Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C. d. e. b. a. on direct labour hours to an activity based costing system. The company manufactures two Supreme Enterprises is considering moving

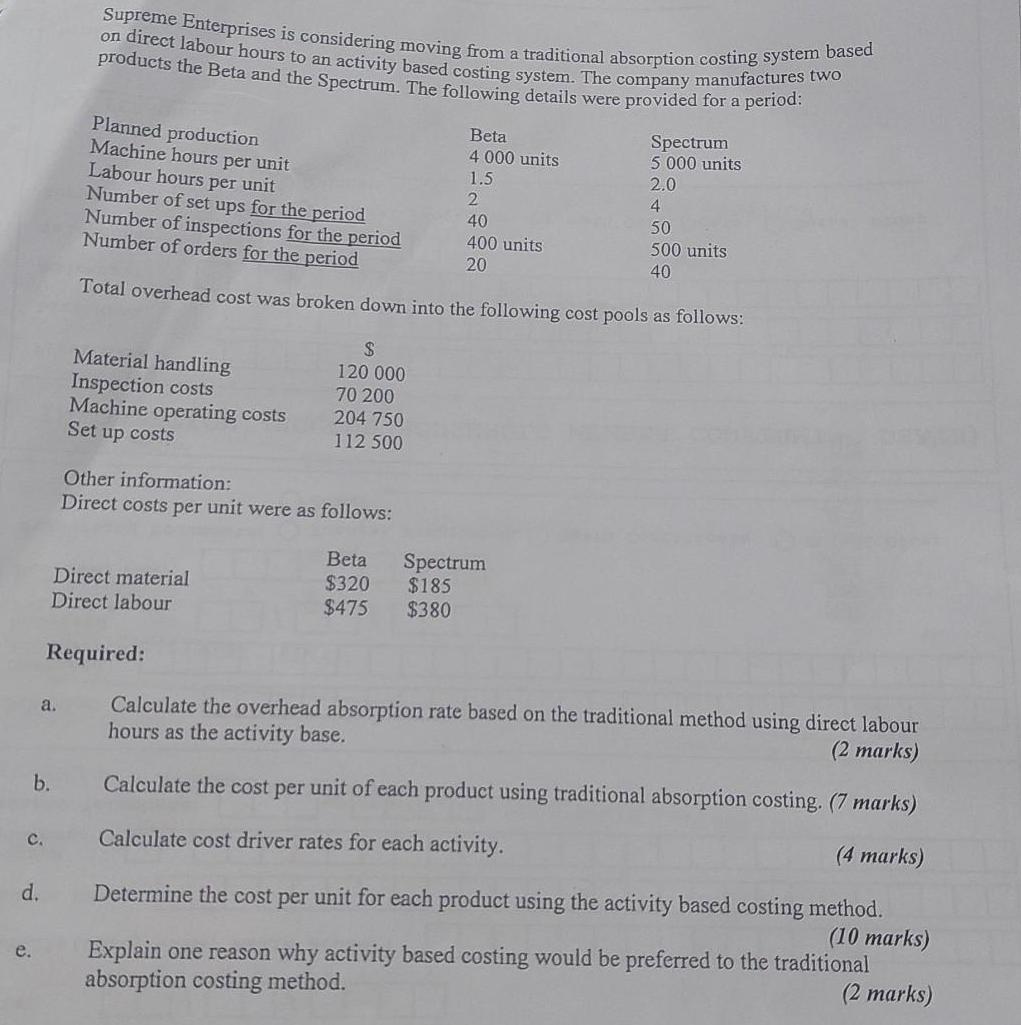

C. d. e. b. a. on direct labour hours to an activity based costing system. The company manufactures two Supreme Enterprises is considering moving from a traditional absorption costing system based products for a period: Planned production Machine hours per unit Labour hours per unit Number of set ups for the period Number of inspections for the period Number of orders for the period Total overhead cost was broken down into the following cost pools as follows: Material handling Inspection costs Machine operating costs Set up costs Direct material Direct labour Required: Other information: Direct costs per unit were as follows: $ 120 000 70 200 204 750 112 500 Beta $320 $185 $475 $380 Beta 4 000 units 1.5 2 40 400 units 20 Spectrum Spectrum 5 000 units 2.0 4 50 500 units 40 Calculate the overhead absorption rate based on the traditional method using direct labour hours as the activity base. (2 marks) Calculate the cost per unit of each product using traditional absorption costing. (7 marks) Calculate cost driver rates for each activity. (4 marks) Determine the cost per unit for each product using the activity based costing method. (10 marks) Explain one reason why activity based costing would be preferred to the traditional absorption costing method. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculate the Overhead Absorption Rate Traditional Method Overhead Absorption Rate Total Overhead Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started