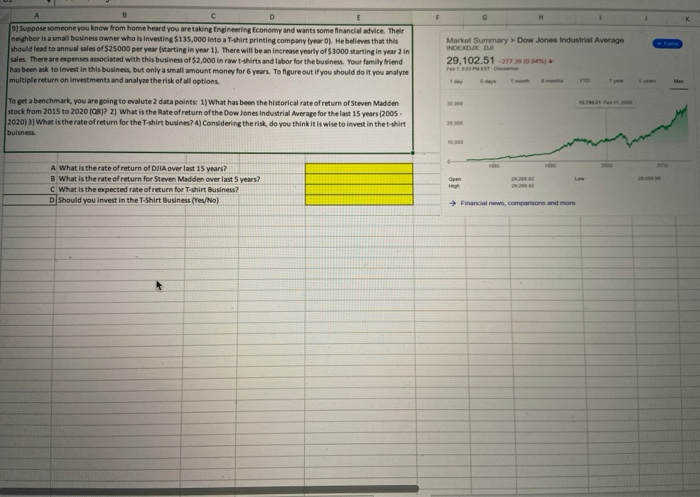

C D E 91 Suppose someone you know from home heard you are taking Engineering Economy and wants some financial advice. Their neighboris ambulness owner who is investing $135,000 into at shirt printing company year. He believes that this should lead to annual sales of $25000 per year starting in year 1). There will be an increase yearly of $3000 starting in year 2 in sales. There are expenses associated with this business of $2,000 inw t-shirts and labor for the business. Your family friend Nas been as to invest in this business, but only a small amount money for years. To figure out if you should do it you analyse multiple return on investments and analyse the risk of options Market Summary> Dow Jones Industrial Average | | | | | 29,102.51-272 To get a benchmark, you are going to evalute 2 data points 1) What has been the historical rate of return of Steve Madden stock from 2015 to 2020 ? 2) What is the Rate of return of the Dow Jones Industrial Average for the last 15 years (2005- 2020) What the rate of return for the T-shirt busines? 4) Considering the risk, do you think it is wise to invest in their bulness A What is the rate of return of DNA overlast 15 years? B What is the rate of return for Steve Madden overlast 5 years? C What is the expected rate of return for T-shirt Business? Should you invest in the T Shirt Business free) C D E 91 Suppose someone you know from home heard you are taking Engineering Economy and wants some financial advice. Their neighboris ambulness owner who is investing $135,000 into at shirt printing company year. He believes that this should lead to annual sales of $25000 per year starting in year 1). There will be an increase yearly of $3000 starting in year 2 in sales. There are expenses associated with this business of $2,000 inw t-shirts and labor for the business. Your family friend Nas been as to invest in this business, but only a small amount money for years. To figure out if you should do it you analyse multiple return on investments and analyse the risk of options Market Summary> Dow Jones Industrial Average | | | | | 29,102.51-272 To get a benchmark, you are going to evalute 2 data points 1) What has been the historical rate of return of Steve Madden stock from 2015 to 2020 ? 2) What is the Rate of return of the Dow Jones Industrial Average for the last 15 years (2005- 2020) What the rate of return for the T-shirt busines? 4) Considering the risk, do you think it is wise to invest in their bulness A What is the rate of return of DNA overlast 15 years? B What is the rate of return for Steve Madden overlast 5 years? C What is the expected rate of return for T-shirt Business? Should you invest in the T Shirt Business free)