Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(c) Draw the tree indicating the price of an American call option at each node. Indicate the nodes where it is optimal to exercise the

(c) Draw the tree indicating the price of an American call option at each node. Indicate the nodes where it is optimal to exercise the option early.

Solve for C please

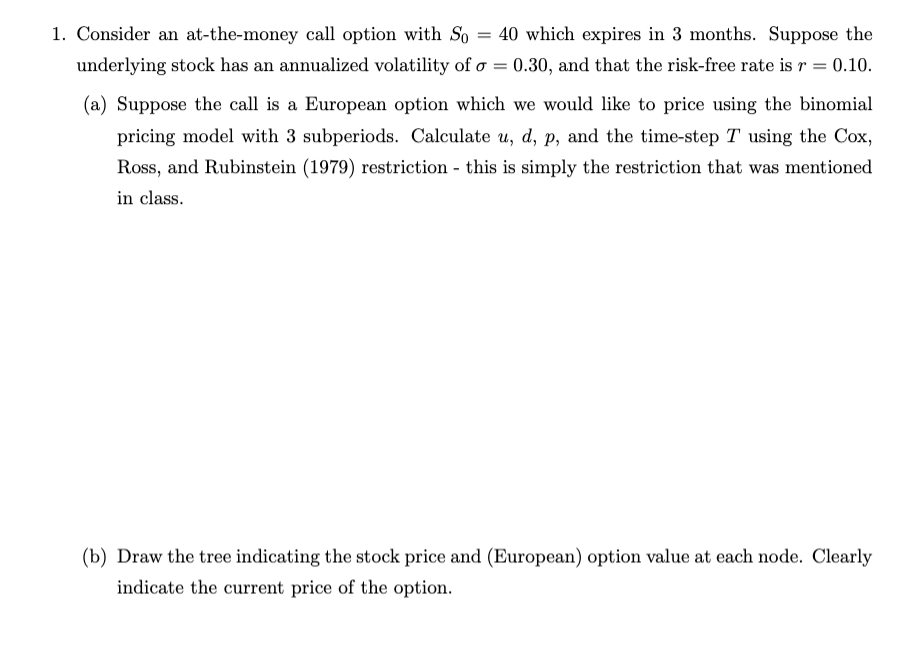

1. Consider an at-the-money call option with So = 40 which expires in 3 months. Suppose the underlying stock has an annualized volatility of o = 0.30, and that the risk-free rate is r 0.10. (a) Suppose the call is a European option which we would like to price using the binomial pricing model with 3 subperiods. Calculate u, d, p, and the time-step T using the Cox, Ross, and Rubinstein (1979) restriction - this is simply the restriction that was mentioned in class. (b) Draw the tree indicating the stock price and (European) option value at each node. Clearly indicate the current price of the option. 1. Consider an at-the-money call option with So = 40 which expires in 3 months. Suppose the underlying stock has an annualized volatility of o = 0.30, and that the risk-free rate is r 0.10. (a) Suppose the call is a European option which we would like to price using the binomial pricing model with 3 subperiods. Calculate u, d, p, and the time-step T using the Cox, Ross, and Rubinstein (1979) restriction - this is simply the restriction that was mentioned in class. (b) Draw the tree indicating the stock price and (European) option value at each node. Clearly indicate the current price of the optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started