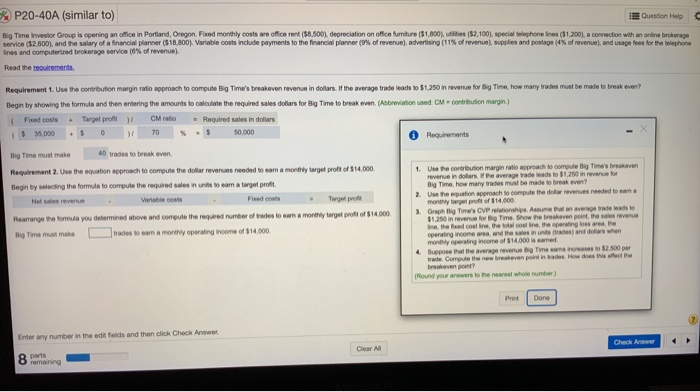

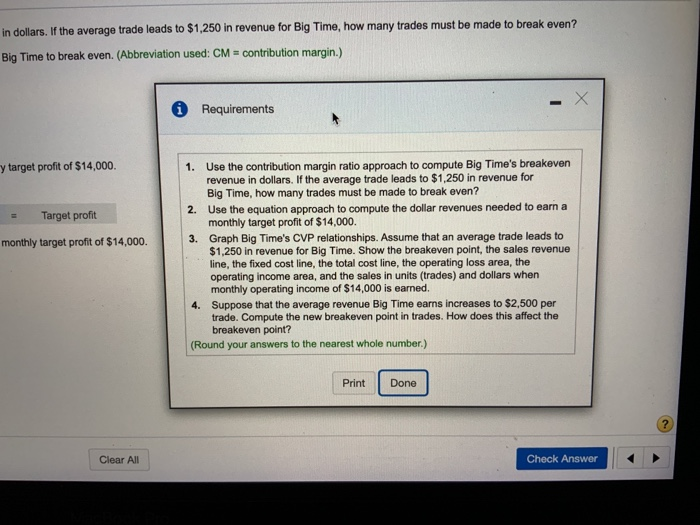

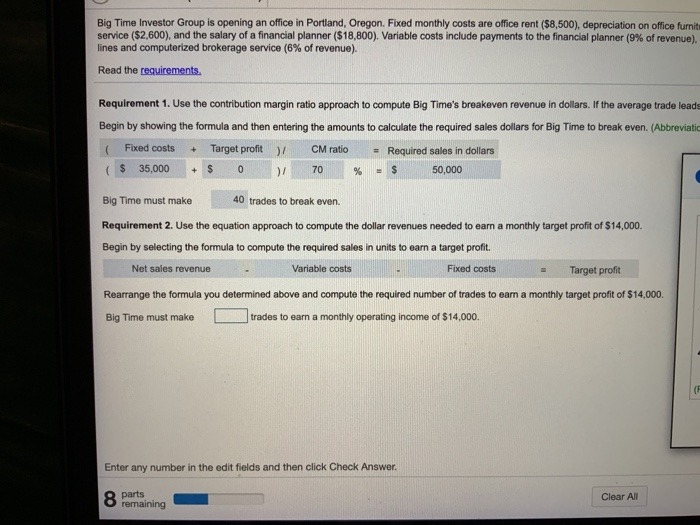

C BP20-40A (similar to) Question Help Big Time Investor Group is opening an office in Portland, Oregon. Fwed monthly costs are office rent ($8,500), depreciation on office fumiture (51,800), i (52,100), special phone lines (51.200), a connection with an ordine brokerage service (52.600), and the salary of a financial planner ($18.800). Variable costs include payments to the financial planner (9% of revenue), advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone lines and computerized brokerage service 10% of revenue). Read the requirements Requirement 1. Use the contribution margin roto approach to compute Big Time's breakeven revenue in dollars. If the average trade leads to 1.250 in revenue for Big Time, how many trades must be made to break even? Begin by showing the forma and then entering the amounts to calculate the required sales dollars for Big Time to break even (Abbreviation used: CM contribution margin) Feed costs + Target profit) CM ratio - Required sales in dollars $ 35,000 + S 0 37 70 50,000 Requirements Big Time must make 40 traces to break even Requirement 2. Use the equation approach to compute the dollar revenues needed to com a monthly target profit of $14.000 1. Use contribution margin ratio approach to compute Big Time's breakeven Begin by selecting the forma to compute the required sales in units to eam a target profit revenue in dollars the average trade leads to $1,250 in revenue for Big Time, how many trades must be made to break even? Notes revenue Variable costs Freedois 2. Use the equation approach to compute the del revenues needed to com a montageprofit of $14,000 Rearrange the fomula you determined above and compute the required number of desto sam a monthly target groft of 14.000 3. Orlig Time's CVP renships. Asume a average rade leads to $1,250 in revenue for me. Show the brave point, the revers Big Time make trades to com a monthly operating incom In the feed cost in the cost in the spring oss are the operating income and the sales in de and do when monly operating income of $14.000 is earned 4. Supose that the average revenue Big Time camins to $2,500 per trade Compute the new breakeven point in den How does is where breakiven point? Round your answers to the nearest whole number) Print Done En any number in the defids and then click Check Answer Check Answer Clear 8 parts remaining in dollars. If the average trade leads to $1,250 in revenue for Big Time, how many trades must be made to break even? Big Time to break even. (Abbreviation used: CM = contribution margin.) Requirements y target profit of $14,000. Target profit monthly target profit of $14,000. 1. Use the contribution margin ratio approach to compute Big Time's breakeven revenue in dollars. If the average trade leads to $1,250 in revenue for Big Time, how many trades must be made to break even? 2. Use the equation approach to compute the dollar revenues needed to earn a monthly target profit of $14,000. 3. Graph Big Time's CVP relationships. Assume that an average trade leads to $1,250 in revenue for Big Time. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, the operating income area, and the sales in units (trades) and dollars when monthly operating income of $14,000 is earned 4. Suppose that the average revenue Big Time earns increases to $2,500 per trade. Compute the new breakeven point in trades. How does this affect the breakeven point? (Round your answers to the nearest whole number.) Print Done ? Clear All Check Answer Big Time Investor Group is opening an office in Portland, Oregon. Fixed monthly costs are office rent ($8,500), depreciation on office furnitu service ($2,600), and the salary of a financial planner ($18,800). Variable costs include payments to the financial planner (9% of revenue). lines and computerized brokerage service (6% of revenue). Read the requirements Requirement 1. Use the contribution margin ratio approach to compute Big Time's breakeven revenue in dollars. If the average trade leade Begin by showing the formula and then entering the amounts to calculate the required sales dollars for Big Time to break even. (Abbreviatic Target profit) = Required sales in dollars $ 35,000 )/ % - $ Fixed costs CM ratio + $ 0 70 50,000 Big Time must make 40 trades to break even. Requirement 2. Use the equation approach to compute the dollar revenues needed to earn a monthly target profit of $14,000. Begin by selecting the formula to compute the required sales in units to earn a target profit. Net sales revenue Variable costs Target profit Rearrange the formula you determined above and compute the required number of trades to earn a monthly target profit of $14,000 Big Time must make trades to earn a monthly operating income of $14,000. Fixed costs Enter any number in the edit fields and then click Check Answer. 8 parts Clear All remaining