Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c Hard_apple Company is considering replacing its old bottling equipment for a new industrial bottling equipment. Project is a 10-year project. You are asked to

c

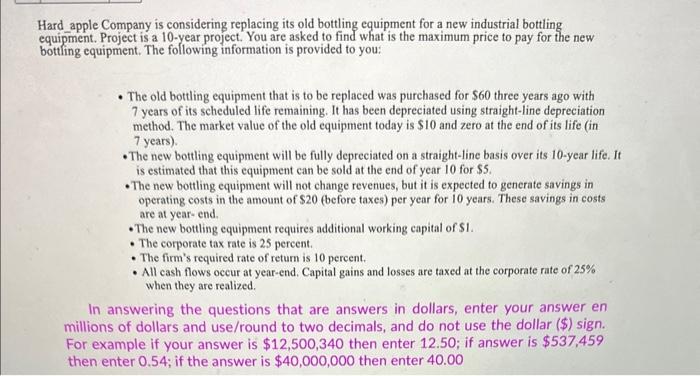

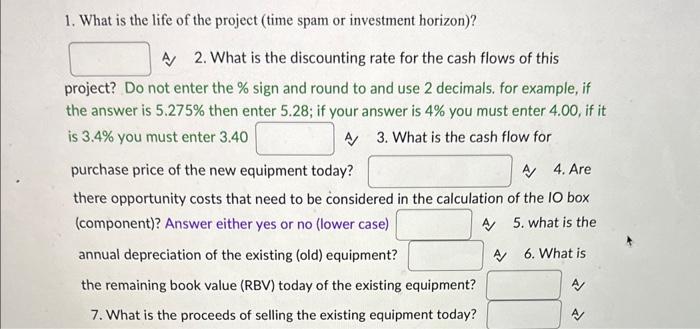

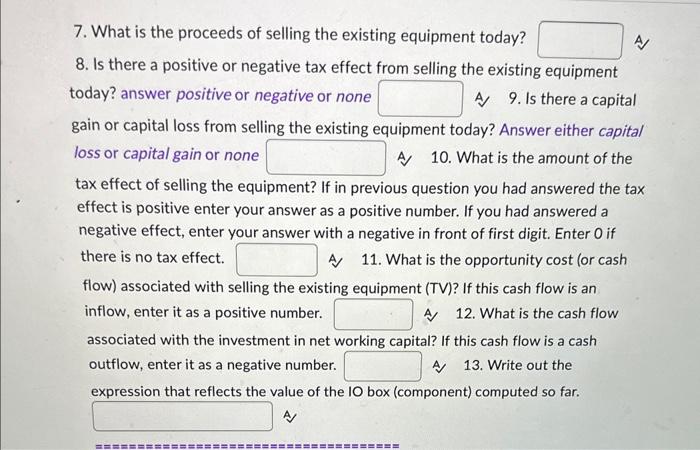

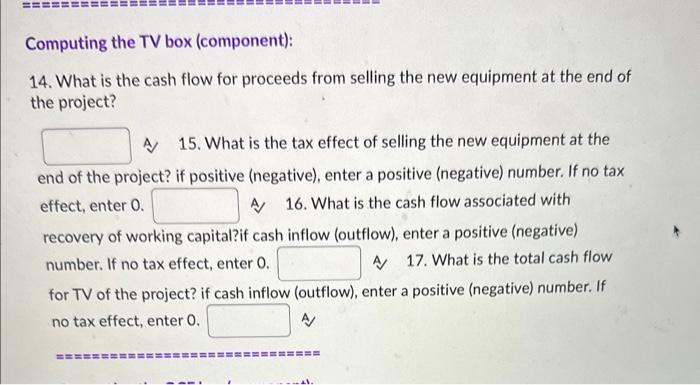

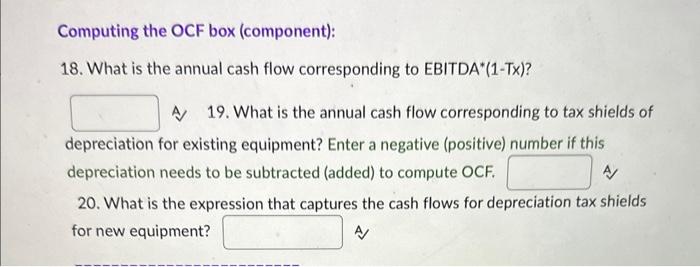

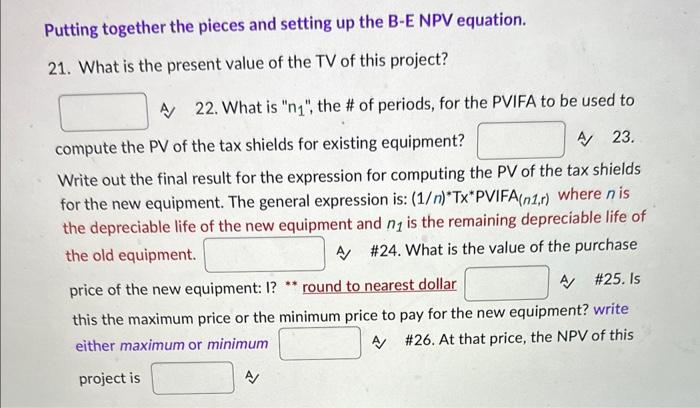

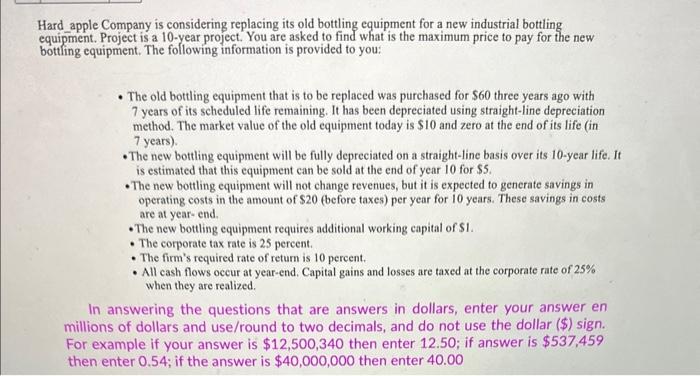

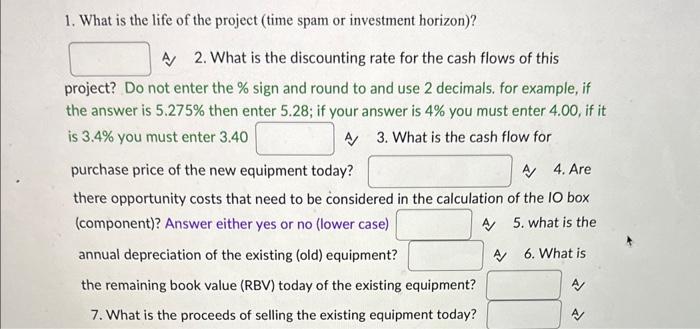

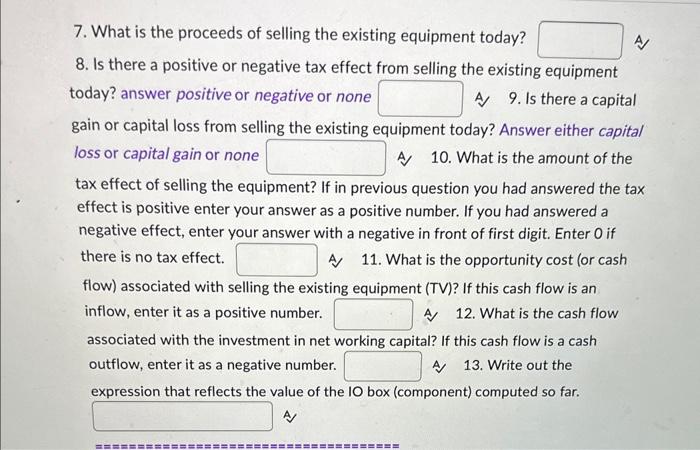

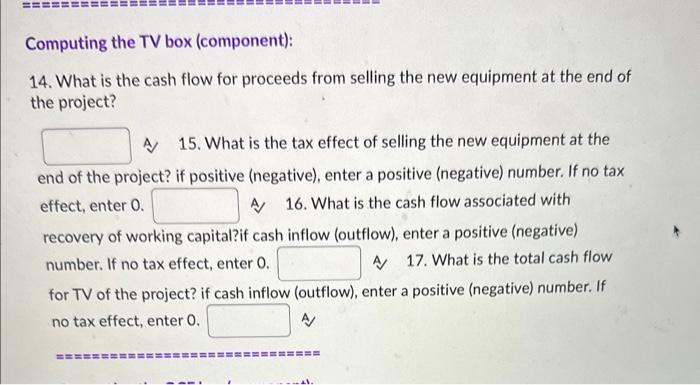

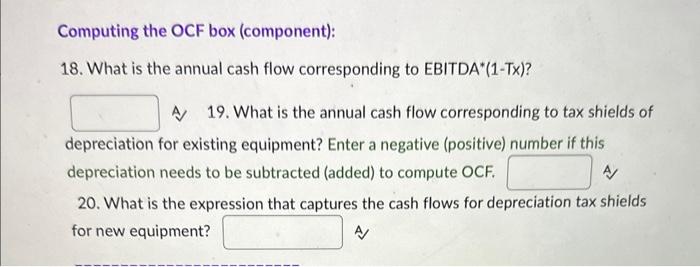

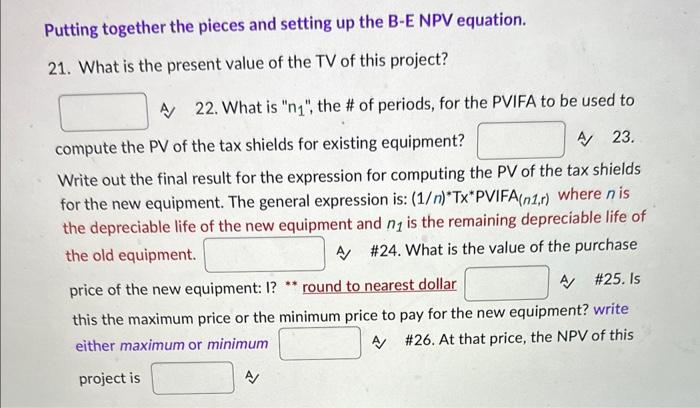

Hard_apple Company is considering replacing its old bottling equipment for a new industrial bottling equipment. Project is a 10-year project. You are asked to find what is the maximum price to pay for the new bottling equipment. The following information is provided to you: - The old bottling equipment that is to be replaced was purchased for $60 three years ago with 7 years of its scheduled life remaining. It has been depreciated using straight-line depreciation method. The market value of the old equipment today is $10 and zero at the end of its life (in 7 years). - The new bottling equipment will be fully depreciated on a straight-line basis over its 10-year life. It is estimated that this equipment can be sold at the end of year 10 for $5. - The new bottling equipment will not change revenues, but it is expected to generate savings in operating costs in the amount of $20 (before taxes) per year for 10 years. These savings in costs are at year- end. - The new botting equipment requires additional working capital of $1. - The corporate tax rate is 25 percent. - The firm's required rate of return is 10 percent. - All cash flows occur at year-end. Capital gains and losses are taxed at the corporate rate of 25% when they are realized. In answering the questions that are answers in dollars, enter your answer en millions of dollars and use/round to two decimals, and do not use the dollar (\$) sign. For example if your answer is $12,500,340 then enter 12.50; if answer is $537,459 then enter 0.54; if the answer is $40,000,000 then enter 40.00 1. What is the life of the project (time spam or investment horizon)? A) 2. What is the discounting rate for the cash flows of this project? Do not enter the \% sign and round to and use 2 decimals. for example, if the answer is 5.275% then enter 5.28; if your answer is 4% you must enter 4.00, if it is 3.4% you must enter 3.40 A) 3. What is the cash flow for purchase price of the new equipment today? A) 4. Are there opportunity costs that need to be considered in the calculation of the 10 box (component)? Answer either yes or no (lower case) A) 5. what is the annual depreciation of the existing (old) equipment? 6. What is the remaining book value (RBV) today of the existing equipment? 7. What is the proceeds of selling the existing equipment today? 7. What is the proceeds of selling the existing equipment today? 8. Is there a positive or negative tax effect from selling the existing equipment today? answer positive or negative or none A) 9. Is there a capital gain or capital loss from selling the existing equipment today? Answer either capital loss or capital gain or none A) 10. What is the amount of the tax effect of selling the equipment? If in previous question you had answered the tax effect is positive enter your answer as a positive number. If you had answered a negative effect, enter your answer with a negative in front of first digit. Enter 0 if there is no tax effect. A 11. What is the opportunity cost (or cash flow) associated with selling the existing equipment (TV)? If this cash flow is an inflow, enter it as a positive number. A 12. What is the cash flow associated with the investment in net working capital? If this cash flow is a cash outflow, enter it as a negative number. A 13. Write out the expression that reflects the value of the IO box (component) computed so far. A Computing the TV box (component): 14. What is the cash flow for proceeds from selling the new equipment at the end of the project? A) 15. What is the tax effect of selling the new equipment at the end of the project? if positive (negative), enter a positive (negative) number. If no tax effect, enter 0. A) 16. What is the cash flow associated with recovery of working capital?if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0 . A 17. What is the total cash flow for TV of the project? if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0. A Computing the OCF box (component): 18. What is the annual cash flow corresponding to EBITDA* (1Tx) ? A. 19. What is the annual cash flow corresponding to tax shields of depreciation for existing equipment? Enter a negative (positive) number if this depreciation needs to be subtracted (added) to compute OCF. 20. What is the expression that captures the cash flows for depreciation tax shields for new equipment? A Putting together the pieces and setting up the B-E NPV equation. 21. What is the present value of the TV of this project? A 22. What is " n1 ", the \# of periods, for the PVIFA to be used to compute the PV of the tax shields for existing equipment? 23. Write out the final result for the expression for computing the PV of the tax shields for the new equipment. The general expression is: (1)TxPVIFA(n1,r) where n is the depreciable life of the new equipment and n1 is the remaining depreciable life of the old equipment. A #24. What is the value of the purchase price of the new equipment: I? "* round to nearest dollar A #25. Is this the maximum price or the minimum price to pay for the new equipment? write either maximum or minimum A \#26. At that price, the NPV of this project is Hard_apple Company is considering replacing its old bottling equipment for a new industrial bottling equipment. Project is a 10-year project. You are asked to find what is the maximum price to pay for the new bottling equipment. The following information is provided to you: - The old bottling equipment that is to be replaced was purchased for $60 three years ago with 7 years of its scheduled life remaining. It has been depreciated using straight-line depreciation method. The market value of the old equipment today is $10 and zero at the end of its life (in 7 years). - The new bottling equipment will be fully depreciated on a straight-line basis over its 10-year life. It is estimated that this equipment can be sold at the end of year 10 for $5. - The new bottling equipment will not change revenues, but it is expected to generate savings in operating costs in the amount of $20 (before taxes) per year for 10 years. These savings in costs are at year- end. - The new botting equipment requires additional working capital of $1. - The corporate tax rate is 25 percent. - The firm's required rate of return is 10 percent. - All cash flows occur at year-end. Capital gains and losses are taxed at the corporate rate of 25% when they are realized. In answering the questions that are answers in dollars, enter your answer en millions of dollars and use/round to two decimals, and do not use the dollar (\$) sign. For example if your answer is $12,500,340 then enter 12.50; if answer is $537,459 then enter 0.54; if the answer is $40,000,000 then enter 40.00 1. What is the life of the project (time spam or investment horizon)? A) 2. What is the discounting rate for the cash flows of this project? Do not enter the \% sign and round to and use 2 decimals. for example, if the answer is 5.275% then enter 5.28; if your answer is 4% you must enter 4.00, if it is 3.4% you must enter 3.40 A) 3. What is the cash flow for purchase price of the new equipment today? A) 4. Are there opportunity costs that need to be considered in the calculation of the 10 box (component)? Answer either yes or no (lower case) A) 5. what is the annual depreciation of the existing (old) equipment? 6. What is the remaining book value (RBV) today of the existing equipment? 7. What is the proceeds of selling the existing equipment today? 7. What is the proceeds of selling the existing equipment today? 8. Is there a positive or negative tax effect from selling the existing equipment today? answer positive or negative or none A) 9. Is there a capital gain or capital loss from selling the existing equipment today? Answer either capital loss or capital gain or none A) 10. What is the amount of the tax effect of selling the equipment? If in previous question you had answered the tax effect is positive enter your answer as a positive number. If you had answered a negative effect, enter your answer with a negative in front of first digit. Enter 0 if there is no tax effect. A 11. What is the opportunity cost (or cash flow) associated with selling the existing equipment (TV)? If this cash flow is an inflow, enter it as a positive number. A 12. What is the cash flow associated with the investment in net working capital? If this cash flow is a cash outflow, enter it as a negative number. A 13. Write out the expression that reflects the value of the IO box (component) computed so far. A Computing the TV box (component): 14. What is the cash flow for proceeds from selling the new equipment at the end of the project? A) 15. What is the tax effect of selling the new equipment at the end of the project? if positive (negative), enter a positive (negative) number. If no tax effect, enter 0. A) 16. What is the cash flow associated with recovery of working capital?if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0 . A 17. What is the total cash flow for TV of the project? if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0. A Computing the OCF box (component): 18. What is the annual cash flow corresponding to EBITDA* (1Tx) ? A. 19. What is the annual cash flow corresponding to tax shields of depreciation for existing equipment? Enter a negative (positive) number if this depreciation needs to be subtracted (added) to compute OCF. 20. What is the expression that captures the cash flows for depreciation tax shields for new equipment? A Putting together the pieces and setting up the B-E NPV equation. 21. What is the present value of the TV of this project? A 22. What is " n1 ", the \# of periods, for the PVIFA to be used to compute the PV of the tax shields for existing equipment? 23. Write out the final result for the expression for computing the PV of the tax shields for the new equipment. The general expression is: (1)TxPVIFA(n1,r) where n is the depreciable life of the new equipment and n1 is the remaining depreciable life of the old equipment. A #24. What is the value of the purchase price of the new equipment: I? "* round to nearest dollar A #25. Is this the maximum price or the minimum price to pay for the new equipment? write either maximum or minimum A \#26. At that price, the NPV of this project is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started