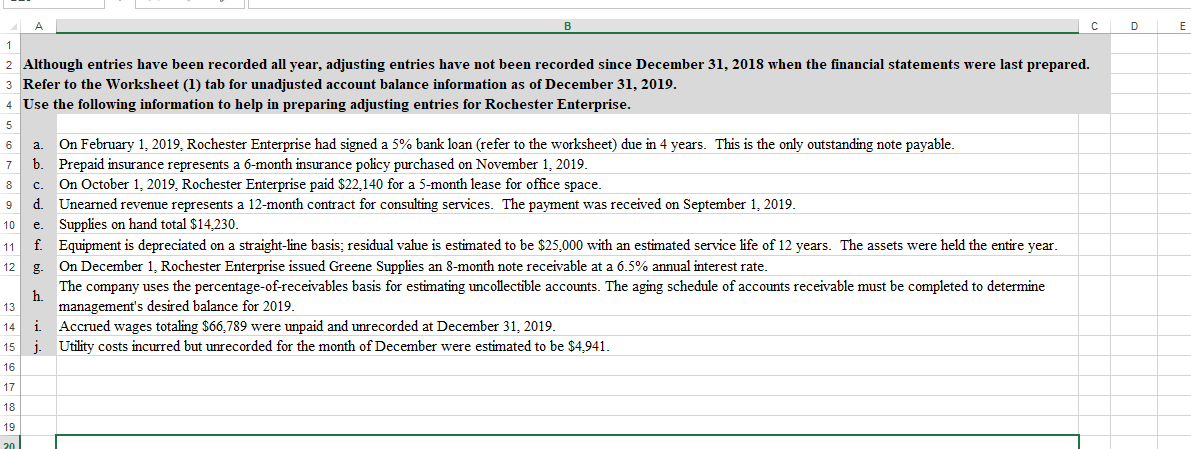

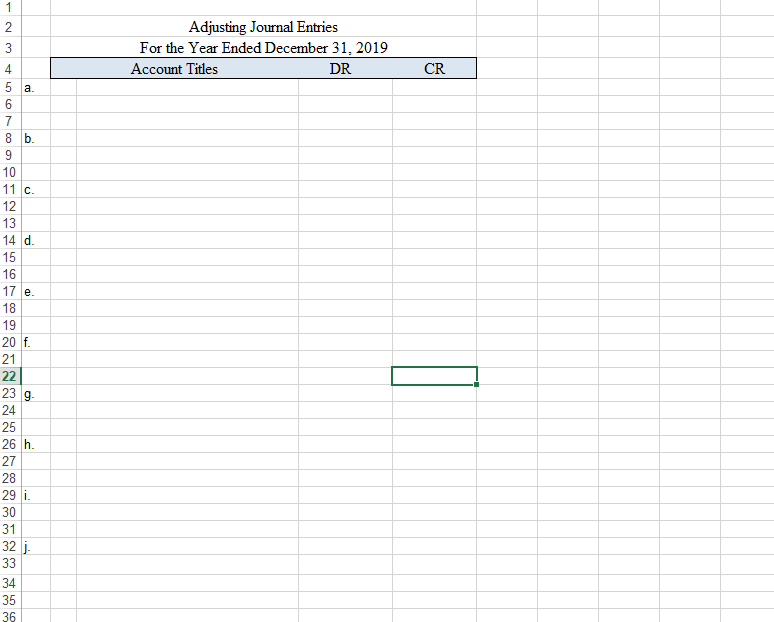

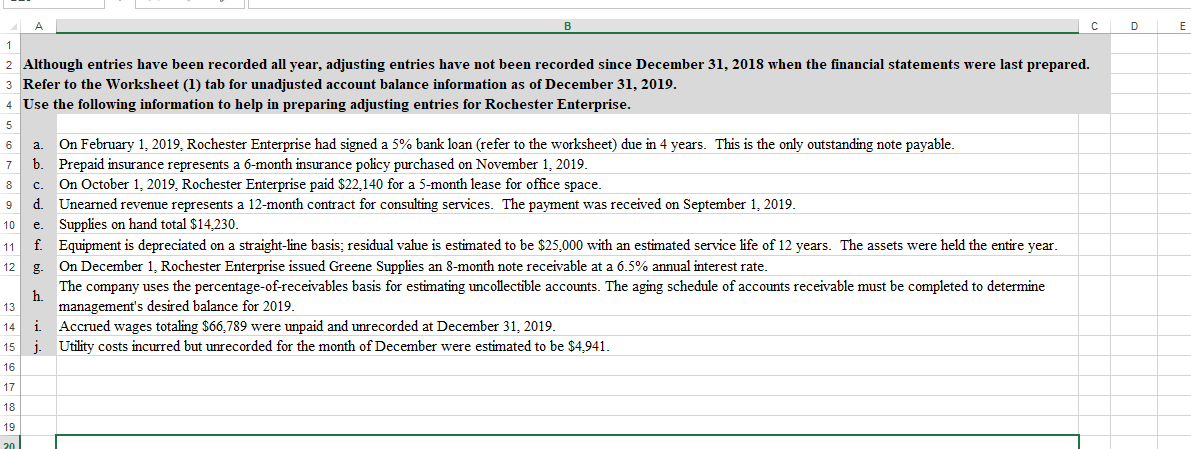

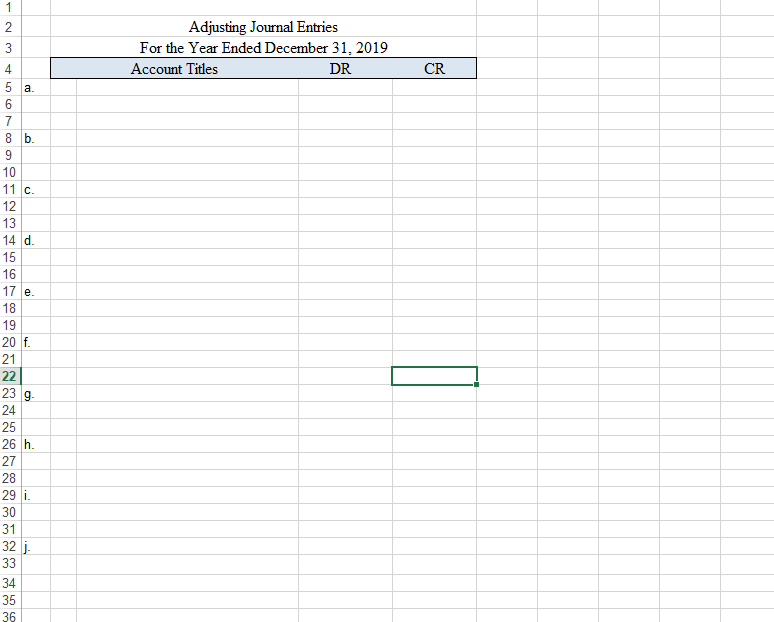

C D E 2 Although entries have been recorded all year, adjusting entries have not been recorded since December 31, 2018 when the financial statements were last prepared. 3 Refer to the Worksheet (1) tab for unadjusted account balance information as of December 31, 2019. 4 Use the following information to help in preparing adjusting entries for Rochester Enterprise. 6 7 8 9 11 12 w 4i bosi a. On February 1, 2019, Rochester Enterprise had signed a 5% bank loan (refer to the worksheet) due in 4 years. This is the only outstanding note payable. b. Prepaid insurance represents a 6-month insurance policy purchased on November 1, 2019. c. On October 1, 2019, Rochester Enterprise paid $22,140 for a 5-month lease for office space. d Unearned revenue represents a 12-month contract for consulting services. The payment was received on September 1, 2019. e. Supplies on hand total $14,230. f. Equipment is depreciated on a straight-line basis; residual value is estimated to be $25,000 with an estimated service life of 12 years. The assets were held the entire year g. On December 1, Rochester Enterprise issued Greene Supplies an 8-month note receivable at a 6.5% annual interest rate. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The aging schedule of accounts receivable must be completed to determine management's desired balance for 2019. i. Accrued wages totaling $66,789 were unpaid and unrecorded at December 31, 2019. j. Utility costs incurred but unrecorded for the month of December were estimated to be $4,941. 14 15 Adjusting Journal Entries For the Year Ended December 31, 2019 Account Titles DR CR 14 d. C D E 2 Although entries have been recorded all year, adjusting entries have not been recorded since December 31, 2018 when the financial statements were last prepared. 3 Refer to the Worksheet (1) tab for unadjusted account balance information as of December 31, 2019. 4 Use the following information to help in preparing adjusting entries for Rochester Enterprise. 6 7 8 9 11 12 w 4i bosi a. On February 1, 2019, Rochester Enterprise had signed a 5% bank loan (refer to the worksheet) due in 4 years. This is the only outstanding note payable. b. Prepaid insurance represents a 6-month insurance policy purchased on November 1, 2019. c. On October 1, 2019, Rochester Enterprise paid $22,140 for a 5-month lease for office space. d Unearned revenue represents a 12-month contract for consulting services. The payment was received on September 1, 2019. e. Supplies on hand total $14,230. f. Equipment is depreciated on a straight-line basis; residual value is estimated to be $25,000 with an estimated service life of 12 years. The assets were held the entire year g. On December 1, Rochester Enterprise issued Greene Supplies an 8-month note receivable at a 6.5% annual interest rate. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The aging schedule of accounts receivable must be completed to determine management's desired balance for 2019. i. Accrued wages totaling $66,789 were unpaid and unrecorded at December 31, 2019. j. Utility costs incurred but unrecorded for the month of December were estimated to be $4,941. 14 15 Adjusting Journal Entries For the Year Ended December 31, 2019 Account Titles DR CR 14 d