Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C Company regularly buys merchandise from Best Company and is allowed to trade discounts of 20% and 10% from the list price. C Company

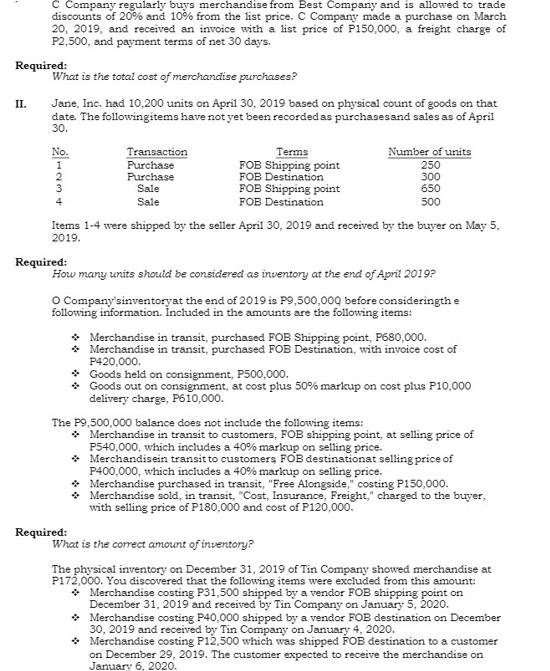

C Company regularly buys merchandise from Best Company and is allowed to trade discounts of 20% and 10% from the list price. C Company made a purchase on March 20, 2019, and received an invoice with a list price of P150,000, a freight charge of P2,500, and payment terms of net 30 days. Required: II. What is the total cost of merchandise purchases? Jane, Inc. had 10,200 units on April 30, 2019 based on physical count of goods on that date. The followingitems have not yet been recorded as purchases and sales as of April 30. No. 1 4 Transaction Purchase Purchase Sale Sale Terms FOB Shipping point FOB Destination FOB Shipping point FOB Destination Number of units 250 300 650 500 Items 1-4 were shipped by the seller April 30, 2019 and received by the buyer on May 5. 2019. Required: Required: How many units should be considered as inventory at the end of April 2019? O Company'sinventory at the end of 2019 is P9,500,000 before consideringth e following information. Included in the amounts are the following items: > Merchandise in transit, purchased FOB Shipping point, P680,000. > Merchandise in transit, purchased FOB Destination, with invoice cost of P420,000. * Goods held on consignment, P500,000. * Goods out on consignment, at cost plus 50% markup on cost plus P10,000 delivery charge, P610,000. The P9,500,000 balance does not include the following items: Merchandise in transit to customers, FOB shipping point, at selling price of P540,000, which includes a 40% markup on selling price. * Merchandisein transit to customers FOB destinationat selling price of P400,000, which includes a 40% markup on selling price. > Merchandise purchased in transit, "Free Alongside," costing P150,000. > Merchandise sold, in transit, "Cost, Insurance, Freight," charged to the buyer, with selling price of P180,000 and cost of P120,000. What is the correct amount of inventory? The physical inventory on December 31, 2019 of Tin Company showed merchandise at P172,000. You discovered that the following items were excluded from this amount: > Merchandise costing P31,500 shipped by a vendor FOB shipping point on December 31, 2019 and received by Tin Company on January 5, 2020. > Merchandise costing P40,000 shipped by a vendor FOB destination on December 30, 2019 and received by Tin Company on January 4, 2020. Merchandise costing P12,500 which was shipped FOB destination to a customer on December 29, 2019. The customer expected to receive the merchandise on January 6, 2020.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions well go through each scenario one by one I C Company Merchandise Purchase The total cost of merchandise purchases can be calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started