Question

c. Change the tenor period to 60 months (5 Years) and generate the monthly spreadsheet. Clue: Divide the annual repayment amount above in the answer

c. Change the tenor period to 60 months (5 Years) and generate the monthly spreadsheet. Clue: Divide the annual repayment amount above in the answer to question (b) by 12 to obtain the monthly payments and generate the spreadsheet. d. Do you think Shaikha should borrow on a fixed interest rate or variable (floating) interest rate across the entire loan repayment period? Why or why not? e. Why is it advantageous (disadvantageous) at times to borrow on a fixed interest rate? Why is it advantageous (disadvantageous) at times to borrow on a variable (floating) interest rate? f. Assuming that Shaikas credit rating is A. What can Shaikha do to ensure that she obtains a loan from (car loan financing bank name) at a much lower interest rate than provided in the market?

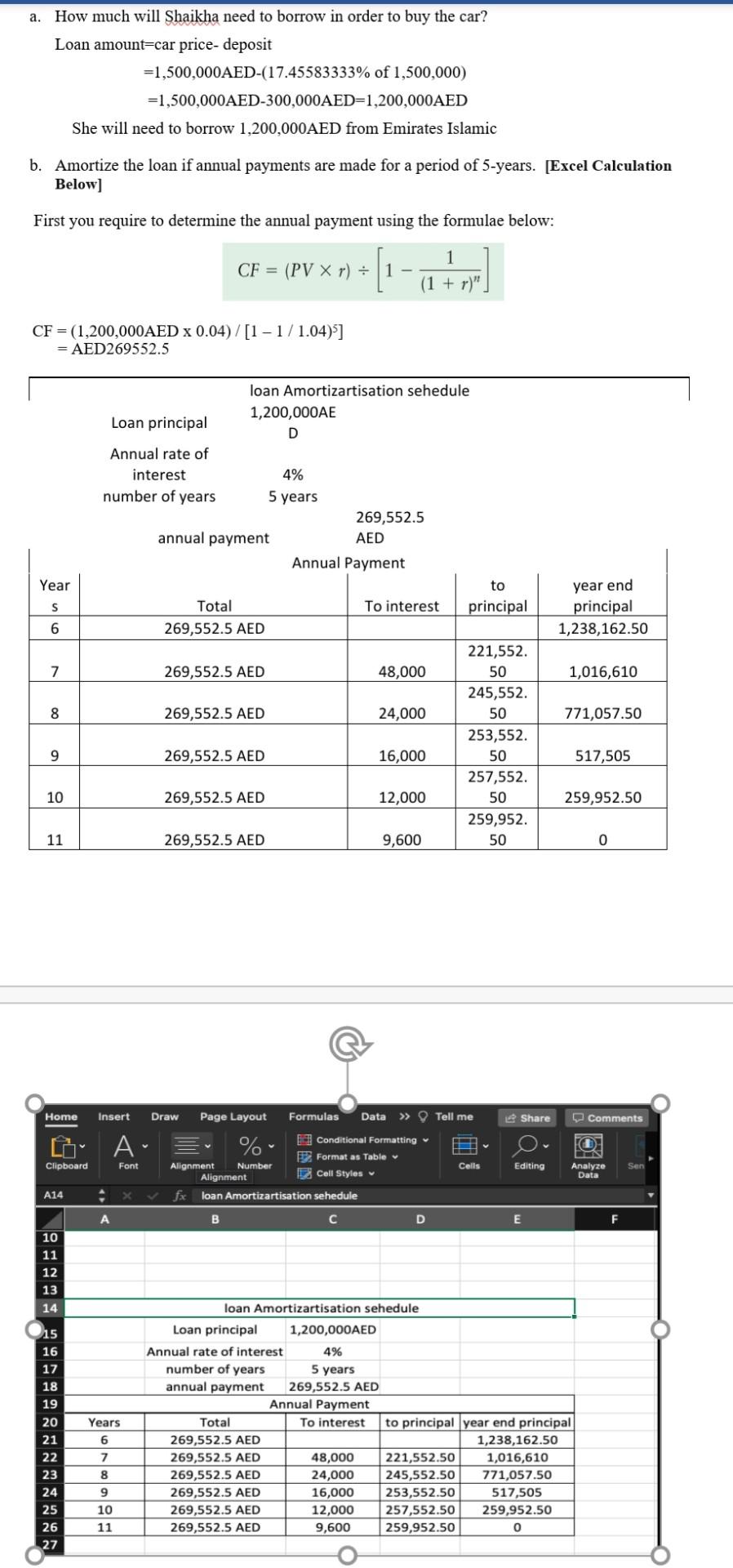

a. How much will Shaikha need to borrow in order to buy the car? Loan amount=car price- deposit =1,500,000AED-(17.45583333% of 1,500,000) =1,500,000AED-300,000AED=1,200,000AED She will need to borrow 1,200,000AED from Emirates Islamic b. Amortize the loan if annual payments are made for a period of 5-years. [Excel Calculation Below] First you require to determine the annual payment using the formulae below: CF = (PV X r) + 1 - +(1-07 (1 + r)" CF = (1,200,000AED x 0.04)/[1 - 1/1.04)] = AED269552.5 loan Amortizartisation sehedule 1,200,000AE D Loan principal Annual rate of interest number of years 4% 5 years 269,552.5 AED annual payment Annual Payment Year year end to principal S To interest Total 269,552.5 AED principal 1,238,162.50 6 7 269,552.5 AED 48,000 1,016,610 8 269,552.5 AED 24,000 ,,05 221,552. 50 245,552. 50 253,552. 50 257,552. 50 259,952. 50 9 269,552.5 AED 16,000 517,505 10 269,552.5 AED 12,000 259,952.50 11 269,552.5 AED 9,600 0 S Home Insert Draw Page Layout Formulas Data >> Tell me Share Comments Lo A % FO Clipboard Font Conditional Formatting E Format as Table Alignment Number Alignment Cell Styles loan Amortizartisation sehedule Cells Editing Analyze Data Sen A14 A B D E F 10 11 12 13 14 15 16 17 18 19 20 loan Amortizartisation sehedule Loan principal 1,200,000 AED Annual rate of interest 4% number of years 5 years anr payment 269,552.5 AED Annual Payment Total To interest to principal year end principal 269,552.5 AED 1,238,162.50 269,552.5 AED 48,000 221,552.50 1,016,610 269,552.5 AED 24,000 245,552.50 771,057.50 269,552.5 AED 16,000 253,552.50 517,505 269,552.5 AED 12,000 257,552.50 259,952.50 269,552.5 AED 9,600 259,952.50 0 Years 6 7 8 9 10 11 21 22 23 24 25 26 27Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started