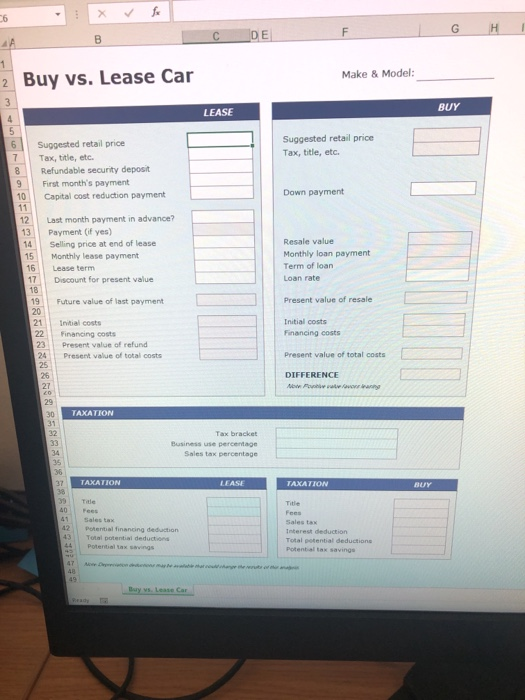

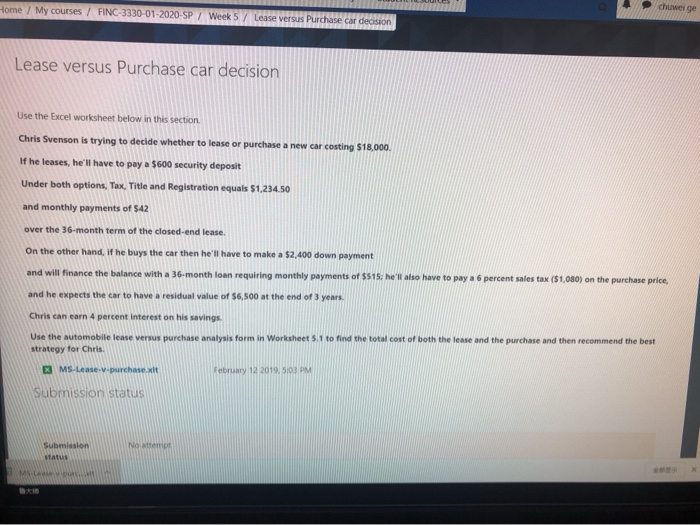

C DE L G H 2 Buy vs. Lease Car Make & Model: w BUY LEASE Suggested retail price Tax, title, etc. Suggested retail price Tax, title, etc. Refundable security deposit First month's payment Capital cost reduction payment Down payment 12 Last month payment in advance? Payment (if yes) Selling price at end of lease Monthly lease payment Lease term Discount for present value Resale value Monthly loan payment Term of loan Loan rate Future value of last payment Present value of resale Initial costs Financing costs Initial costs Financing costs Present value of refund Present value of total costs Present value of total costs DIFFERENCE TAXATION Tax bracket Business use percentage Sales tax percentage TAXATION LEASE TAXATION Potential financing deduction Total potential deductions Potential tax wings sales tan Interest deduction Total potential deductions Buy vs. Less Car chuwelge Home / My courses / FINC-3330-01-2020-SP / Week 5 / Lease versus Purchase car decision Lease versus Purchase car decision Use the Excel worksheet below in this section Chris Svenson is trying to decide whether to lease or purchase a new car costing $18.000 If he leases, he'll have to pay a $600 security deposit Under both options, Tax, Title and Registration equals 51.234.50 and monthly payments of $42 over the 36-month term of the closed-end lease. On the other hand, if he buys the car then he'll have to make a $2,400 down payment and will finance the balance with a 36-month loan requiring monthly payments of $515 he'll also have to pay a 6 percent sales tax ($1,080) on the purchase price, and the expects the car to have a residual value of $6,500 at the end of years. Chris can earn 4 percent interest on his savings Use the automobile lease versus purchase analysis form in Worksheet 5.1 to find the total cost of both the lease and the purchase and then recommend the best strategy for Chris E MS-Lease purchase.xlt February 12 2019, S PM Submission status No attempt Submission status C DE L G H 2 Buy vs. Lease Car Make & Model: w BUY LEASE Suggested retail price Tax, title, etc. Suggested retail price Tax, title, etc. Refundable security deposit First month's payment Capital cost reduction payment Down payment 12 Last month payment in advance? Payment (if yes) Selling price at end of lease Monthly lease payment Lease term Discount for present value Resale value Monthly loan payment Term of loan Loan rate Future value of last payment Present value of resale Initial costs Financing costs Initial costs Financing costs Present value of refund Present value of total costs Present value of total costs DIFFERENCE TAXATION Tax bracket Business use percentage Sales tax percentage TAXATION LEASE TAXATION Potential financing deduction Total potential deductions Potential tax wings sales tan Interest deduction Total potential deductions Buy vs. Less Car chuwelge Home / My courses / FINC-3330-01-2020-SP / Week 5 / Lease versus Purchase car decision Lease versus Purchase car decision Use the Excel worksheet below in this section Chris Svenson is trying to decide whether to lease or purchase a new car costing $18.000 If he leases, he'll have to pay a $600 security deposit Under both options, Tax, Title and Registration equals 51.234.50 and monthly payments of $42 over the 36-month term of the closed-end lease. On the other hand, if he buys the car then he'll have to make a $2,400 down payment and will finance the balance with a 36-month loan requiring monthly payments of $515 he'll also have to pay a 6 percent sales tax ($1,080) on the purchase price, and the expects the car to have a residual value of $6,500 at the end of years. Chris can earn 4 percent interest on his savings Use the automobile lease versus purchase analysis form in Worksheet 5.1 to find the total cost of both the lease and the purchase and then recommend the best strategy for Chris E MS-Lease purchase.xlt February 12 2019, S PM Submission status No attempt Submission status