Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C Corporation vs LLC: What is better for the Tax Museum? Purpose: The purpose of this exercise is to compare organizing the Tax Museum as

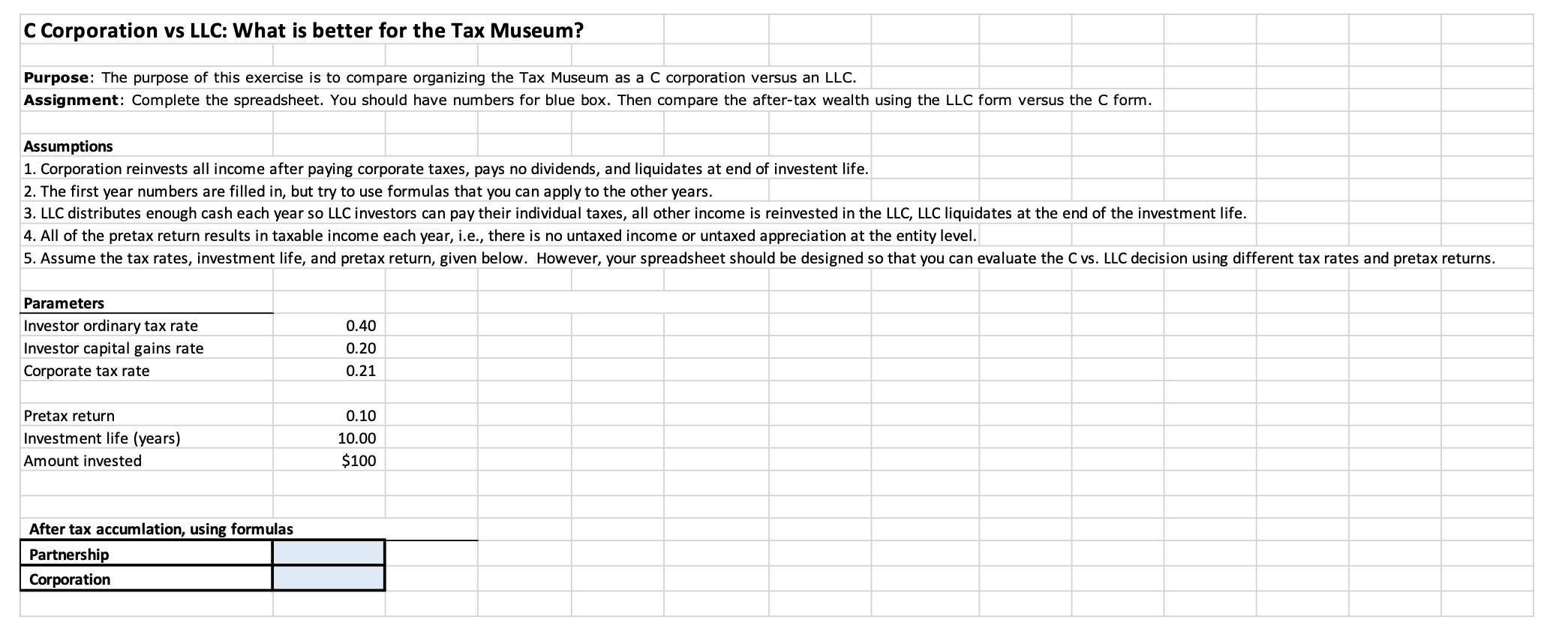

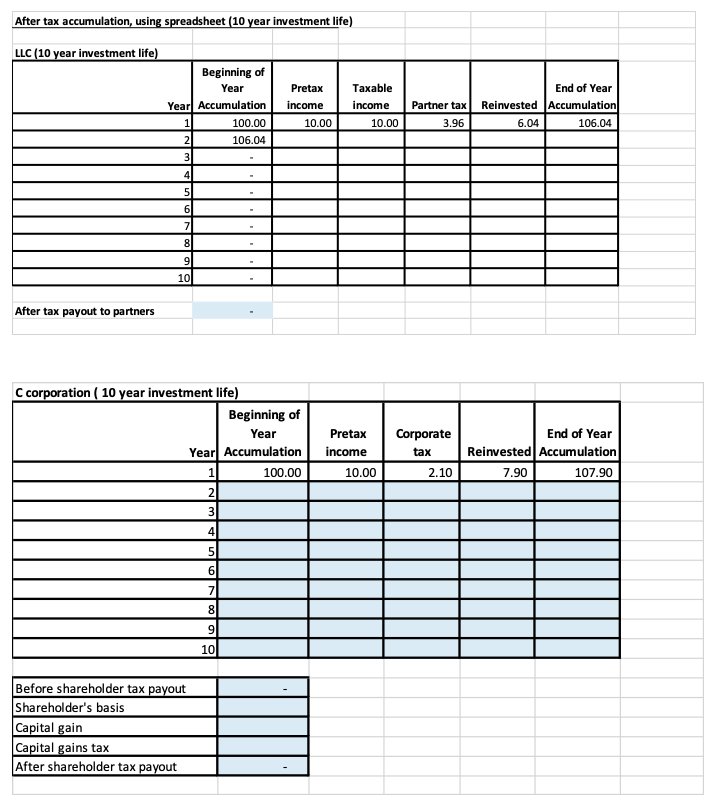

C Corporation vs LLC: What is better for the Tax Museum? Purpose: The purpose of this exercise is to compare organizing the Tax Museum as a corporation versus an LLC. Assignment: Complete the spreadsheet. You should have numbers for blue box. Then compare the after-tax wealth using the LLC form versus the C form. Assumptions 1. Corporation reinvests all income after paying corporate taxes, pays no dividends, and liquidates at end of investent life. 2. The first year numbers are filled in, but try to use formulas that you can apply to the other years. 3. LLC distributes enough cash each year so LLC investors can pay their individual taxes, all other income is reinvested in the LLC, LLC liquidates at the end of the investment life. 4. All of the pretax return results in taxable income each year, i.e., there is no untaxed income or untaxed appreciation at the entity level. Parameters Investor ordinary tax rate Investor capital gains rate Corporate tax rate Pretax return Investment life (years) Amount invested 0.40 0.20 0.21 0.10 $100 After tax accumlation, using formulas \begin{tabular}{|l|l|} \hline Parter tax accumip & \\ \hline Corporation & \\ \hline & \\ \hline \end{tabular} After tax accumulation, using spreadsheet (10 year investment life) LLC (10 year investment life) After tax payout to partners C corporation ( 10 year investment life) \begin{tabular}{|l|l|} \hline Before shareholder tax payout & \\ \hline Shareholder's basis & \\ \hline Capital gain & \\ \hline Capital gains tax & \\ \hline After shareholder tax payout & \\ \hline \end{tabular}

C Corporation vs LLC: What is better for the Tax Museum? Purpose: The purpose of this exercise is to compare organizing the Tax Museum as a corporation versus an LLC. Assignment: Complete the spreadsheet. You should have numbers for blue box. Then compare the after-tax wealth using the LLC form versus the C form. Assumptions 1. Corporation reinvests all income after paying corporate taxes, pays no dividends, and liquidates at end of investent life. 2. The first year numbers are filled in, but try to use formulas that you can apply to the other years. 3. LLC distributes enough cash each year so LLC investors can pay their individual taxes, all other income is reinvested in the LLC, LLC liquidates at the end of the investment life. 4. All of the pretax return results in taxable income each year, i.e., there is no untaxed income or untaxed appreciation at the entity level. Parameters Investor ordinary tax rate Investor capital gains rate Corporate tax rate Pretax return Investment life (years) Amount invested 0.40 0.20 0.21 0.10 $100 After tax accumlation, using formulas \begin{tabular}{|l|l|} \hline Parter tax accumip & \\ \hline Corporation & \\ \hline & \\ \hline \end{tabular} After tax accumulation, using spreadsheet (10 year investment life) LLC (10 year investment life) After tax payout to partners C corporation ( 10 year investment life) \begin{tabular}{|l|l|} \hline Before shareholder tax payout & \\ \hline Shareholder's basis & \\ \hline Capital gain & \\ \hline Capital gains tax & \\ \hline After shareholder tax payout & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started