Question

c) Erlich decided to invest $78,000 in Intel, $120,000 in Oracle, $60,000 in Yahoo!, and the rest in ebay. What is the portfolio weight in

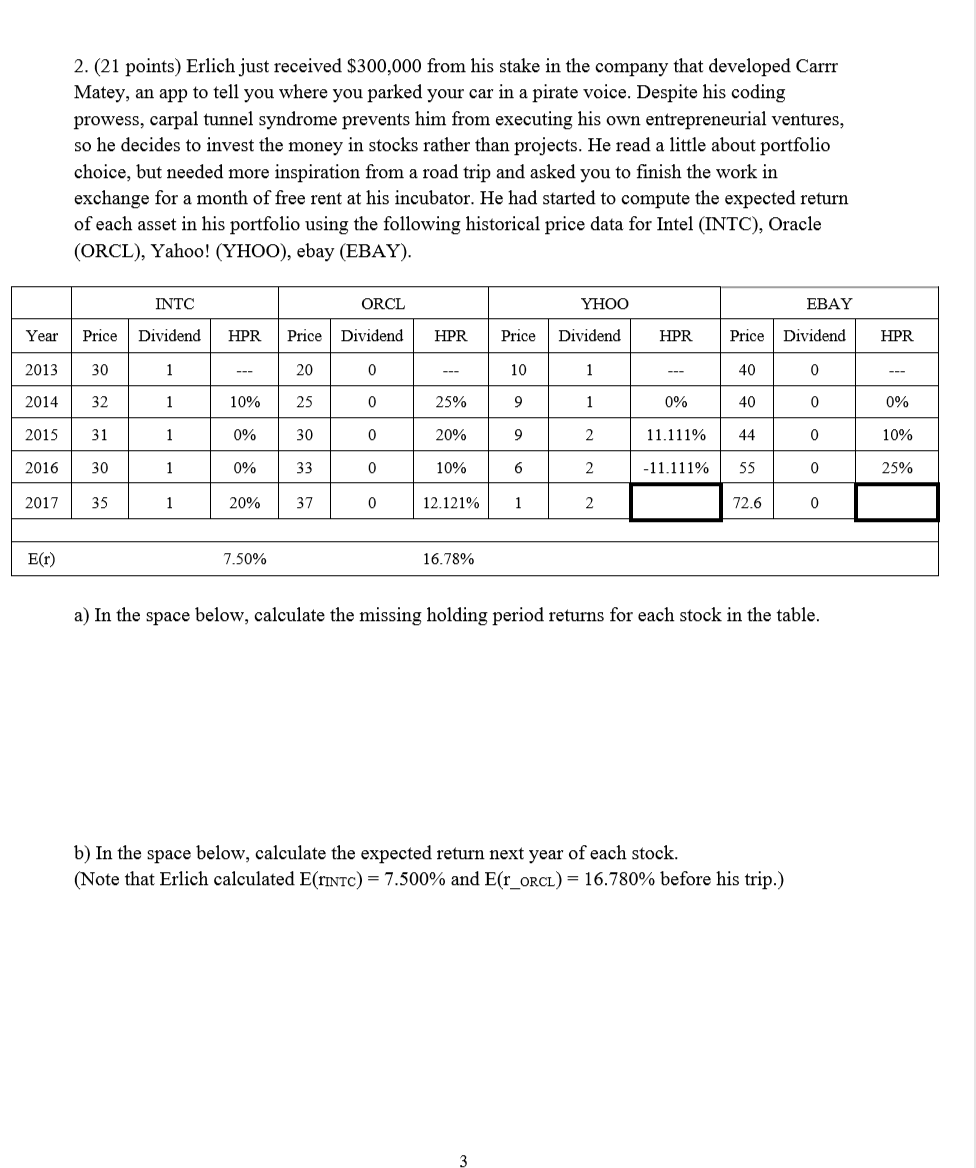

c) Erlich decided to invest $78,000 in Intel, $120,000 in Oracle, $60,000 in Yahoo!, and the rest in ebay. What is the portfolio weight in each stock? d) What is the expected value of Erlichss $300,000 investment next year? 5 e) You tell Erlich that he might be able to do better if he had more information about the extent to which all of the assets in his portfolio moved together. Set up but do not calculate the covariance between returns on INTC and EBAY. f) If you were to calculate the variance-covariance matrix of returns for Erlichs portfolio, how many variance terms would you have? g) How many unique covariance terms would you have?

c) Erlich decided to invest $78,000 in Intel, $120,000 in Oracle, $60,000 in Yahoo!, and the rest in ebay. What is the portfolio weight in each stock? d) What is the expected value of Erlichss $300,000 investment next year? 5 e) You tell Erlich that he might be able to do better if he had more information about the extent to which all of the assets in his portfolio moved together. Set up but do not calculate the covariance between returns on INTC and EBAY. f) If you were to calculate the variance-covariance matrix of returns for Erlichs portfolio, how many variance terms would you have? g) How many unique covariance terms would you have?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started