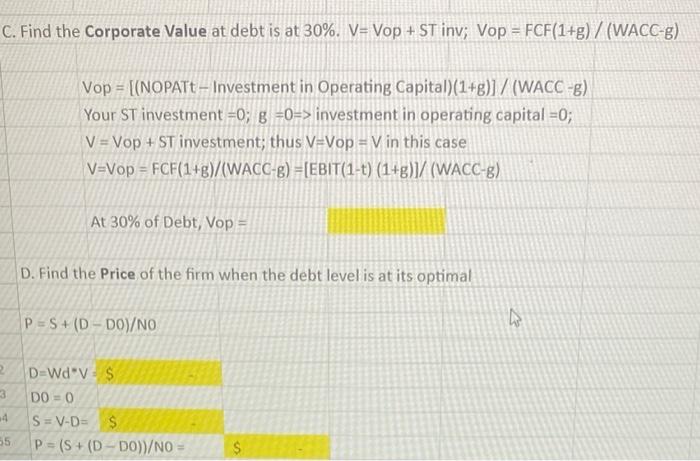

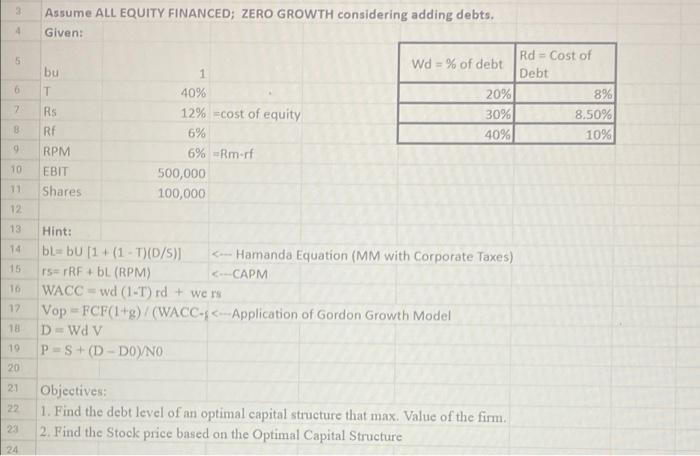

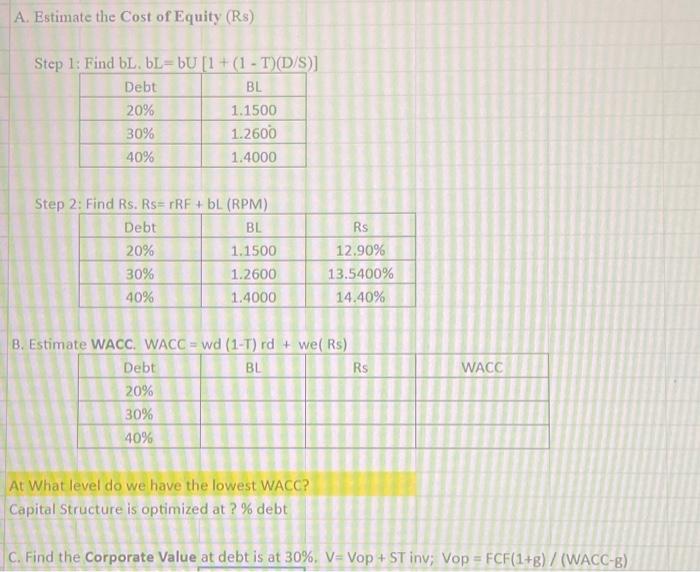

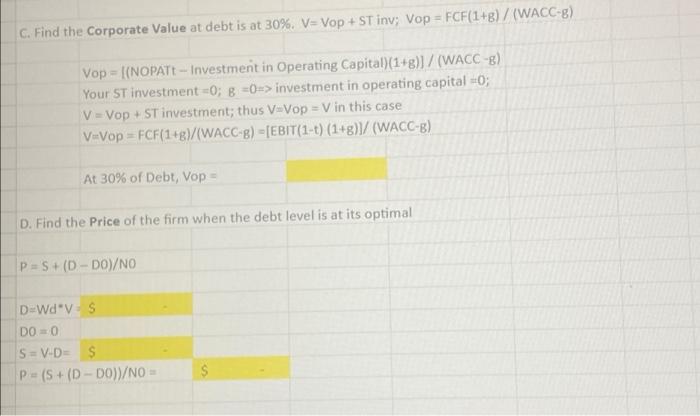

C. Find the Corporate Value at debt is at 30%. V=Vop + ST inv; Vop = FCF(1+g)/(WACC-g) Vop = [[NOPATt - Investment in Operating Capital)(1+g)]/(WACC +g) Your ST investment =0; 8 =0=> investment in operating capital =0; V=Vop + ST investment; thus V=Vop=V in this case V=Vop = FCF(1+g)/(WACC-6) = [EBIT(1-t) (1+g)]/(WACC-B) At 30% of Debt, Vop= D. Find the Price of the firm when the debt level is at its optimal P = S + (D-DO/NO > 3 D=Wd V: S DO = 0 S = V-D- $ P = (S +(D-DO/NO 14 55 $ 3 Assume ALL EQUITY FINANCED; ZERO GROWTH considering adding debts. Given: 4 5 Wd = % of debt 6 bu T RS RE RPM 2 Rd = Cost of Debt 896 8.50% 10% 1 40% 12% -cost of equity 6% 6% -Rm-rf 500,000 100,000 20% 30% 40% B 9 10 EBIT Shares 10 12 13 14 15 To Hin bl-bU (1 + (1 - T)(D/S)] investment in operating capital 0; V = Vop + ST investment; thus V=Vop=V in this case VuVop= FCF(1+g)/(WACC-g) - [EBIT(1-1) 1+g)]/(WACC-B) At 30% of Debt, Vop- D. Find the Price of the firm when the debt level is at its optimal P = S+(D-DO)/NO D-Wd V-S DO 0 15=V-D- S P - (5+ (D-DO))/NO = C. Find the Corporate Value at debt is at 30%. V=Vop + ST inv; Vop = FCF(1+g)/(WACC-g) Vop = [[NOPATt - Investment in Operating Capital)(1+g)]/(WACC +g) Your ST investment =0; 8 =0=> investment in operating capital =0; V=Vop + ST investment; thus V=Vop=V in this case V=Vop = FCF(1+g)/(WACC-6) = [EBIT(1-t) (1+g)]/(WACC-B) At 30% of Debt, Vop= D. Find the Price of the firm when the debt level is at its optimal P = S + (D-DO/NO > 3 D=Wd V: S DO = 0 S = V-D- $ P = (S +(D-DO/NO 14 55 $ 3 Assume ALL EQUITY FINANCED; ZERO GROWTH considering adding debts. Given: 4 5 Wd = % of debt 6 bu T RS RE RPM 2 Rd = Cost of Debt 896 8.50% 10% 1 40% 12% -cost of equity 6% 6% -Rm-rf 500,000 100,000 20% 30% 40% B 9 10 EBIT Shares 10 12 13 14 15 To Hin bl-bU (1 + (1 - T)(D/S)] investment in operating capital 0; V = Vop + ST investment; thus V=Vop=V in this case VuVop= FCF(1+g)/(WACC-g) - [EBIT(1-1) 1+g)]/(WACC-B) At 30% of Debt, Vop- D. Find the Price of the firm when the debt level is at its optimal P = S+(D-DO)/NO D-Wd V-S DO 0 15=V-D- S P - (5+ (D-DO))/NO =