget. All is not lost: You just received an offer in the mail to transfer your $10,000 balance from your current credit card, which charges an annual rate of 18.6 percent, to a new credit card charging a rate of 8.2 percent. How much faster could you pay the loan off by making your planned monthly payments of $200 with the new card? What if there was a 2 percent fee charged on any balances transferred? Annuity Present Values and Effective Rates You have just won the lottery. You will receive $2,500,000 today, and then receive 40 payments of $1,250,000. These payments will start one year from now and will be paid every six months. A representative from Greenleaf Investments has offered to purchase all the payments from you for $23 million. If the appropriate interest rate is a 9 percent APR compounded daily, should you take the offer? Assume there are 12 months in a year, each with 30 days. Calculating Interest Rates A financial planning service offers a college savings program. The plan calls for you to make six annual payments of $11,000 each, with the first payment occurring today, your child's 12th birthday. Beginning on your child's 18th birthday, the plan will provide $25,000 per year for four years. What return is this investment offering? EAR versus APR Two banks in the area offer 30-year, $200,000 mortgages at 5.3 percent and charge a $2,400 loan application fee. However, the application fee charged by Insecurity Bank and Trust is refundable if the loan application is denied, whereas that charged by I. M. Greedy and Sons Mortgage Bank is not. The current disclosure law requires that any fees that will be refunded if the applicant is rejected be included in calculating the APR, but this is not required with nonrefundable fees (presumably because refundable fees are part of the loan rather than a fee). What are the EARs on these two loans? What are the APRs?! Part 1 Overview Use the following information for Ingersoll, Inc., for Problems 22 and 23 (assume the tax rate is 34 percent): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2011 $7,835 1.125 2,696 639 525 4,109 5,439 794 13,460 34,455 4,316 9,670 2012 $ 8,409 1.126 3,060 534 603 5,203 6,127 746 16,050 35,277 4,185 9,938 1.051 956 22. Financial Statements Draw up an income statement and balance sheet for this company for 2011 and 2012. Calculating Cash Flow For 2012, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. Ceph DuPont Identity If Jares, Inc., has an equity multiplier of 1.55, total asset turnover of 1.75, and a profit margin of 4.3 percent, what is its ROE? Equity Multiplier and Return on Equity Nuber Company has a debt-equity ratio of .80. Return on assets is 9.7 percent, and total equity is $735,000. What is the equity multiplier? Return on equity? Net income? Using the DuPont Identity Y3K, Inc., has sales of $2,700, total assets of $1,310, and a debt-equity ratio of 1.20. If its return on equity is 15 percent, what is its net income? wel three Al now with a retiremen first payment received 30 years ike to purchase a cabin in Rivendell i hird, after he passes on at the end of the inheritance of $1,000,000 to his inth for the next 10 years. If he 8 percent EAR after he retires, objectives. I'113, TIU $23.000 per month for 20 years, with the first pay and 1 month from now. Second, he would like to purchase 10 vears at an estimated cost of $320,000. Third, after 20 vears of withdrawals, he would like to leave an inheritance nephew Frodo. He can afford to save $2,100 per month for the can earn an 11 percent EAR before he retires and an 8 percent FA how much will he have to save each month in Years 11 through 302 Calculating Annuity Values After deciding to buy a new car, you can either lease the car or purchase it with a three-year loan. The car you wish to buy costs $31.000 The dealer has a special leasing arrangement where you pay $1,500 today and $405 per month for the next three years. If you purchase the car, you will pay it off in monthly payments over the next three years at an APR of 6 percent. You believe that you will be able to sell the car for $20,000 in three years. Should you buy or lease the car? What break-even resale price in three years would make you between buying and leasing? Calculating Annuity Values An All-Pro defensive lineman is in con The team has offered the following salary structure: nemanis in contract negotiations Time Salary Agency Problems Who owns a corporation? Describe the process whereby the owners control the firm's management. What is the main reason that an agency relationship exists in the corporate form of organization? In this context, what kinds of problems can arise? Not-for-Profit Firm Goals Suppose you were the financial manager of a not-for- profit business (a not-for-profit hospital, perhaps). What kinds of goals do you think would be appropriate? Goal of the Firm Evaluate the following statement: Managers should not focus on the current stock value because doing so will lead to an overemphasis on short-term profits at the expense of long-term profits. Agency Problems Suppose you own stock in a company. The current price per share is $25. Another company has just announced that it wants to buy your company and will pay $35 per share to acquire all the outstanding stock. Your company's management immediately begins fighting off this hostile bid. Is management acting in the shareholders' best interests? Why or why not? Agency Problems and Corporate Ownership Corporate ownership varies around the world. Historically, individuals have owned the majority of shares in public corporations in the United States. In Germany and Japan, however, banks, other large financial institutions, and other companies own most of the stock in public corporations. Do you think agency problems are likely to be more or less severe in Germany and Japan than in the United States? Calculating Project NPV Pilot Plus Pens is deciding when to replace its old machine. The machine's current salvage value is $2.2 million. Its current book value is $1.4 million. If not sold, the old machine will require maintenance costs of $845,000 at the end of the year for the next five years. Depreciation on the old machine is $280,000 per year. At the end of five years, it will have a salvage value of $120,000 and a book value of $0. A replacement machine costs $4.3 million now and requires maintenance costs of $330,000 at the end of each year during its economic life of five years. At the end of the five years, the new machine will have a salvage value of $800,000. It will be fully depreciated by the straight-line method. In five years a replacement machine will cost $3,200,000. Pilot will need to purchase this machine regardless of what choice it makes today. The corporate tax rate is 40 percent and the appropriate discount rate is 8 percent. The company is assumed to earn sufficient revenues to generate tax shields from depreciation. Should Pilot Plus Pens replace the old machine now or at the end of five years? EAC and Inflation Office Automation, Inc., must choose between two copiers, the con and will last for three years The conier Ethics and Firm Goals Can the goal of maximizing the value of the stock conflict with other goals, such as avoiding unethical or illegal behavior? In particular, do you think subjects like customer and employee safety, the environment, and the general good of society fit in this framework, or are they essentially ignored? Think of some specific scenarios to illustrate your