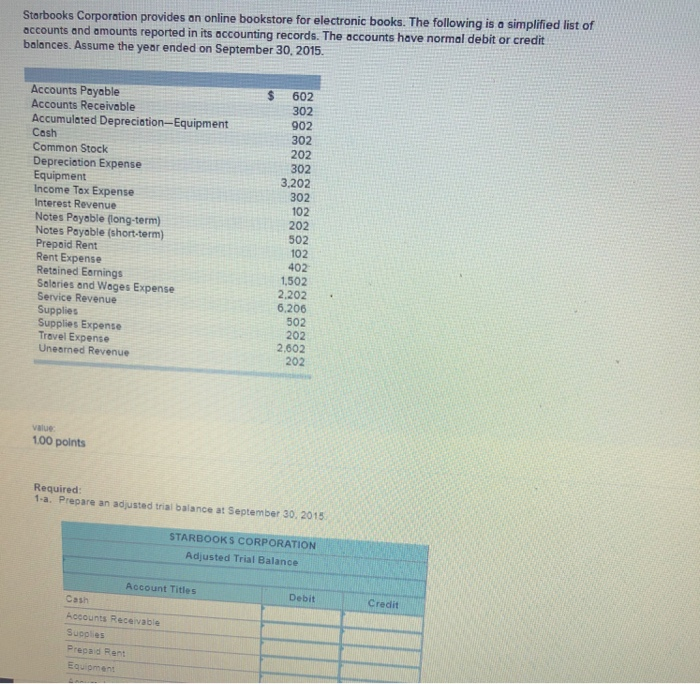

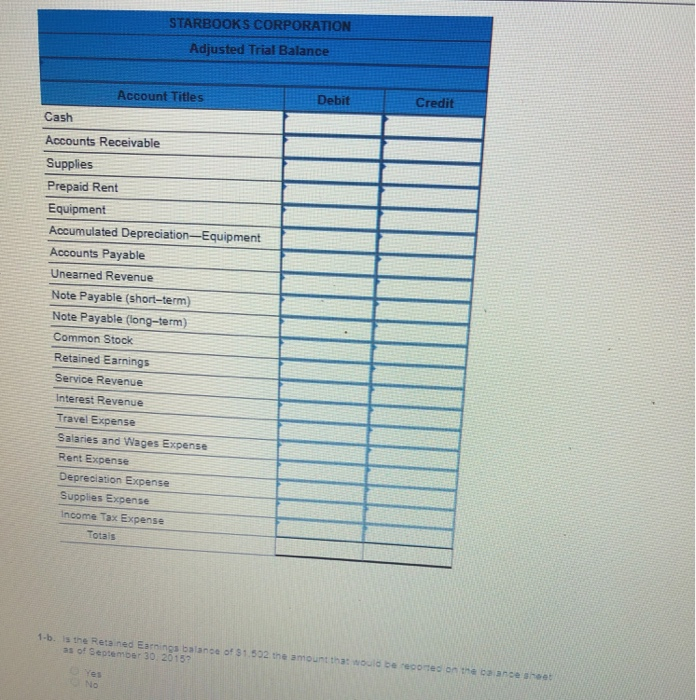

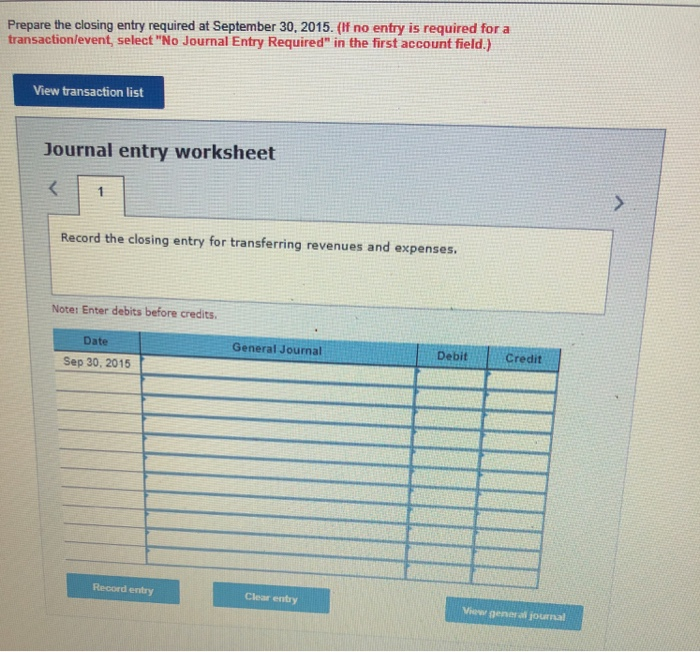

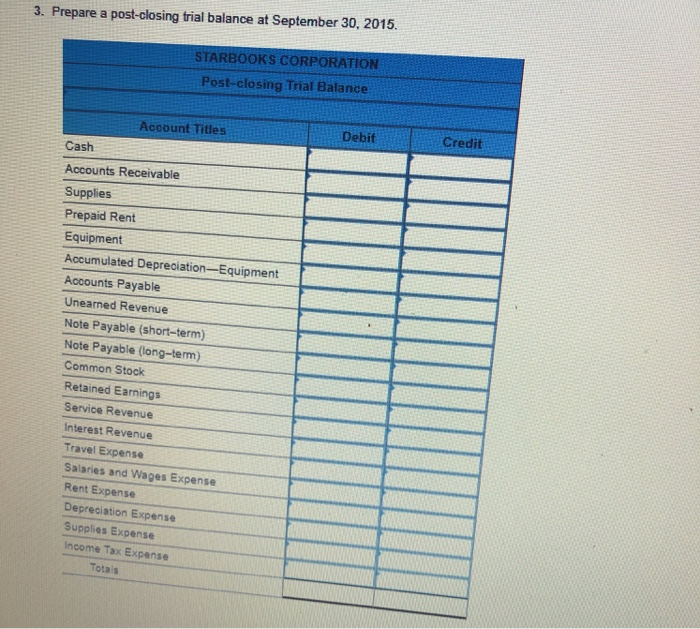

Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal d ebit or credit balances. Assume the year ended on September 30, 2015 Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment $ 602 302 902 302 202 Cash Common Stock Depreciation Expense Equipment Income Tox Expense Interest Revenue Notes Payable (long-term) Notes Payable (short-term) Prepoid Rent 3.202 302 102 202 502 102 402 1,502 2.202 6,206 502 202 2,602 202 Rent Expense Retained Earnings Salaries and Wages Expense 0 Service Revenue Supplies Supplies Expense Travel Expense Uneerned Revenue value 100 points Required 1-a. Prepare an adjusted trial balance at September 30, 2015 STARBOOKS CORPORATION Adjusted Trial Balance Account Titles Debit Credit Cesh Accounts Receivable Supplies Prepaid Rent quipment STARBOOKS CORPORATION Adjusted Trial Balance Debit Credit Account Titles Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Revenue Note Payable (short-term) Note Payable (long-term) Common Stock Retained Earnings Service Revenue Interest Revenue Travel Expense Salaries and Wages Expense Rent Expense Depreciation Expense Supplies Expense Income Tax Expense Totals 1-b. is the Reta ned Earnings balance of 31. 502 the amount tha: would be recored on the ca anpe ahees as of September 30 2015 Prepare the closing entry required at September 30,2015. (lf no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the closing entry for transferring revenues and expenses Note: Enter debits before credits. Date General Journal Debit Credit Sep 30, 2015 Record entry Clear entry Viewr general journal 3. Prepare a post-closing trial balance at September 30, 2015. STARBOOKS CORPORATION Post-closing Trial Balance Debit Credit Account Titles Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Revenue Note Payable (short-term) Note Payable (long-term) Common Stock Retained Earnings Service Revenue Interest Revenue Travel Expense Salaries and Wages Expense Rent Expense Depreciation Expense Supplies Expense Income Tax Expense Totals