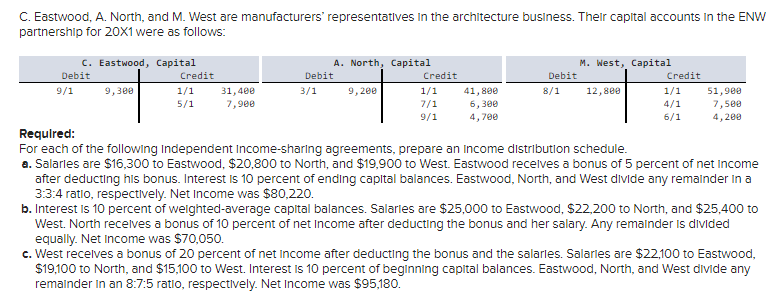

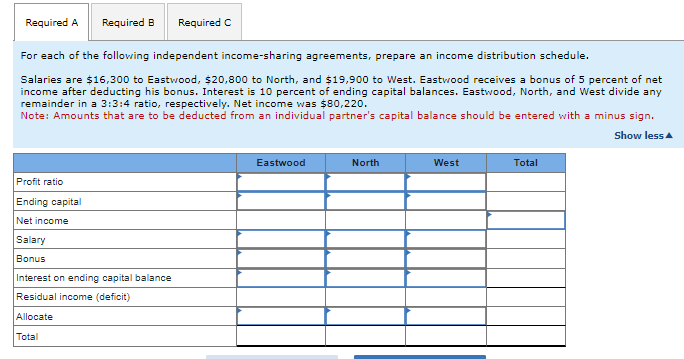

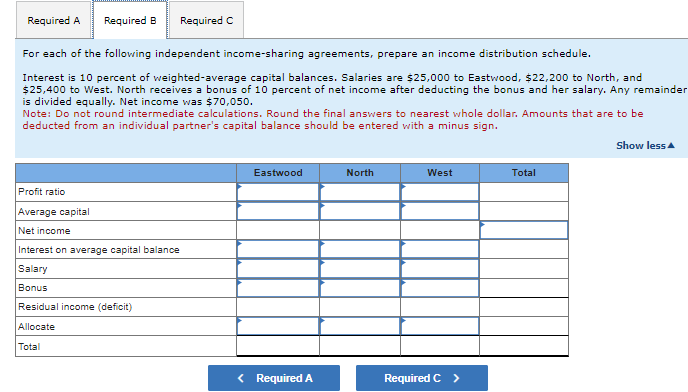

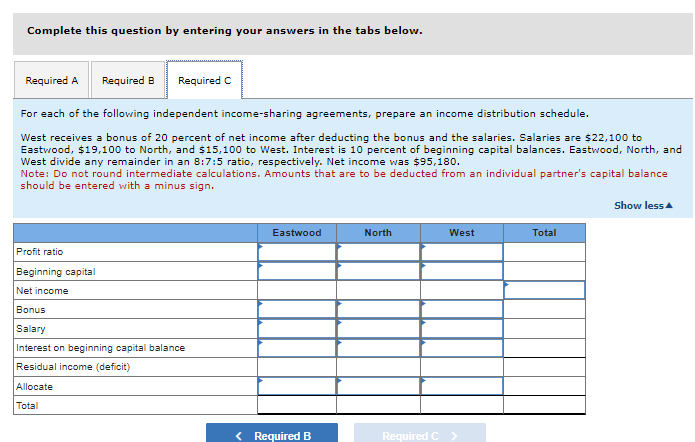

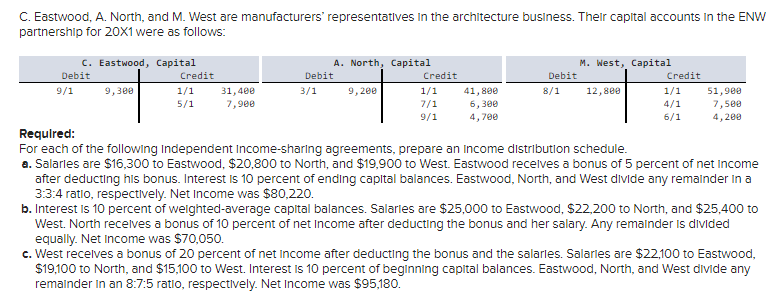

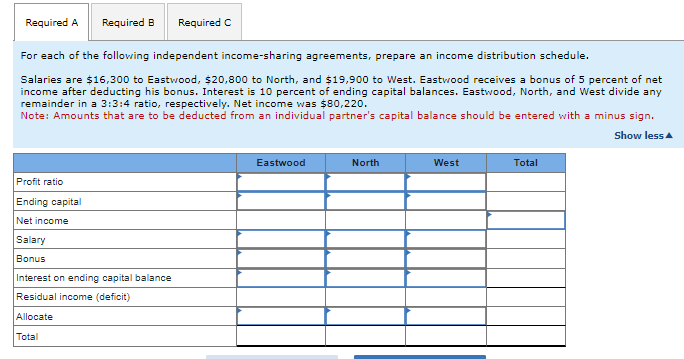

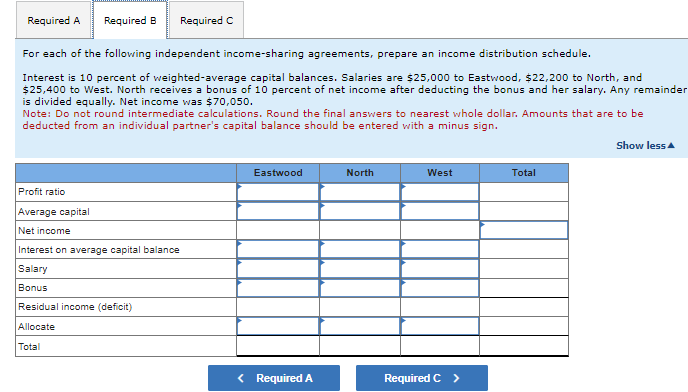

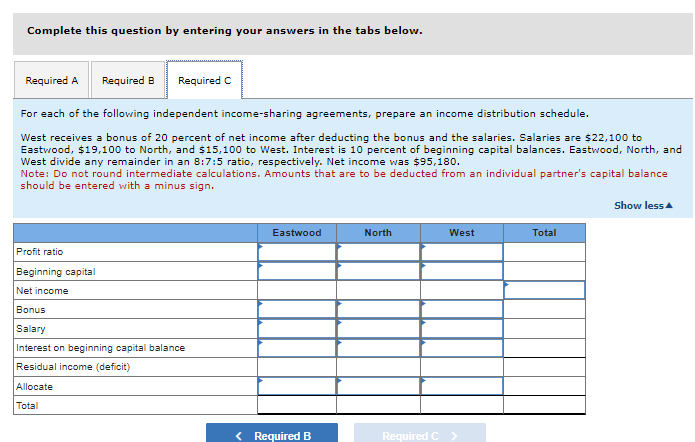

C. Eastwood, A. North, and M. West are manufacturers' representatlves in the architecture business. Their capital accounts in the ENW partnership for 201 were as follows: Required: For each of the following Independent Income-sharing agreements, prepare an Income distribution schedule. a. Salarles are $16,300 to Eastwood, $20,800 to North, and $19,900 to West. Eastwood recelves a bonus of 5 percent of net Income after deducting his bonus. Interest is 10 percent of ending capital balances. Eastwood, North, and West divide any remainder In a 3:3:4 ratio, respectlvely. Net Income was $80,220. b. Interest is 10 percent of weighted-average capital balances. Salarles are $25,000 to Eastwood, $22,200 to North, and $25,400 to West. North recelves a bonus of 10 percent of net Income after deducting the bonus and her salary. Any remainder Is divided equally. Net Income was $70,050. c. West recelves a bonus of 20 percent of net Income after deducting the bonus and the salarles. Salarles are $22,100 to Eastwood, $19,100 to North, and $15,100 to West. Interest is 10 percent of beginning capital balances. Eastwood, North, and West divide any remainder in an 8:7:5 ratio, respectively. Net Income was $95,180. For each of the following independent income-sharing agreements, prepare an income distribution schedule. Salaries are $16,300 to Eastwood, $20,800 to North, and $19,900 to West. Eastvood receives a bonus of 5 percent of net income after deducting his bonus. Interest is 10 percent of ending capital balances. Eastwood, North, and West divide any remainder in a 3:3:4 ratio, respectively. Net income was $80,220. Note: Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. For each of the folloving independent income-sharing agreements, prepare an income distribution schedule. Interest is 10 percent of weighted-average capital balances. Salaries are $25,000 to Eastwood, $22,200 to North, and $25,400 to West. North receives a bonus of 10 percent of net income after deducting the bonus and her salary. Any remainde is divided equally. Net income was $70,050. Note: Do not round intermediate calculations. Round the final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. Complete this question by entering your answers in the tabs below. For each of the following independent income-sharing agreements, prepare an income distribution schedule. West receives a bonus of 20 percent of net income after deducting the bonus and the salaries. Salaries are $22,100 to Eastwood, $19,100 to North, and $15,100 to West. Interest is 10 percent of beginning capital balances. Eastwood, North, and West divide any remainder in an 8:7:5 ratio, respectively. Net income was $95,180. Note: Do not round intermediate calculations. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign