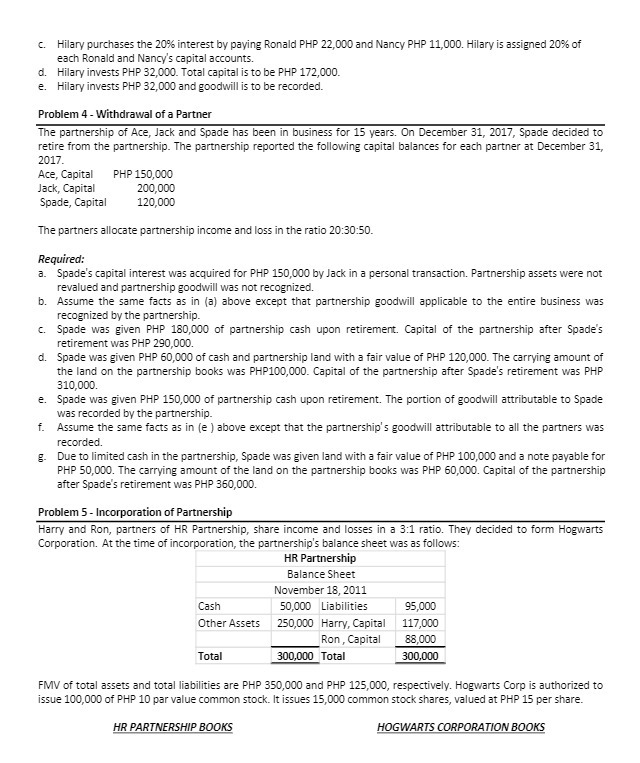

C. Hilary purchases the 20% interest by paying Ronald PHP 22,000 and Nancy PHP 11,000. Hilary is assigned 20% of each Ronald and Nancy's capital accounts. d. Hilary invests PHP 32,000. Total capital is to be PHP 172,000. e. Hilary invests PHP 32,000 and goodwill is to be recorded. Problem 4 - Withdrawal of a Partner The partnership of Ace, Jack and Spade has been in business for 15 years. On December 31, 2017, Spade decided to retire from the partnership. The partnership reported the following capital balances for each partner at December 31, 2017. Ace, Capital PHP 150,000 Jack, Capital 200,000 Spade, Capital 120,000 The partners allocate partnership income and loss in the ratio 20:30:50. Required: a. Spade's capital interest was acquired for PHP 150,000 by Jack in a personal transaction. Partnership assets were not revalued and partnership goodwill was not recognized. b. Assume the same facts as in (a) above except that partnership goodwill applicable to the entire business was recognized by the partnership. C. Spade was given PHP 180,000 of partnership cash upon retirement. Capital of the partnership after Spade's retirement was PHP 290,000 d. Spade was given PHP 60,000 of cash and partnership land with a fair value of PHP 120,000. The carrying amount of the land on the partnership books was PHP100,000. Capital of the partnership after Spade's retirement was PHP 310,000 e. Spade was given PHP 150,000 of partnership cash upon retirement. The portion of goodwill attributable to Spade was recorded by the partnership. F. Assume the same facts as in (e ) above except that the partnership's goodwill attributable to all the partners was recorded Due to limited cash in the partnership, Spade was given land with a fair value of PHP 100,000 and a note payable for PHP 50,000. The carrying amount of the land on the partnership books was PHP 60,000. Capital of the partnership after Spade's retirement was PHP 360,000. Problem 5 - Incorporation of Partnership Harry and Ron, partners of HR Partnership, share income and losses in a 3:1 ratio. They decided to form Hogwarts Corporation. At the time of incorporation, the partnership's balance sheet was as follows: HR Partnership Balance Sheet November 18, 2011 Cash 50,000 Liabilities 95,000 Other Assets 250,000 Harry, Capital 117,000 Ron, Capital 38,000 Total 300,000 Total 300,000 FMV of total assets and total liabilities are PHP 350,000 and PHP 125,000, respectively. Hogwarts Corp is authorized to issue 100,000 of PHP 10 par value common stock. It issues 15,000 common stock shares, valued at PHP 15 per share. HR PARTNERSHIP BOOKS HOGWARTS CORPORATION BOOKS