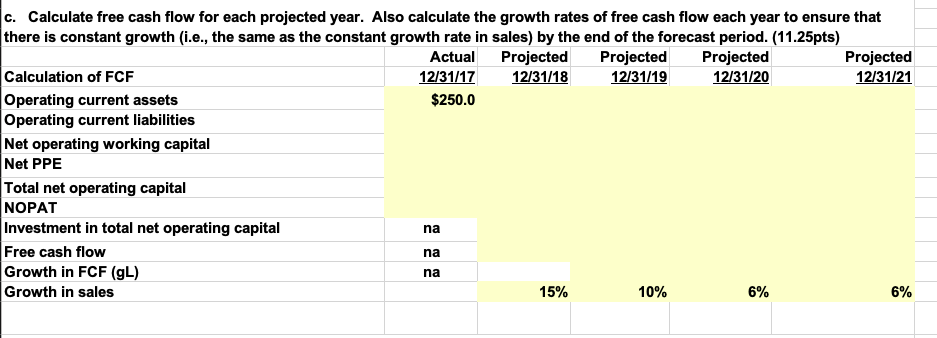

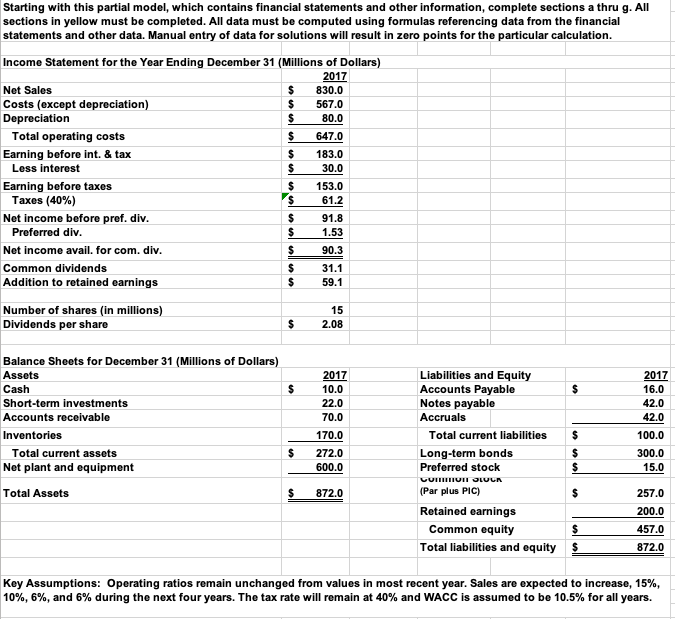

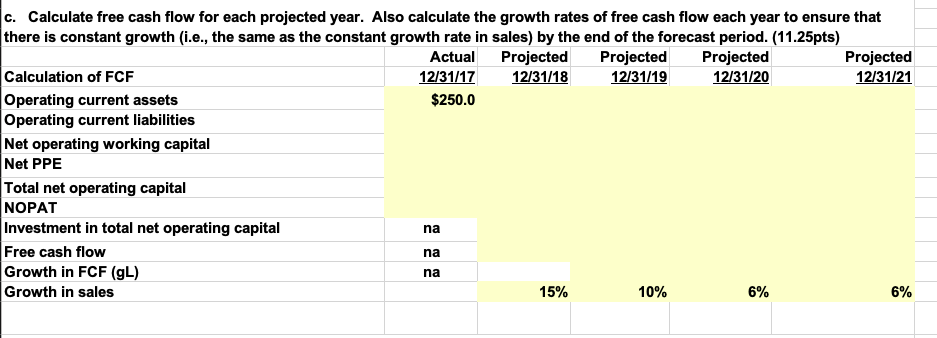

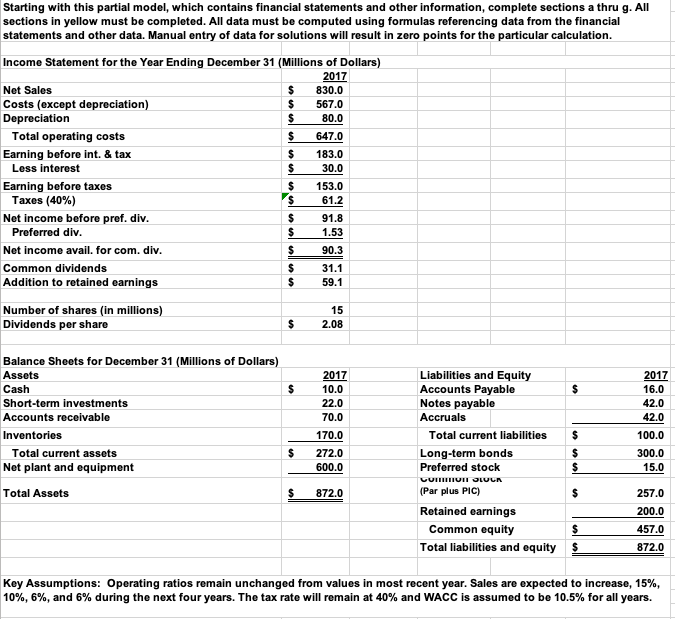

c. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that |there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the forecast period. (11.25pts) Actual Projected 12/31/18 Projected 12/31/19 Projected 12/31/20 Projected 12/31/21 Calculation of FCF Operating current assets Operating current liabilities Net operating working capital Net PPE Total net operating capital NOPAT Investment in total net operating capital Free cash flow Growth in FCF (gL) Growth in sales 12/31/17 $250.0 na na na 6% 15% 10% 6% Starting with this partial model, which contains financial statements and other information, complete sections a thru g. All sections in yellow must be completed. All data must be computed using formulas referencing data from the financial statements and other data. Manual entry of data for solutions will result in zero points for the particular calculation Income Statement for the Year Ending December 31 (Millions of Dollars) 2017 S Net Sales 830.0 S 567.0 Costs (except depreciation) Depreciation 80.0 647.0 Total operating costs Earning before int. & tax S 183.0 S Less interest 30.0 S Earning before taxes Taxes (40%) 153.0 S 61.2 Net income before pref. div. Preferred div. S 91.8 1.53 S Net income avail. for com. div. 90.3 S Common dividends 31.1 Addition to retained earnings S 59.1 Number of shares (in millions) Dividends per share 15 S 2.08 Balance Sheets for December 31 (Millions of Dollars) Liabilities and Equity Accounts Payable Notes payable Assets 2017 2017 S Cash S 10.0 16.0 Short-term investments 22.0 42.0 Accounts receivable 70.0 Accruals 42,0 S Inventories 170.0 Total current liabilities 100.0 Total current assets Net plant and equipment Long-term bonds 272.0 300.0 S 600.0 Preferred stock 15.0 (Par plus PIC) Total Assets 872.0 257.0 Retained earnings 200.0 Common equity 457.0 Total liabilities and equity S 872.0 Key Assumptions: Operating ratios remain unchanged from values in most recent year. Sales are expected to increase, 15%, 10%, 6%, and 6% during the next four years. The tax rate will remain at 40% and WACC is assumed to be 10.5% for all years. c. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that |there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the forecast period. (11.25pts) Actual Projected 12/31/18 Projected 12/31/19 Projected 12/31/20 Projected 12/31/21 Calculation of FCF Operating current assets Operating current liabilities Net operating working capital Net PPE Total net operating capital NOPAT Investment in total net operating capital Free cash flow Growth in FCF (gL) Growth in sales 12/31/17 $250.0 na na na 6% 15% 10% 6% Starting with this partial model, which contains financial statements and other information, complete sections a thru g. All sections in yellow must be completed. All data must be computed using formulas referencing data from the financial statements and other data. Manual entry of data for solutions will result in zero points for the particular calculation Income Statement for the Year Ending December 31 (Millions of Dollars) 2017 S Net Sales 830.0 S 567.0 Costs (except depreciation) Depreciation 80.0 647.0 Total operating costs Earning before int. & tax S 183.0 S Less interest 30.0 S Earning before taxes Taxes (40%) 153.0 S 61.2 Net income before pref. div. Preferred div. S 91.8 1.53 S Net income avail. for com. div. 90.3 S Common dividends 31.1 Addition to retained earnings S 59.1 Number of shares (in millions) Dividends per share 15 S 2.08 Balance Sheets for December 31 (Millions of Dollars) Liabilities and Equity Accounts Payable Notes payable Assets 2017 2017 S Cash S 10.0 16.0 Short-term investments 22.0 42.0 Accounts receivable 70.0 Accruals 42,0 S Inventories 170.0 Total current liabilities 100.0 Total current assets Net plant and equipment Long-term bonds 272.0 300.0 S 600.0 Preferred stock 15.0 (Par plus PIC) Total Assets 872.0 257.0 Retained earnings 200.0 Common equity 457.0 Total liabilities and equity S 872.0 Key Assumptions: Operating ratios remain unchanged from values in most recent year. Sales are expected to increase, 15%, 10%, 6%, and 6% during the next four years. The tax rate will remain at 40% and WACC is assumed to be 10.5% for all years