Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) The following information relates to Apex Forwarders Limited, a multinational corporation based in Switzerland: 1. The company is considering a project which involves

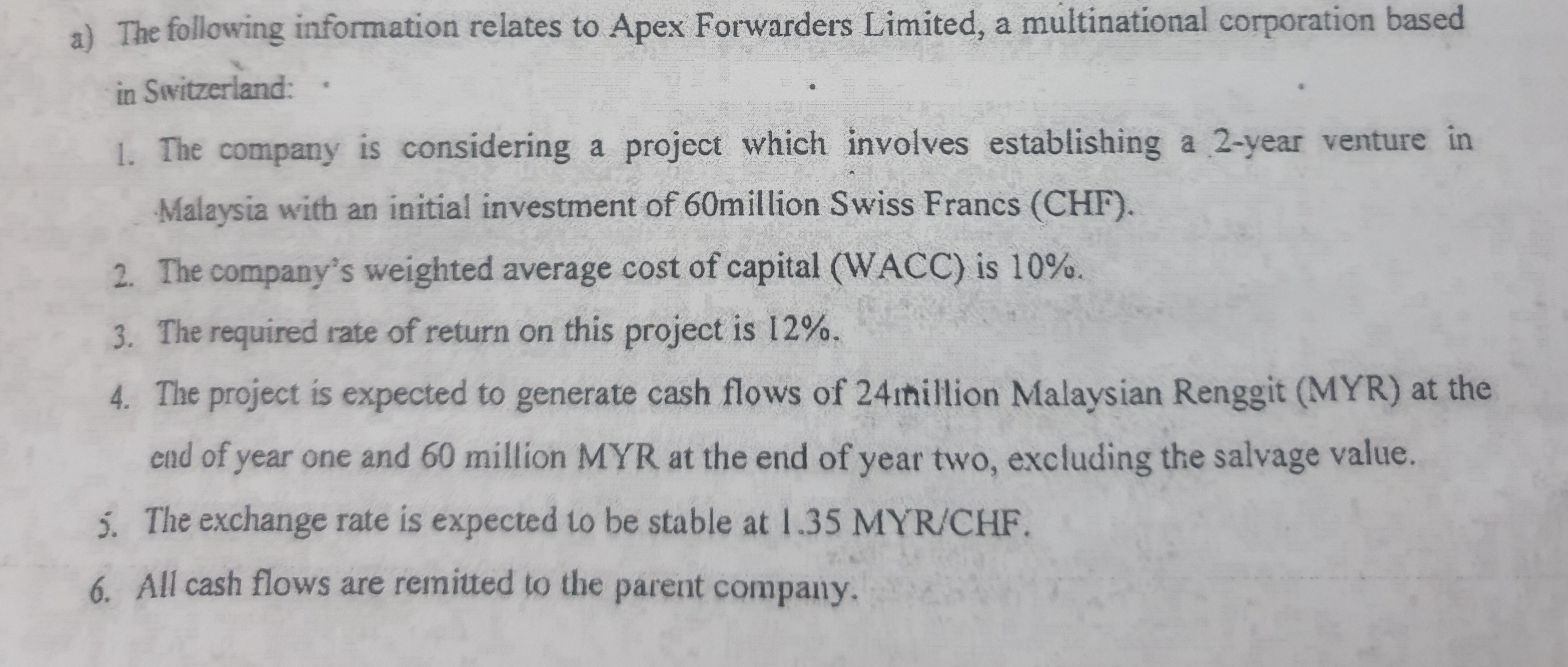

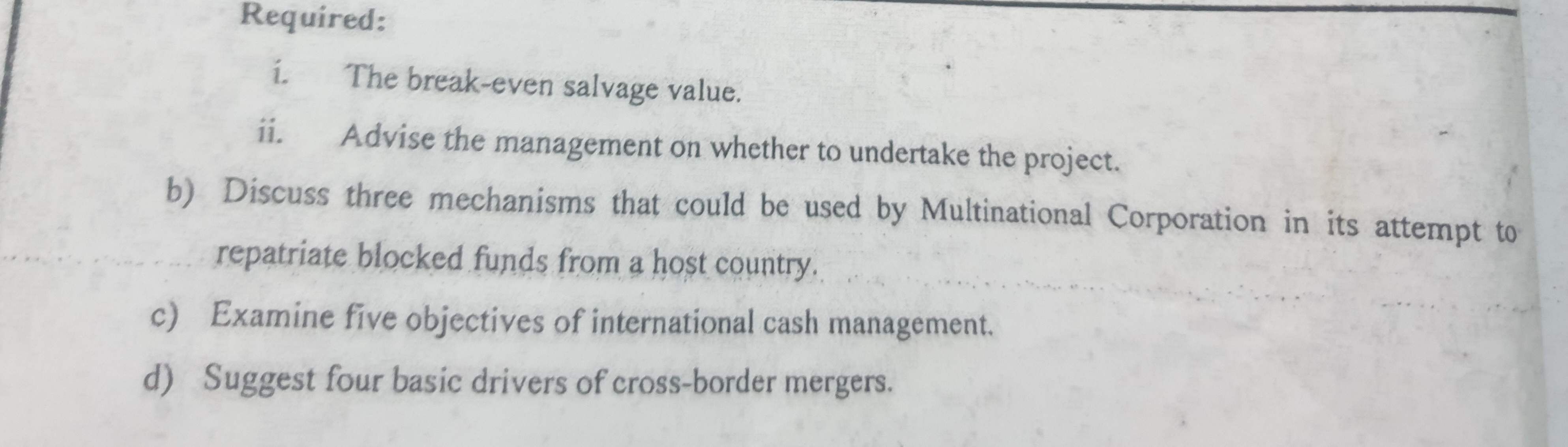

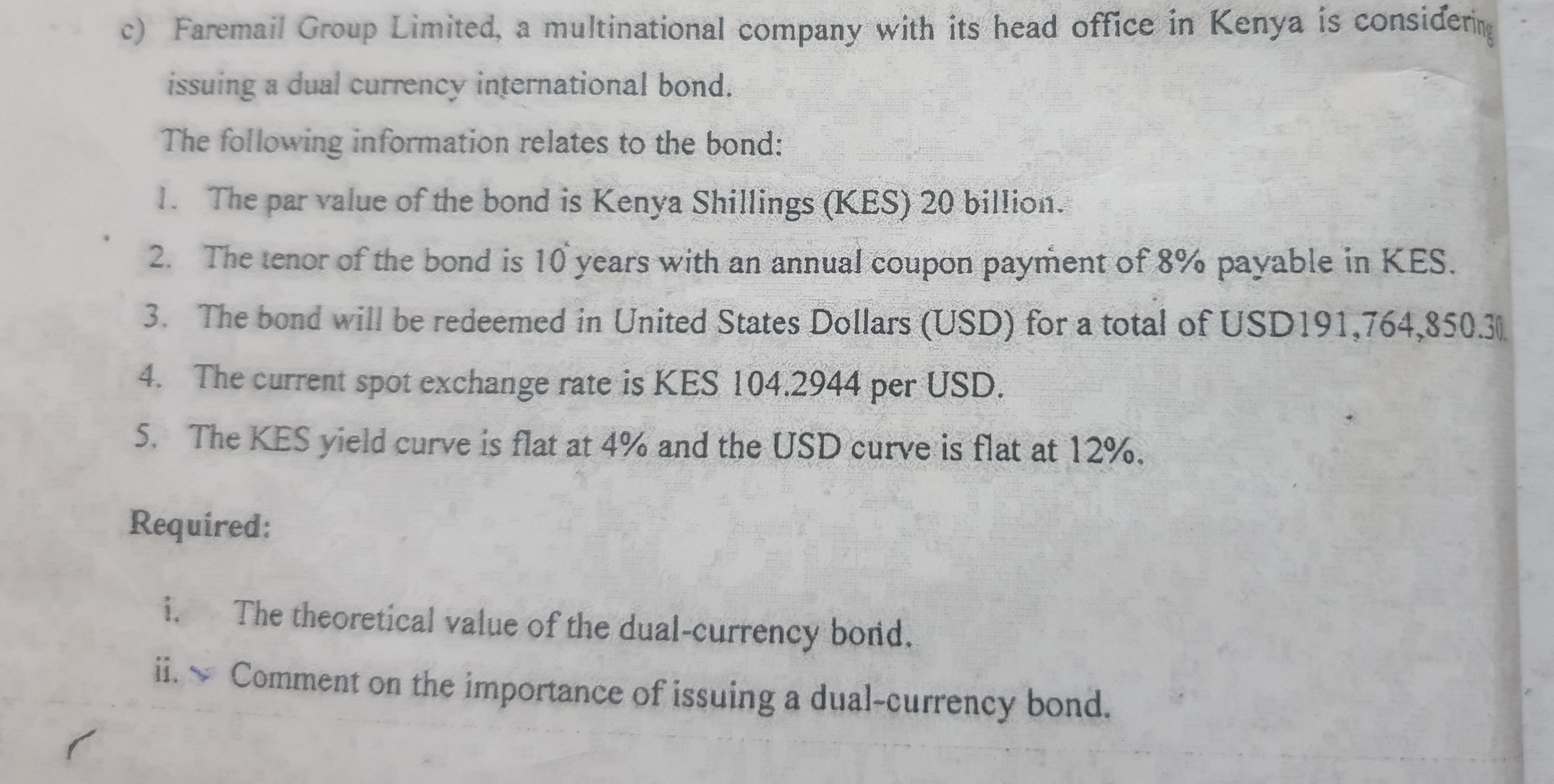

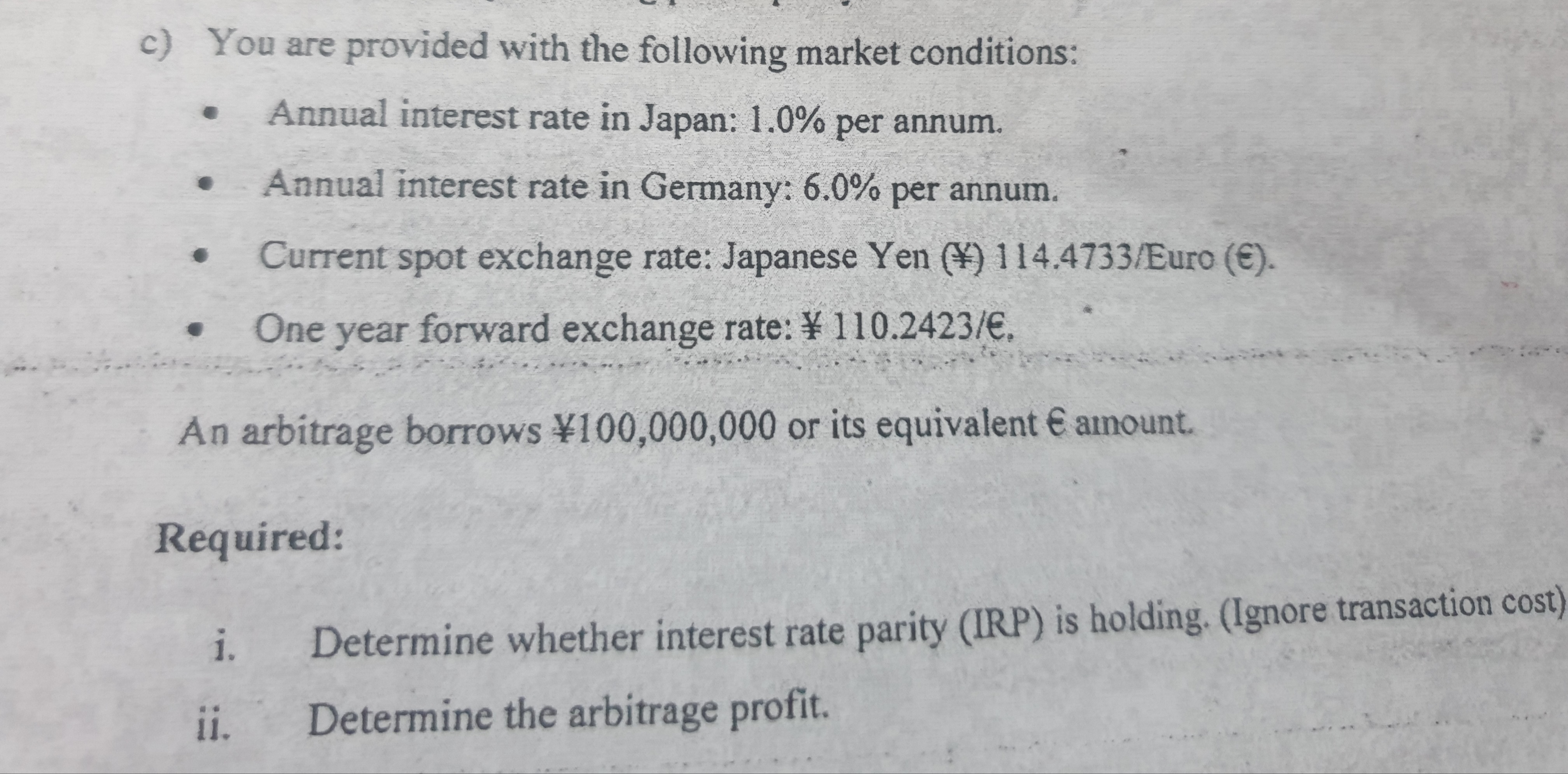

a) The following information relates to Apex Forwarders Limited, a multinational corporation based in Switzerland: 1. The company is considering a project which involves establishing a 2-year venture in Malaysia with an initial investment of 60million Swiss Francs (CHF). 2. The company's weighted average cost of capital (WACC) is 10%. 3. The required rate of return on this project is 12%. 4. The project is expected to generate cash flows of 24million Malaysian Renggit (MYR) at the end of year one and 60 million MYR at the end of year two, excluding the salvage value. 5. The exchange rate is expected to be stable at 1.35 MYR/CHF. 6. All cash flows are remitted to the parent company. Required: i. The break-even salvage value. ii. Advise the management on whether to undertake the project. b) Discuss three mechanisms that could be used by Multinational Corporation in its attempt to repatriate blocked funds from a host country. c) Examine five objectives of international cash management. d) Suggest four basic drivers of cross-border mergers. c) Faremail Group Limited, a multinational company with its head office in Kenya is considerin issuing a dual currency international bond. The following information relates to the bond: 1. The par value of the bond is Kenya Shillings (KES) 20 billion. 2. The tenor of the bond is 10 years with an annual coupon payment of 8% payable in KES. 3. The bond will be redeemed in United States Dollars (USD) for a total of USD191,764,850.30 4. The current spot exchange rate is KES 104.2944 per USD. 5. The KES yield curve is flat at 4% and the USD curve is flat at 12%. Required: i. The theoretical value of the dual-currency bond. ii. Comment on the importance of issuing a dual-currency bond. c) You are provided with the following market conditions: . Annual interest rate in Japan: 1.0% per annum. . Annual interest rate in Germany: 6.0% per annum. Current spot exchange rate: Japanese Yen () 114.4733/Euro (). One year forward exchange rate: \ 110.2423/. An arbitrage borrows 100,000,000 or its equivalent amount. Required: i. ii. Determine whether interest rate parity (IRP) is holding. (Ignore transaction cost) Determine the arbitrage profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go stepbystep through each part of the provided questions A Apex Forwarders Limited Project Evaluation i Breakeven Salvage Value To calculate the breakeven salvage value we need to determine the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started