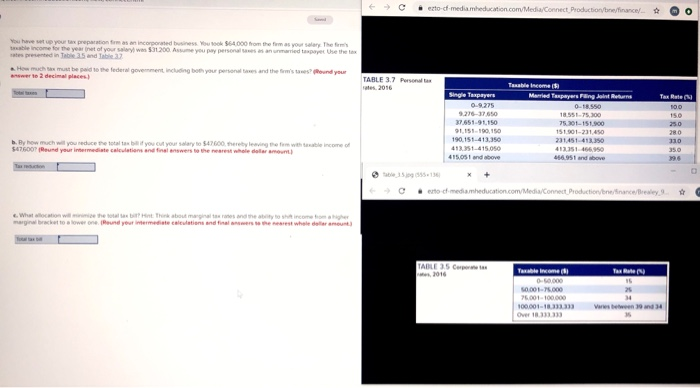

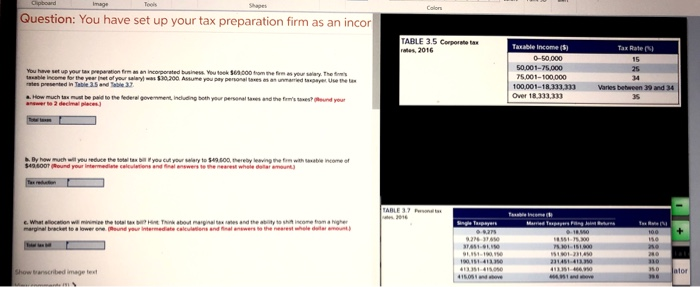

C e zto-of-media education.com/Media/Connect Production/be/finance OO You have you to preparation form an incorporated in Yusok 564 000 from them as you say The be income for the year that of your w 200 Asupaya an m e t het es presentate and Table 32 How much mbead to the federal government w ith your personal and the w o und your answer to 2 decimal places) TABLE 3.7 Personal Single Taxpayers 0.9275 Married Tasper Fangon Returns 1855-75100 7501_151000 1-1001 190151-413350 231451-413,350 b. By how much will you reduce the total ab out your salary to 547600, thereby leaving 6760 Round your mediate calculation and finala 415.051 and bove 666.951 and above 3 5 136 o t omedia education.com Media/Connect Production What location wi th think about mat os de calculations and in t erest when and your TABLE 35 C Tax Rate Table Income 0-60.000 OOOOO Varies between 0 and 34 100,001-1333333 Over 1.333333 Clipboard Question: You have set up your tax preparation firm as an incor TARLE 3.5 Corporate wes, 2016 Taxable income Tax Rate You have set up your print and incorporated business. You to com e to your way. There's incor r eta 5.10.200. Assume you pay persones suwe toe How much tax mutted to the federal government, including both your person and the s o und your answer to decine 50001-75.000 75 001-100 000 100001-18.333,333 Over 18.333,333 Varles between 3 and 34 By how much will you reduce the y e a r to $40.00, rebeving with 349.00T Round your intermediate cations and final awwersenare whole dar amount income of TABLE mage What location with a marginal bracket to a lower the mound your intermediate a bomagns and the i w esome Show transcribed image text C e zto-of-media education.com/Media/Connect Production/be/finance OO You have you to preparation form an incorporated in Yusok 564 000 from them as you say The be income for the year that of your w 200 Asupaya an m e t het es presentate and Table 32 How much mbead to the federal government w ith your personal and the w o und your answer to 2 decimal places) TABLE 3.7 Personal Single Taxpayers 0.9275 Married Tasper Fangon Returns 1855-75100 7501_151000 1-1001 190151-413350 231451-413,350 b. By how much will you reduce the total ab out your salary to 547600, thereby leaving 6760 Round your mediate calculation and finala 415.051 and bove 666.951 and above 3 5 136 o t omedia education.com Media/Connect Production What location wi th think about mat os de calculations and in t erest when and your TABLE 35 C Tax Rate Table Income 0-60.000 OOOOO Varies between 0 and 34 100,001-1333333 Over 1.333333 Clipboard Question: You have set up your tax preparation firm as an incor TARLE 3.5 Corporate wes, 2016 Taxable income Tax Rate You have set up your print and incorporated business. You to com e to your way. There's incor r eta 5.10.200. Assume you pay persones suwe toe How much tax mutted to the federal government, including both your person and the s o und your answer to decine 50001-75.000 75 001-100 000 100001-18.333,333 Over 18.333,333 Varles between 3 and 34 By how much will you reduce the y e a r to $40.00, rebeving with 349.00T Round your intermediate cations and final awwersenare whole dar amount income of TABLE mage What location with a marginal bracket to a lower the mound your intermediate a bomagns and the i w esome Show transcribed image text