Answered step by step

Verified Expert Solution

Question

1 Approved Answer

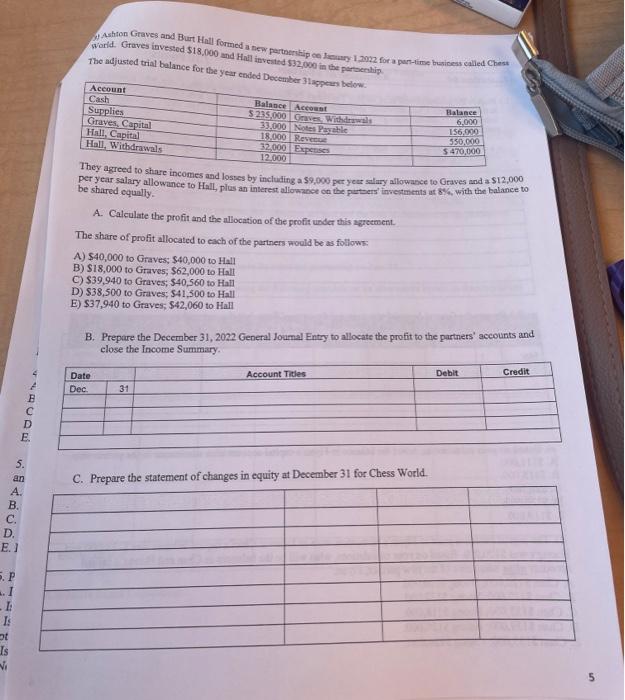

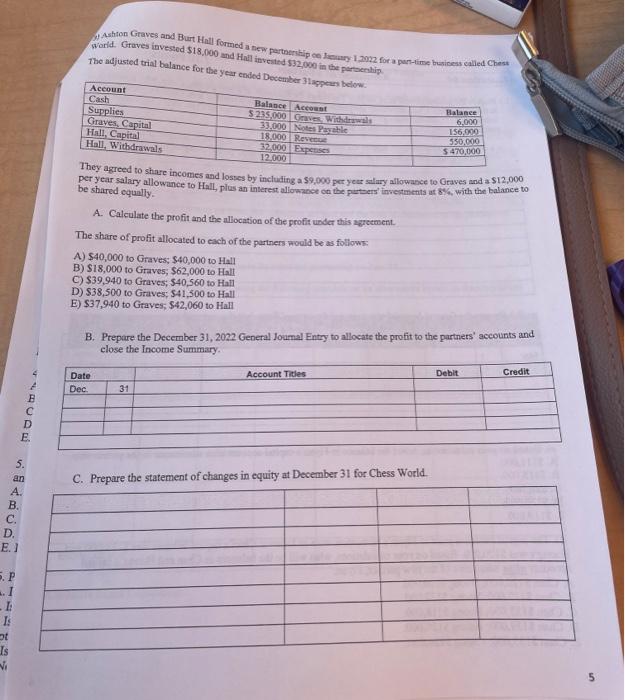

C. D. E. 1 5. P .I Is ot Is TARCA ARCA 3) Ashton Graves and Burt Hall formed a new partnership on January 1,2022

C. D. E. 1 5. P .I Is ot Is TARCA ARCA 3) Ashton Graves and Burt Hall formed a new partnership on January 1,2022 for a part-time business called Chess world. Graves invested $18,000 and Hall invested $32,000 in the partnership. The adjusted trial balance for the year ended December 31appears below. Account Cash Supplies Graves, Capital Hall, Capital Hall, Withdrawals They agreed to share incomes and losses by including a $9,000 per year salary allowance to Graves and a $12,000 per year salary allowance to Hall, plus an interest allowance on the partners' investments at 8%, with the balance to be shared equally. A. Calculate the profit and the allocation of the profit under this agreement. The share of profit allocated to each of the partners would be as follows: A) $40,000 to Graves; $40,000 to Hall B) $18,000 to Graves; $62,000 to Hall C) $39,940 to Graves; $40,560 to Hall D) $38,500 to Graves; $41,500 to Hall E) $37,940 to Graves; $42,060 to Hall Balance Account $ 235,000 Graves, Withdrawals 33,000 Notes Payable 18,000 Revenue 32,000 Expenses 12,000 Date Dec. B. Prepare the December 31, 2022 General Journal Entry to allocate the profit to the partners' accounts and close the Income Summary. 31 Balance 6,000 156,000 550,000 $ 470,000 Account Titles C. Prepare the statement of changes in equity at December 31 for Chess World. Debit Credit 0009172 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started