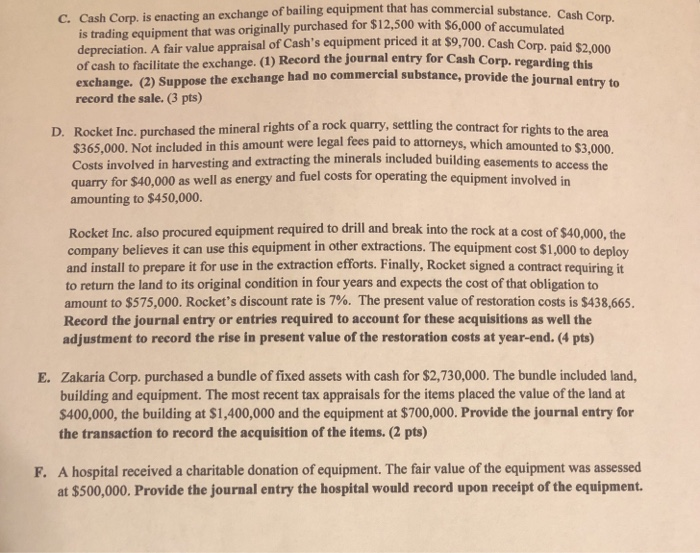

C. Cash Corp. is enacting an exchange of bailing equipment that has commercial substance. Cash Corp. is trading equipment that was originally purchased for $12,500 with $6,000 of accumulated depreciation. A fair value appraisal of Cash's equipment priced it at $9,700. Cash Corp. paid $2,000 of cash to facilitate the exchange. (1) Record the journal entry for Cash Corp. regarding this exchange. (2) Suppose the exchange had no commercial substance, provide the journal entry to record the sale. (3 pts) D. Rocket Inc. purchased the mineral rights of a rock quarry, settling the contract for rights to the area $365,000. Not included in this amount were legal fees paid to attorneys, which amounted to $3,000. Costs involved in harvesting and extracting the minerals included building easements to access the quarry for $40,000 as well as energy and fuel costs for operating the equipment involved in amounting to $450,000. Rocket Inc. also procured equipment required to drill and break into the rock at a cost of $40,000, the company believes it can use this equipment in other extractions. The equipment cost $1,000 to deploy and install to prepare it for use in the extraction efforts. Finally, Rocket signed a contract requiring it to return the land to its original condition in four years and expects the cost of that obligation to amount to $575,00o. Rocket's discount rate is 7%. The present value of restoration costs is $438,665. Record the journal entry or entries required to account for these acquisitions as well the adjustment to record the rise in present value of the restoration costs at year-end. (4 pts) E. Zakaria Corp. purchased a bundle of fixed assets with cash for $2,730,000. The bundle included land, building and equipment. The most recent tax appraisals for the items placed the value of the land at $400,000, the building at $1,400,000 and the equipment at $700,000. Provide the journal entry for the transaction to record the acquisition of the items. (2 pts) F.A hospital received a charitable donation of equipment. The fair value of the equipment was assessed at $500,000. Provide the journal entry the hospital would record upon receipt of the equipment. C. Cash Corp. is enacting an exchange of bailing equipment that has commercial substance. Cash Corp. is trading equipment that was originally purchased for $12,500 with $6,000 of accumulated depreciation. A fair value appraisal of Cash's equipment priced it at $9,700. Cash Corp. paid $2,000 of cash to facilitate the exchange. (1) Record the journal entry for Cash Corp. regarding this exchange. (2) Suppose the exchange had no commercial substance, provide the journal entry to record the sale. (3 pts) D. Rocket Inc. purchased the mineral rights of a rock quarry, settling the contract for rights to the area $365,000. Not included in this amount were legal fees paid to attorneys, which amounted to $3,000. Costs involved in harvesting and extracting the minerals included building easements to access the quarry for $40,000 as well as energy and fuel costs for operating the equipment involved in amounting to $450,000. Rocket Inc. also procured equipment required to drill and break into the rock at a cost of $40,000, the company believes it can use this equipment in other extractions. The equipment cost $1,000 to deploy and install to prepare it for use in the extraction efforts. Finally, Rocket signed a contract requiring it to return the land to its original condition in four years and expects the cost of that obligation to amount to $575,00o. Rocket's discount rate is 7%. The present value of restoration costs is $438,665. Record the journal entry or entries required to account for these acquisitions as well the adjustment to record the rise in present value of the restoration costs at year-end. (4 pts) E. Zakaria Corp. purchased a bundle of fixed assets with cash for $2,730,000. The bundle included land, building and equipment. The most recent tax appraisals for the items placed the value of the land at $400,000, the building at $1,400,000 and the equipment at $700,000. Provide the journal entry for the transaction to record the acquisition of the items. (2 pts) F.A hospital received a charitable donation of equipment. The fair value of the equipment was assessed at $500,000. Provide the journal entry the hospital would record upon receipt of the equipment