Answered step by step

Verified Expert Solution

Question

1 Approved Answer

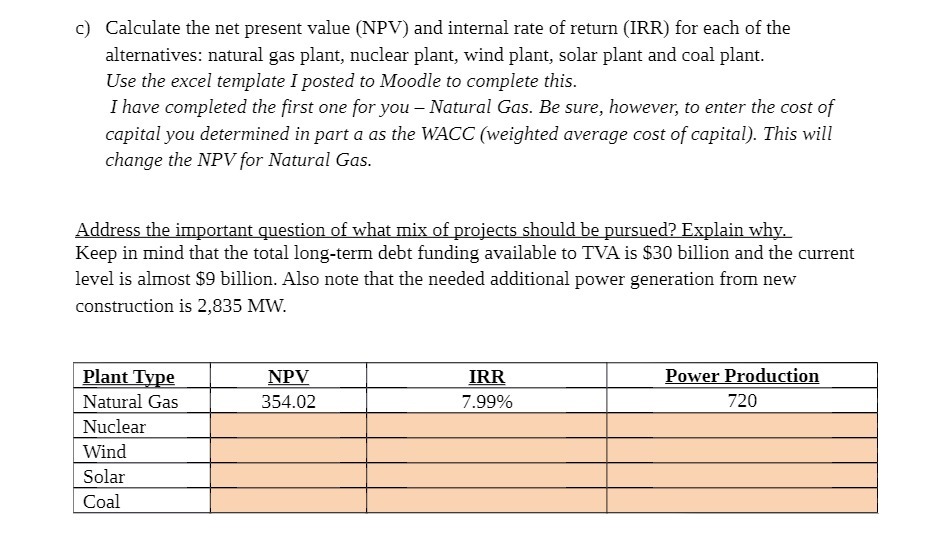

c) Calculate the net present value (NPV) and internal rate of return (IRR) for each of the alternatives: natural gas plant, nuclear plant, wind

c) Calculate the net present value (NPV) and internal rate of return (IRR) for each of the alternatives: natural gas plant, nuclear plant, wind plant, solar plant and coal plant. Use the excel template I posted to Moodle to complete this. I have completed the first one for you - Natural Gas. Be sure, however, to enter the cost of capital you determined in part a as the WACC (weighted average cost of capital). This will change the NPV for Natural Gas. Address the important question of what mix of projects should be pursued? Explain why. Keep in mind that the total long-term debt funding available to TVA is $30 billion and the current level is almost $9 billion. Also note that the needed additional power generation from new construction is 2,835 MW. Plant Type NPV IRR Power Production Natural Gas 354.02 7.99% 720 Nuclear Wind Solar Coal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started