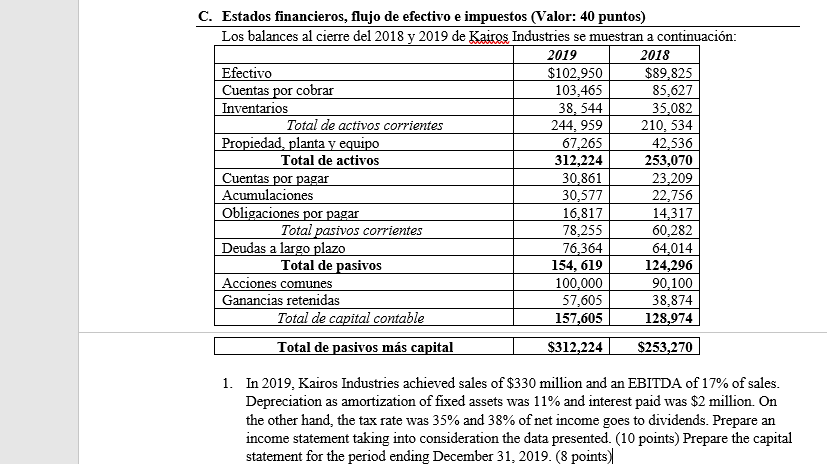

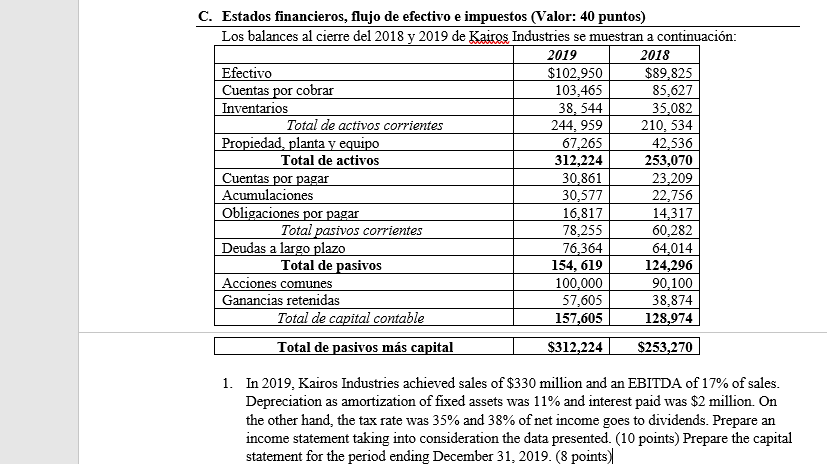

C. Estados financieros, flujo de efectivo e impuestos (Valor: 40 puntos) Los balances al cierre del 2018 y 2019 de Kairos Industries se muestran a continuacin: 2019 2018 Efectivo $102.950 $89,825 Cuentas por cobrar 103,465 85,627 Inventarios 38, 544 35,082 Total de activos corrientes 244, 959 210, 534 Propiedad, planta y equipo 67,265 42,536 Total de activos 312,224 253,070 Cuentas por pagar 30,861 23,209 Acumulaciones 30,577 22,756 Obligaciones por pagar 16,817 14,317 Total pasivos corrientes 78,255 60,282 Deudas a largo plazo 76,364 64,014 Total de pasivos 154, 619 124,296 Acciones comunes 100,000 90,100 Ganancias retenidas 57,605 38,874 Total de capital contable 157,605 128,974 Total de pasivos ms capital $312,224 $253,270 1. In 2019, Kairos Industries achieved sales of $330 million and an EBITDA of 17% of sales. Depreciation as amortization of fixed assets was 11% and interest paid was $2 million. On the other hand, the tax rate was 35% and 38% of net income goes to dividends. Prepare an income statement taking into consideration the data presented. (10 points) Prepare the capital statement for the period ending December 31, 2019. (8 points) C. Estados financieros, flujo de efectivo e impuestos (Valor: 40 puntos) Los balances al cierre del 2018 y 2019 de Kairos Industries se muestran a continuacin: 2019 2018 Efectivo $102.950 $89,825 Cuentas por cobrar 103,465 85,627 Inventarios 38, 544 35,082 Total de activos corrientes 244, 959 210, 534 Propiedad, planta y equipo 67,265 42,536 Total de activos 312,224 253,070 Cuentas por pagar 30,861 23,209 Acumulaciones 30,577 22,756 Obligaciones por pagar 16,817 14,317 Total pasivos corrientes 78,255 60,282 Deudas a largo plazo 76,364 64,014 Total de pasivos 154, 619 124,296 Acciones comunes 100,000 90,100 Ganancias retenidas 57,605 38,874 Total de capital contable 157,605 128,974 Total de pasivos ms capital $312,224 $253,270 1. In 2019, Kairos Industries achieved sales of $330 million and an EBITDA of 17% of sales. Depreciation as amortization of fixed assets was 11% and interest paid was $2 million. On the other hand, the tax rate was 35% and 38% of net income goes to dividends. Prepare an income statement taking into consideration the data presented. (10 points) Prepare the capital statement for the period ending December 31, 2019. (8 points)