Answered step by step

Verified Expert Solution

Question

1 Approved Answer

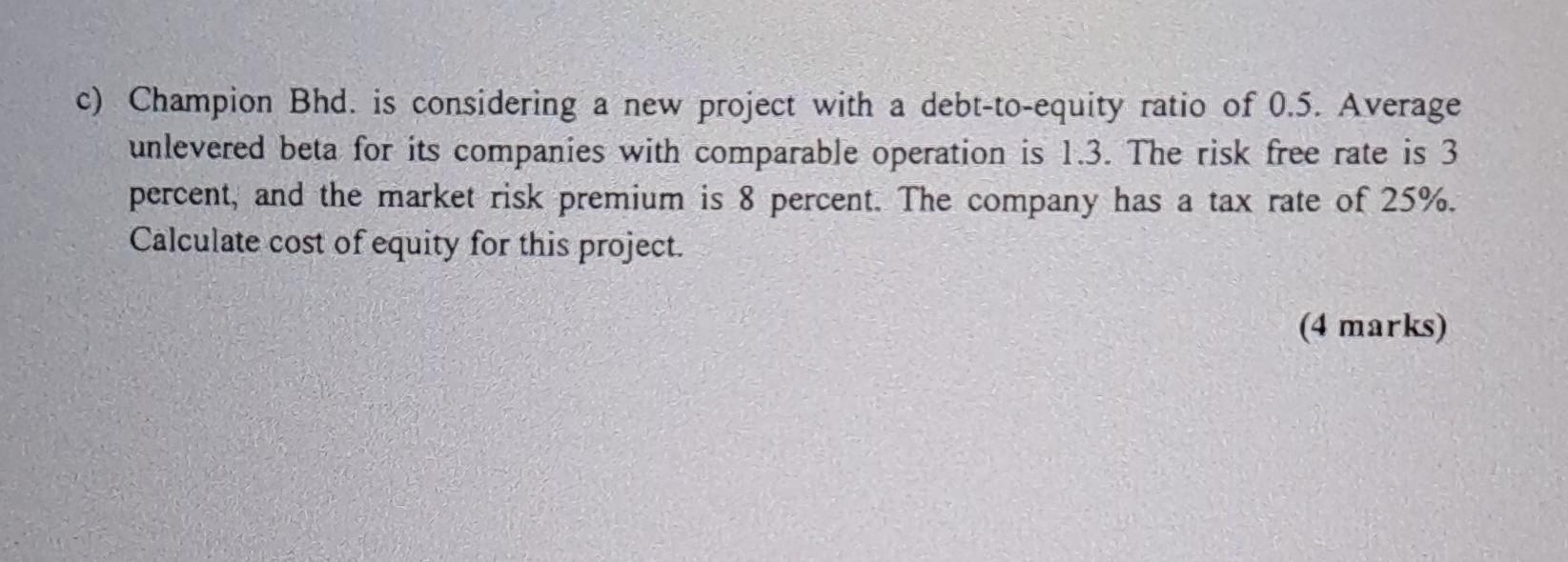

c) Champion Bhd. is considering a new project with a debt-to-equity ratio of 0.5 . Average unlevered beta for its companies with comparable operation is

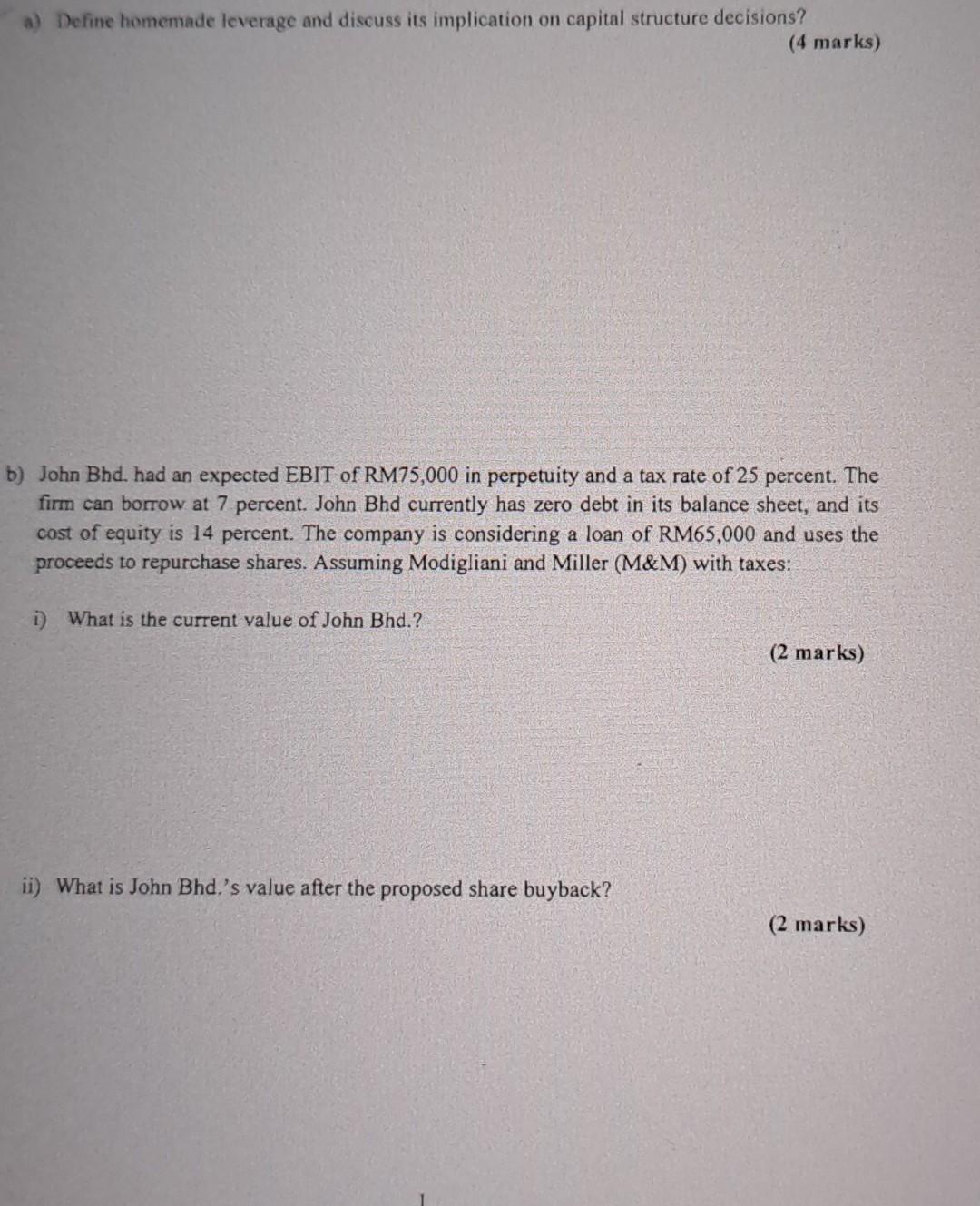

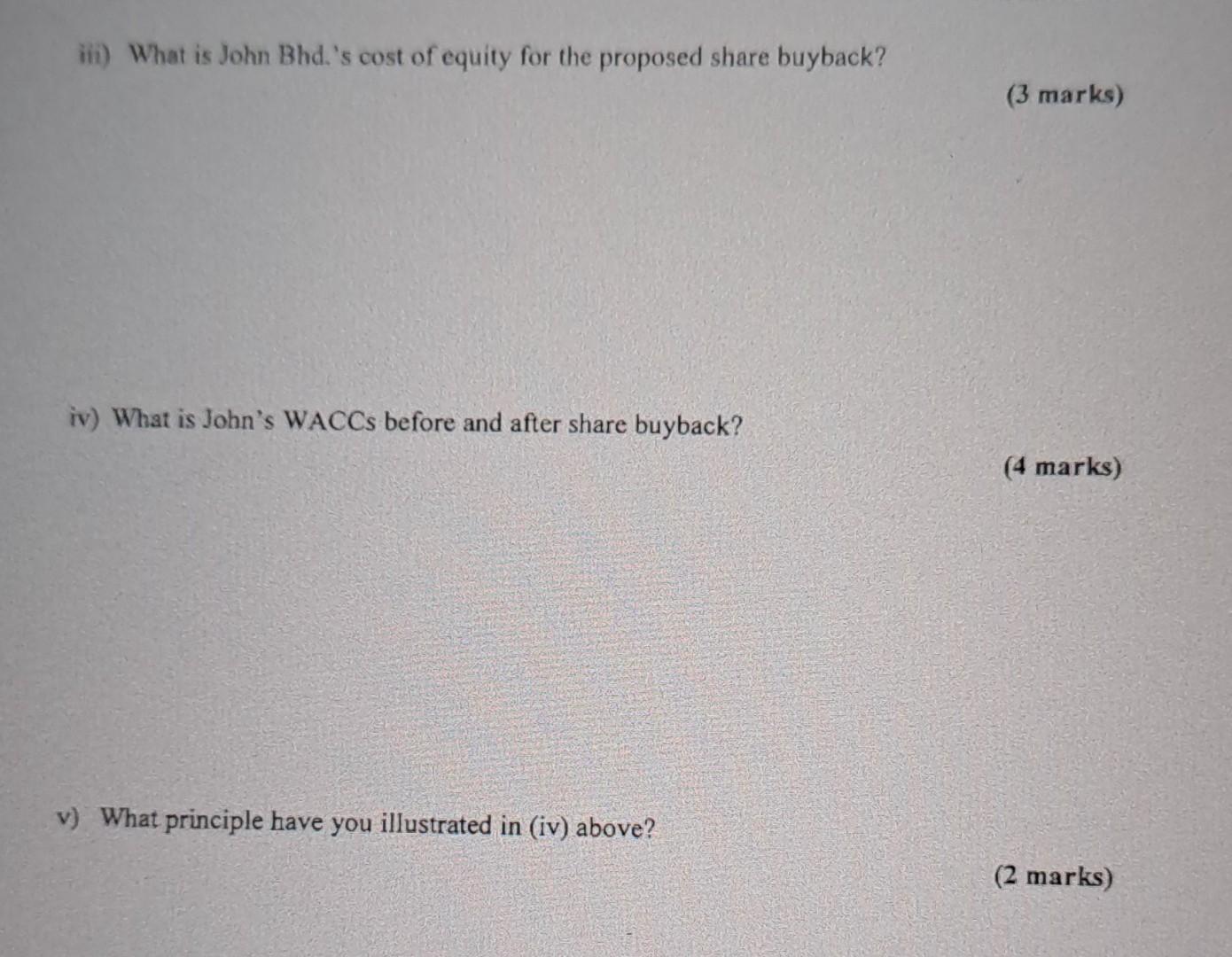

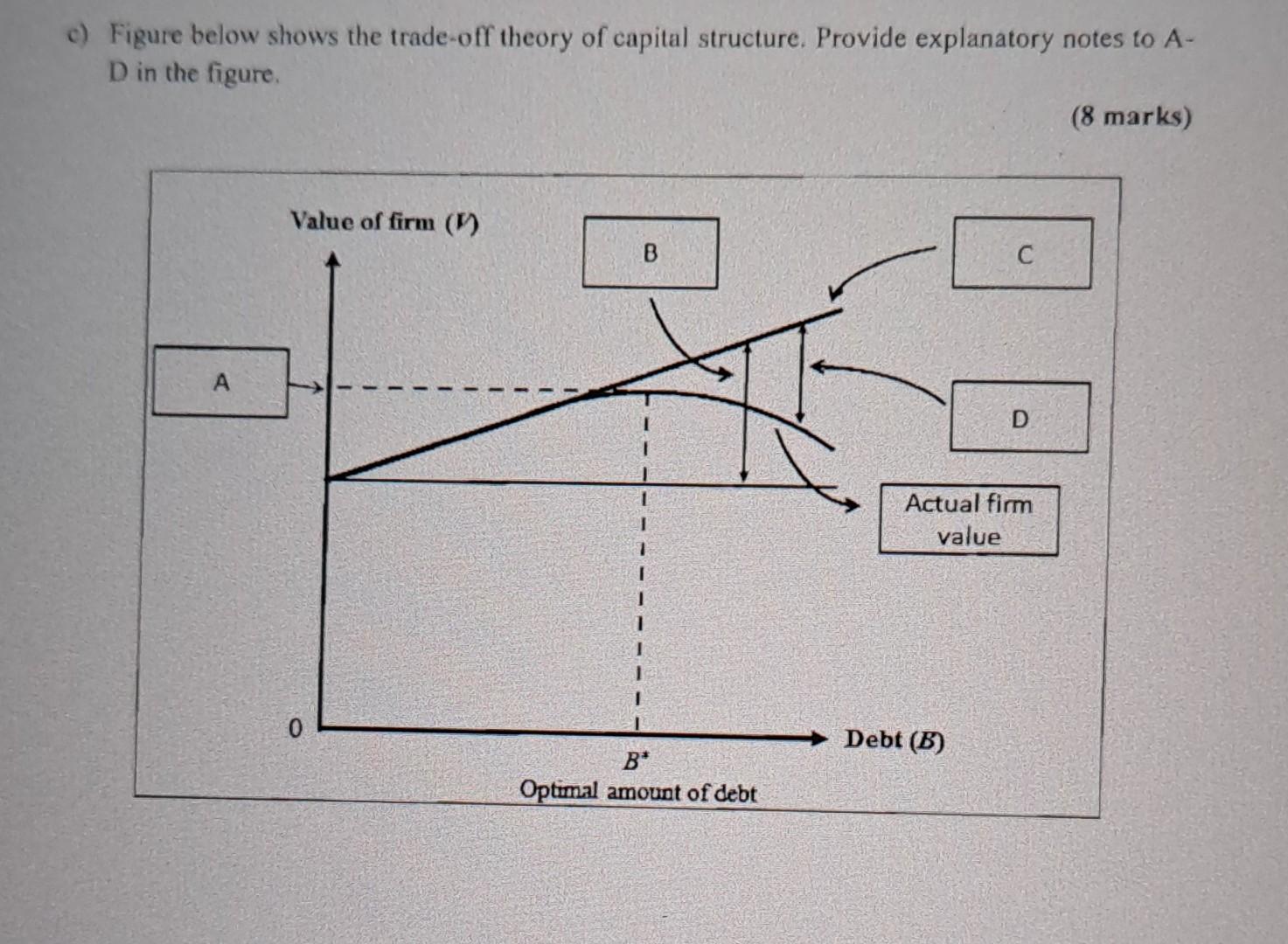

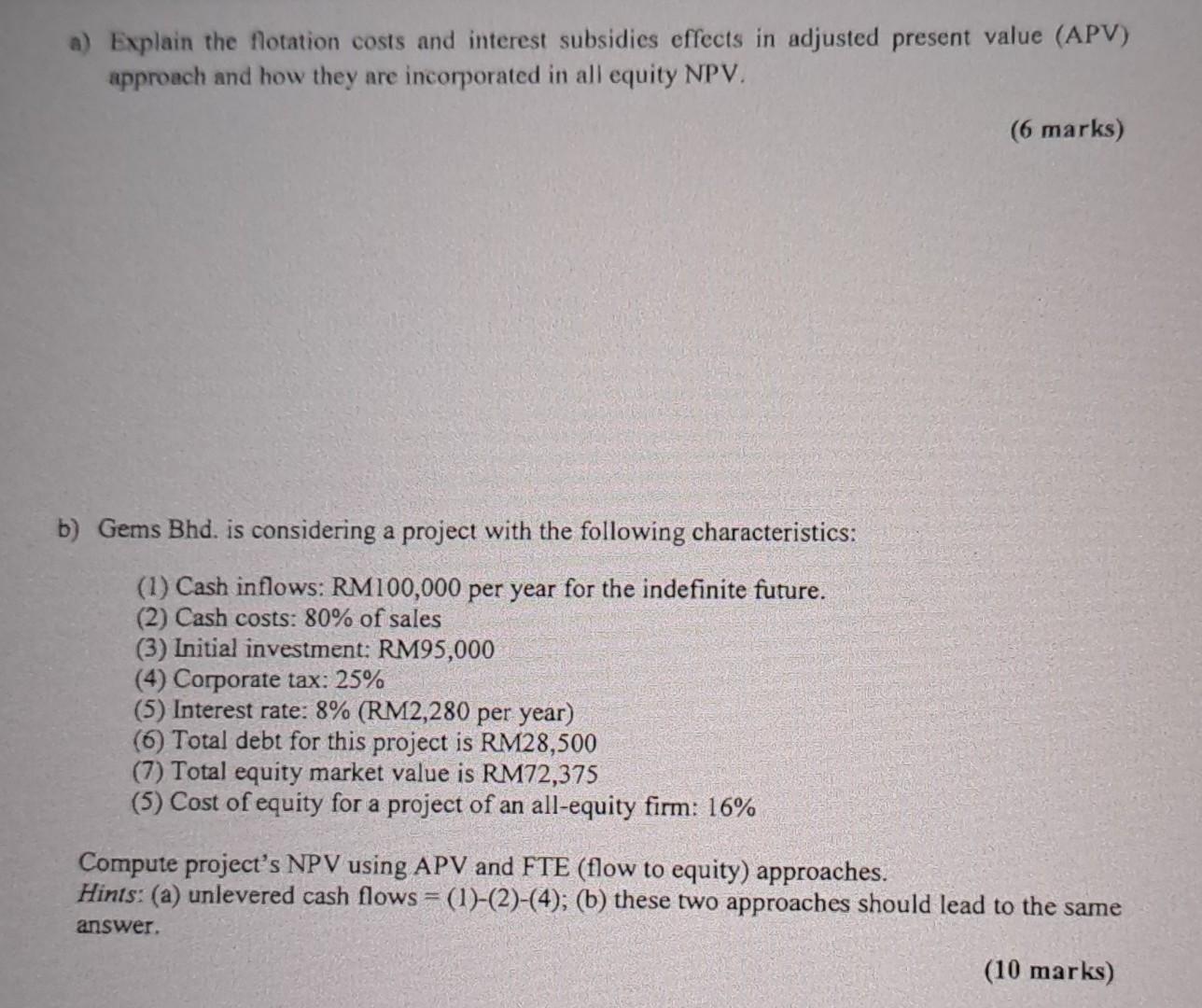

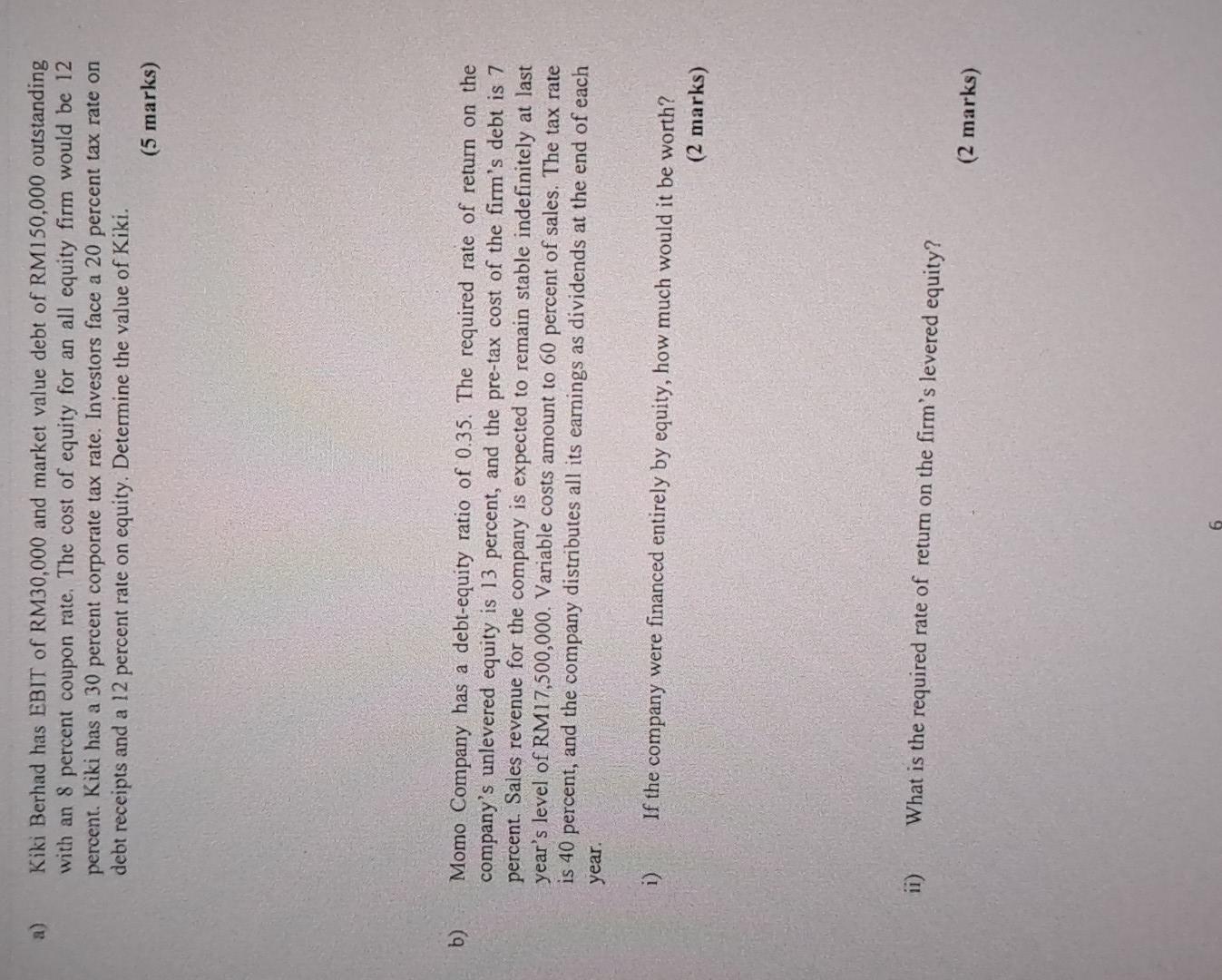

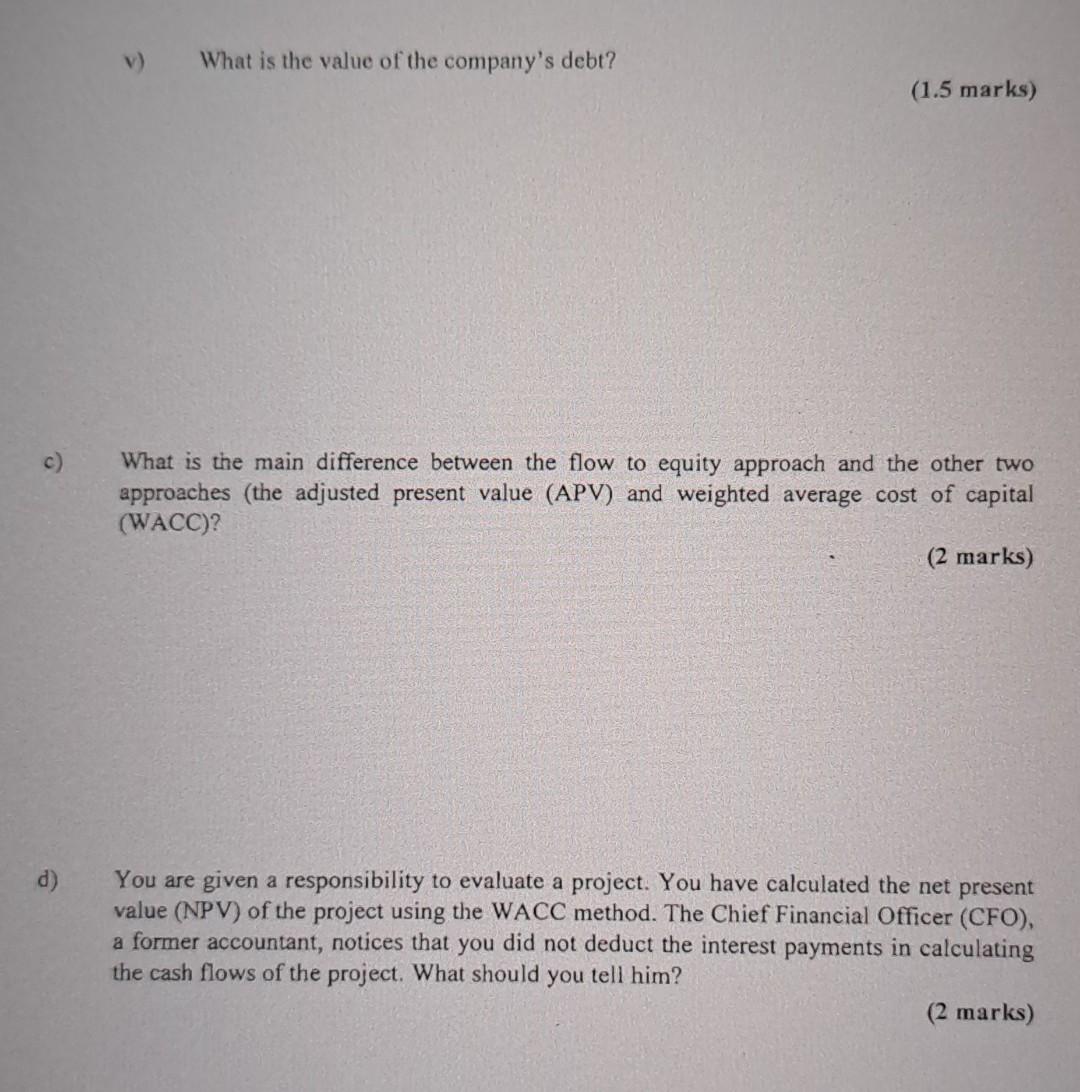

c) Champion Bhd. is considering a new project with a debt-to-equity ratio of 0.5 . Average unlevered beta for its companies with comparable operation is 1.3 . The risk free rate is 3 percent, and the market risk premium is 8 percent. The company has a tax rate of 25%. Calculate cost of equity for this project. a) Define homemade leverage and discuss its implication on capital structure decisions? (4 marks) b) John Bhd. had an expected EBIT of RM75,000 in perpetuity and a tax rate of 25 percent. The firm can borrow at 7 percent. John Bhd currently has zero debt in its balance sheet, and its cost of equity is 14 percent. The company is considering a loan of RM65,000 and uses the proceeds to repurchase shares. Assuming Modigliani and Miller (M\&M) with taxes: i) What is the current value of John Bhd.? (2 marks) ii) What is John Bhd.'s value after the proposed share buyback? Kiki Berhad has EBIT of RM30,000 and market value debt of RM150,000 outstanding with an 8 percent coupon rate. The cost of equity for an all equity firm would be 12 percent. Kiki has a 30 percent corporate tax rate. Investors face a 20 percent tax rate on debt receipts and a 12 percent rate on equity. Determine the value of Kiki. (5 marks) Momo Company has a debt-equity ratio of 0.35 . The required rate of return on the company's unlevered equity is 13 percent, and the pre-tax cost of the firm's debt is 7 percent. Sales revenue for the company is expected to remain stable indefinitely at last year's level of RM17,500,000. Variable costs amount to 60 percent of sales. The tax rate is 40 percent, and the company distributes all its earnings as dividends at the end of each year. i) If the company were financed entirely by equity, how much would it be worth? (2 marks) ii) What is the required rate of return on the firm's levered equity? iii) What is John Bhd.'s cost of equity for the proposed share buyback? (3 marks) iv) What is John's WACCs before and after share buyback? (4 marks) v) What principle have you illustrated in (iv) above? (2 marks) v) What is the value of the company's debt? (1.5 marks) c) What is the main difference between the flow to equity approach and the other two approaches (the adjusted present value (APV) and weighted average cost of capital (WACC)? (2 marks) d) You are given a responsibility to evaluate a project. You have calculated the net present value (NPV) of the project using the WACC method. The Chief Financial Officer (CFO), a former accountant, notices that you did not deduct the interest payments in calculating the cash flows of the project. What should you tell him? (2 marks) c) Figure below shows the trade-off theory of capital structure. Provide explanatory notes to AD in the figure. iii) Use the weighted average cost of capital (WACC) method to calculate the value of the company. (4 marks) iv) What is the value of the company's equity? (1.5 marks) a) Explain the flotation costs and interest subsidies effects in adjusted present value (APV) approach and how they are incorporated in all equity NPV. (6 marks) b) Gems Bhd. is considering a project with the following characteristics: (1) Cash inflows: RM100,000 per year for the indefinite future. (2) Cash costs: 80% of sales (3) Initial investment: RM95,000 (4) Corporate tax: 25% (5) Interest rate: 8%(RM2,280 per year) (6) Total debt for this project is RM28,500 (7) Total equity market value is RM72,375 (5) Cost of equity for a project of an all-equity firm: 16% Compute project's NPV using APV and FTE (flow to equity) approaches. Hints: (a) unlevered cash flows =(1)-(2)-(4); (b) these two approaches should lead to the same answer. (10 marks) v) What is the value of the company's debt? (1.5 marks) What is the main difference between the flow to equity approach and the other two approaches (the adjusted present value (APV) and weighted average cost of capital (WACC)? (2 marks) You are given a responsibility to evaluate a project. You have calculated the net present value (NPV) of the project using the WACC method. The Chief Financial Officer (CFO), a former accountant, notices that you did not deduct the interest payments in calculating the cash flows of the project. What should you tell him? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started