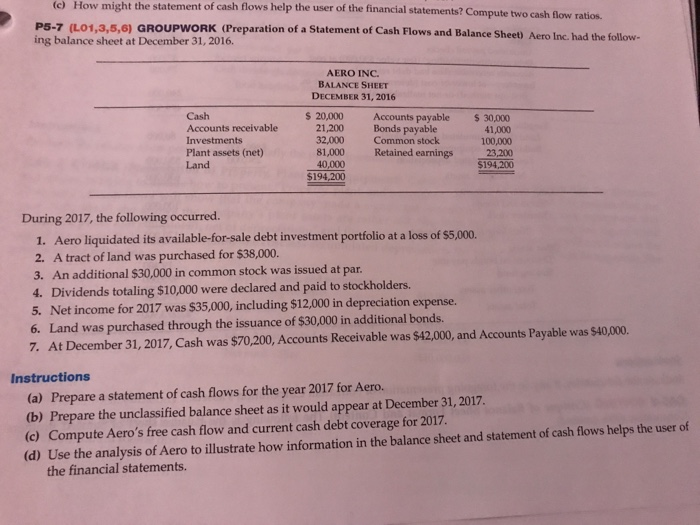

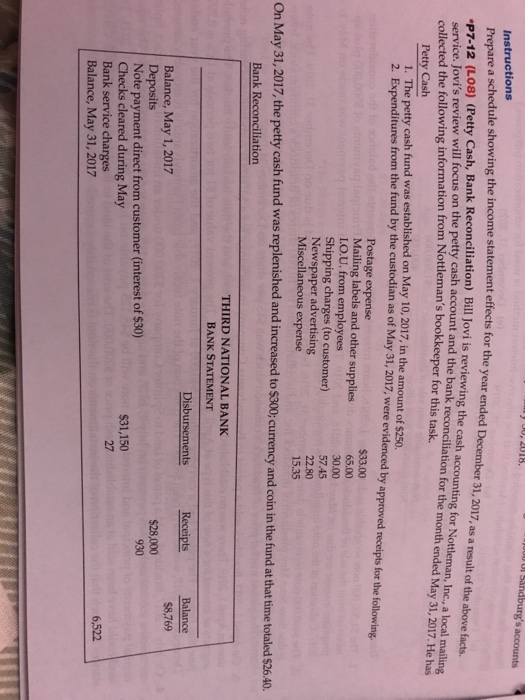

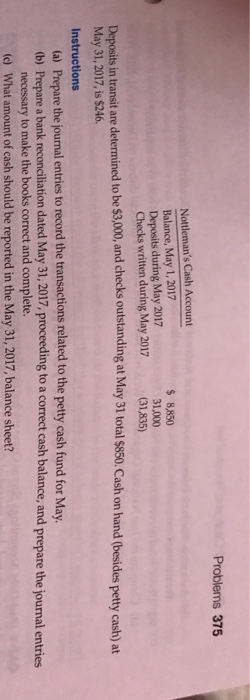

(c) How might the statement of cash flows help the user of the financial statements? P5-7 (L01,3,5,6) GROUPWORK (Preparation of a Statement of Cash ing balance sheet at December 31, 2016. Flows and Balance Sheet) Aero Inc. had the follow- AERO INC. BALANCE SHEET DECEMBER 31, 2016 Cash Accounts receivable Investments Plant assets (net) Land s 20,000 Accounts payable $ 30,000 41,000 100,000 23,200 $194,.200 21,200 Bonds payable 32,000 Common stock 81,000 Retained earnings 40,000 $194,200 During 2017, the following occurred. 1. Aero liquidated its available-for-sale debt investment portfolio at a loss of $5,000. 2. A tract of land was purchased for $38,000. 3. An additional $30,000 in common stock was issued at par 4. Dividends totaling $10,000 were declared and paid to stockholders. 5. Net income for 2017 was $35,000, including $12,000 in depreciation expense. 6. Land was purchased through the issuance of $30,000 in additional bonds. 7. At December 31, 2017, Cash was $70,200, Accounts Receivable was $42,000, and Accounts Payable was $40,000. Instructions (a) Prepare a statement of cash flows for the year 2017 for Aero. (b) Prepare the unclassified balance sheet as it would appear at December 31, 2017. (c) Compute Aero's free cash flow and current cash debt coverage for 2017. (d) Use the analysis of Aero to illustrate how information in the balance sheet and statement of cash flows helps the user of the financial statements. l Sandburg's Instructions Prepare a schedule showing the income s tatement effects for the year ended December 31, 2017, as a result of the above facts. P7-12 (Lo8) (Petty Cash, Bank Reconciliation) Bil lovi's review will focus on the petty cash account and the bank reconciliation for the month ended May 31.2017 1 Jovi is reviewing the cash accounting for g for Nottleman, Inc, a local mailing co lected the following information from Nottleman's bookkeeper for this task. Petty Cash 1. The petty cash fund was established on May 10, 2017, in the amount of $250. 2. Expenditures from the fund by the custodian as of May 31, 2017, were evidenced by approved receipts for the following Postage expense Mailing labels and other supplies LO.U. from employees Shipping charges (to customer) Newspaper advertising Miscellaneous expense $33.00 65.00 30.00 57.45 15.35 On May 31, 2017, the petty cash fund was replenished and increased to $300, currency and coin in in the fund at that time totaled $26.40 Bank Reconciliation THIRD NATIONAL BANK BANK STATEMENT ReceiptsBalance $8,769 Disbursements Balance, May 1, 2017 Deposits Note payment direct from customer (interest of $30) Checks cleared during May Bank service charges Balance, May 31, 2017 $28,000 930 $31,150 27 6,522 Problems 375 Nottleman's Cash Account Balance, May 1,2017 Deposits during May 2017 Checks written during May 2017 $ 8,850 (31,835) Deposits in transit are determined to be $3,00, and checks outstanding at May 31 total $850. Cash on hand (besides pety cash) at May 31, 2017, is $246. Instructions (a) Prepare the journal entries to record the transactions related to the petty cash fund for May (b) Prepare a bank reconciliation dated May 31, 2017, proceeding to a correct cash balance, and prepare the journal entries necessary to make the books correct and complete. What amount of cash should be reported in the May 31, 2017, balance sheet? (c)