Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c. Based on your calculations above, answer the following: 1) Did the company acquire or dispose of assets in net terms? 2) What activities of

c. Based on your calculations above, answer the following:

1) Did the company acquire or dispose of assets in net terms?

2) What activities of the companies generated cash (if any), what activities burned cash (if any)?

3) How much dividends did the company pay in 2010?

4) Did the company have a net increase in working capital or a net decrease in working from 2009 to 2010?

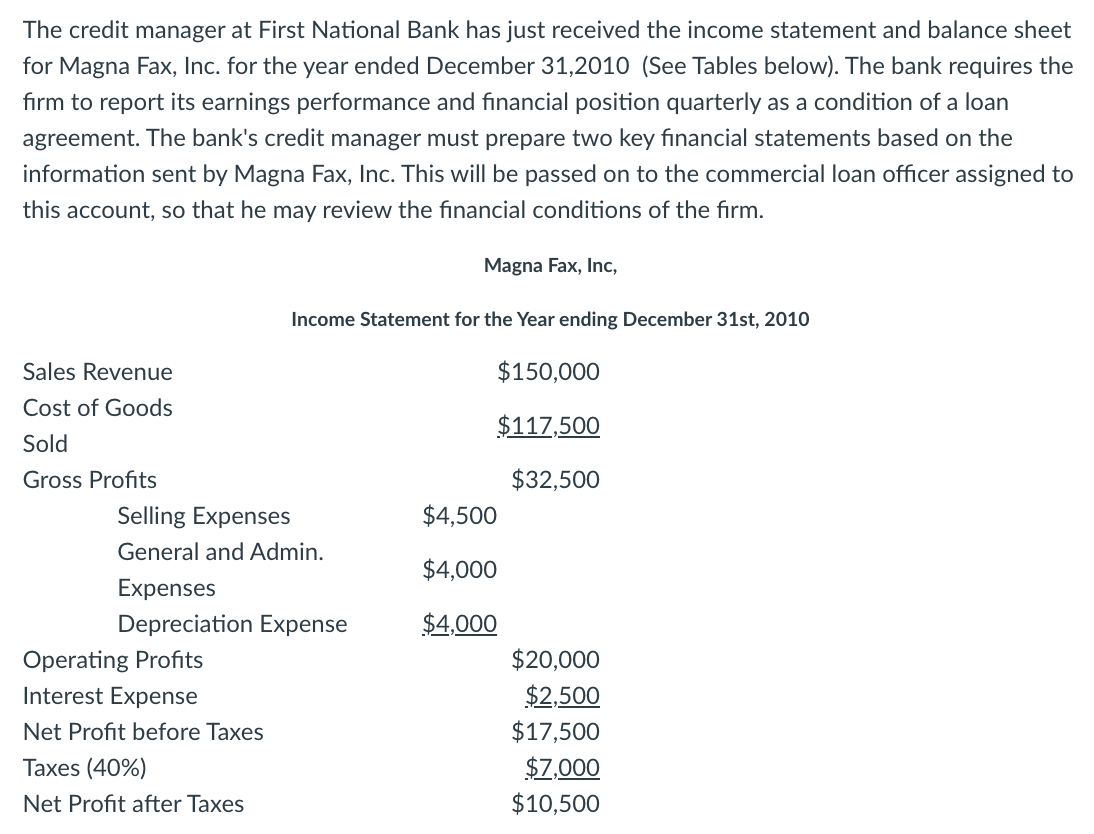

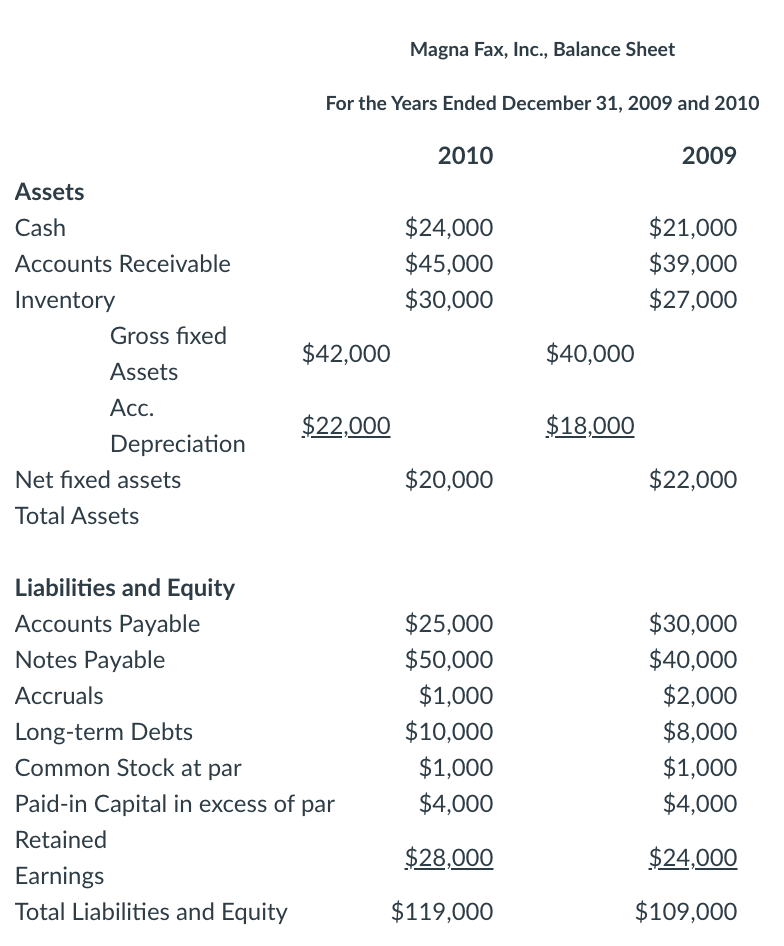

The credit manager at First National Bank has just received the income statement and balance sheet for Magna Fax, Inc. for the year ended December 31,2010 (See Tables below). The bank requires the firm to report its earnings performance and financial position quarterly as a condition of a loan agreement. The bank's credit manager must prepare two key financial statements based on the information sent by Magna Fax, Inc. This will be passed on to the commercial loan officer assigned to this account, so that he may review the financial conditions of the firm. Magna Fax, Inc., Balance Sheet Liabilities and Equity AccountsPayableNotesPayableAccrualsLong-termDebtsCommonStockatparPaid-inCapitalinexcessofparRetainedEarningsTotalLiabilitiesandEquity$25,000$50,000$1,000$10,000$1,000$4,000$28,000$119,000$190$30,000$40,000$2,000$8,000$1,000$4,000$24,000$109,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started