Question

C. Eastwood, A. North, and M. West are manufacturers representatives in the architecture business. Their capital accounts in the ENW partnership for 20X1 were as

C. Eastwood, A. North, and M. West are manufacturers representatives in the architecture business. Their capital accounts in the ENW partnership for 20X1 were as follows:

| C. Eastwood, Capital | ||||

| 9/1 | 10,000 | 1/1 | 30,100 | |

| 5/1 | 7,200 | |||

| A. North, Capital | ||||

| 3/1 | 9,600 | 1/1 | 41,500 | |

| 7/1 | 6,600 | |||

| 9/1 | 4,500 | |||

| M. West, Capital | ||||

| 8/1 | 12,800 | 1/1 | 51,400 | |

| 4/1 | 8,900 | |||

| 6/1 | 4,200 | |||

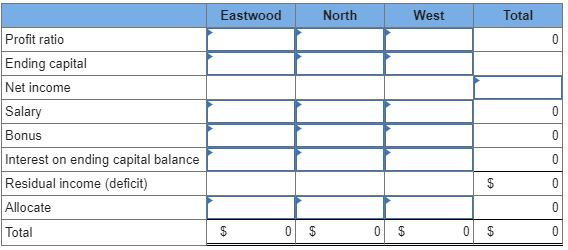

Required: For each of the following independent income-sharing agreements, prepare an income distribution schedule. a. Salaries are $16,000 to Eastwood, $20,200 to North, and $18,400 to West. Eastwood receives a bonus of 5 percent of net income after deducting his bonus. Interest is 10 percent of ending capital balances. Eastwood, North, and West divide any remainder in a 3:3:4 ratio, respectively. Net income was $81,270. (Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.)

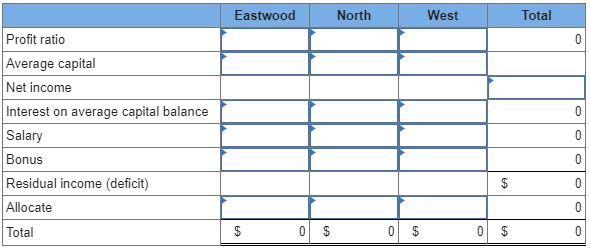

b. Interest is 10 percent of weighted-average capital balances. Salaries are $25,100 to Eastwood, $21,400 to North, and $26,200 to West. North receives a bonus of 10 percent of net income after deducting the bonus and her salary. Any remainder is divided equally. Net income was $69,360. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.)

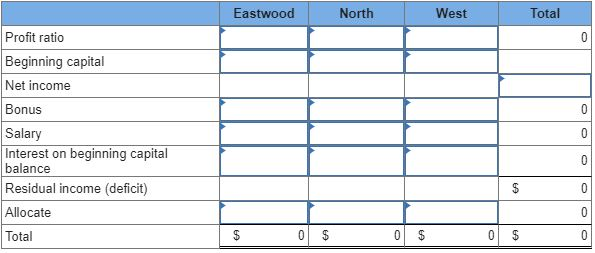

c. West receives a bonus of 20 percent of net income after deducting the bonus and the salaries. Salaries are $21,600 to Eastwood, $19,500 to North, and $15,200 to West. Interest is 10 percent of beginning capital balances. Eastwood, North, and West divide any remainder in an 8:7:5 ratio, respectively. Net income was $95,060. (Do not round intermediate calculations. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started