Question

c. Exchange of Plant Assets - At a Gain, But Gain Not Recognized: On 9/10 Year 6 ECU Corporation disposes of old MACHINERY &

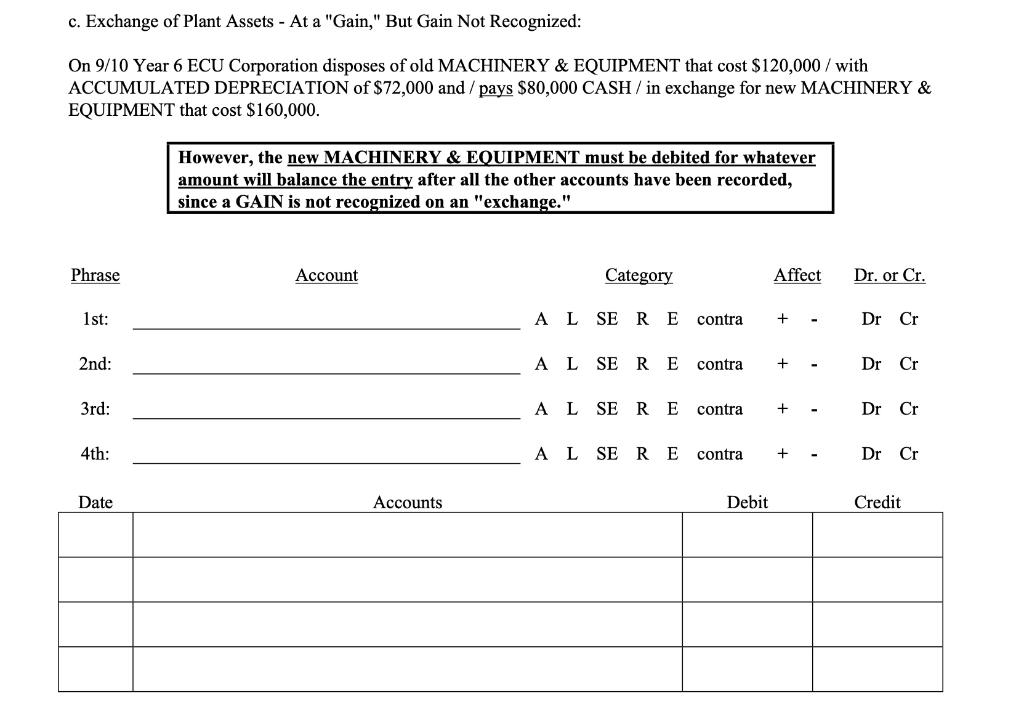

c. Exchange of Plant Assets - At a "Gain," But Gain Not Recognized: On 9/10 Year 6 ECU Corporation disposes of old MACHINERY & EQUIPMENT that cost $120,000/ with ACCUMULATED DEPRECIATION of $72,000 and / pays $80,000 CASH / in exchange for new MACHINERY & EQUIPMENT that cost $160,000. However, the new MACHINERY & EQUIPMENT must be debited for whatever amount will balance the entry after all the other accounts have been recorded, since a GAIN is not recognized on an "exchange." Phrase Account Category Affect Dr. or Cr. 1st: AL SE RE contra Dr Cr 2nd: AL SE RE contra Dr Cr 3rd: AL SE RE contra Dr Cr 4th: AL SE RE contra Dr Cr Date Accounts Debit + + + + Credit

Step by Step Solution

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Phrase Accounts Category Affect Dr or Cr 1st Machinery Equipment Old A Cr 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater, Mike Deschamps

14th Edition

0134729315, 978-0134729312

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App