Answered step by step

Verified Expert Solution

Question

1 Approved Answer

c. If Index 3 gains 80% in a certain year, what return would GHK be expected to have? Select the correct choice below and fill

c. If Index 3 gains 80% in a certain year, what return would GHK be expected to have? Select the correct choice below and fill in the answer box to complete your choice.

A.If Index 3 gains 80% in a year, GHK is expected to gain an estimated __%.

B.If Index 3 gains 80% in a year, GHK is expected to lose an estimated __%.

(Just answer b and c, thank you)

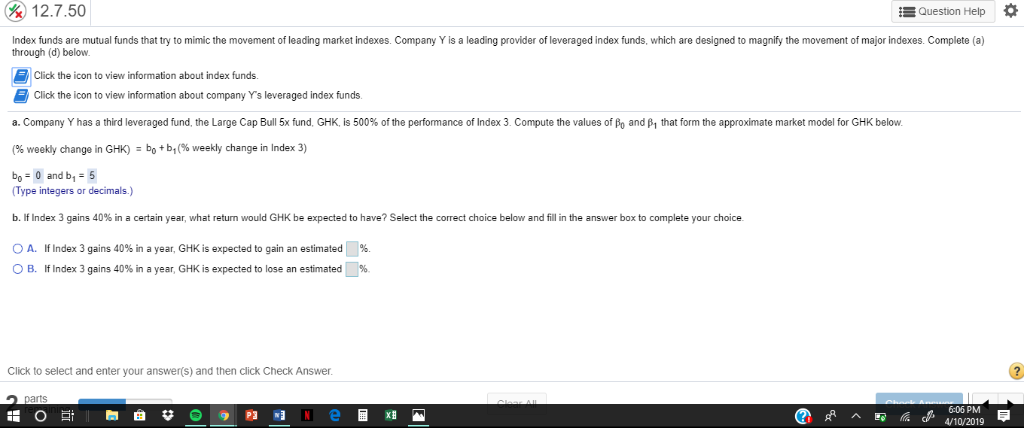

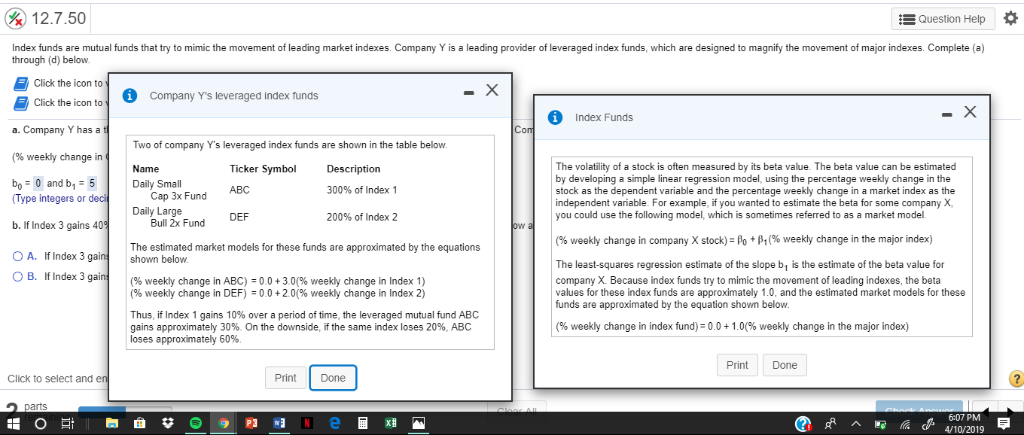

(%) 12.7.50 Question Help * Index funds are mutual funds that try to mimic the movement of leading market indexes. Company Y is a leading provider of leveraged index funds, which are designed to magnify the movement of major indexes. Complete (a) through (d) below. Click the icon to view information about index fund Click the icon to view information about company Y's leveraged index funds. a Company Y has a third leveraged fund the Large Cap Bull 5 fund. GHI s 50 % of the perfomance of Index 3. Compute the values of (% weekly change in GHK) = b0 + b1 (% weekly change in Index 3) o-0 and by-5 and that om the approximate m et mod for t 10. (Type integers or decimals.) b Index 3 gains 40% n a certain year what return would GH be expected to have? Select the correct choice below and O A. If Index 3 gains 40% in a year, GHK is expected to gain an estimated %. Ilin the answer box to complete your choice. O B. If Index 3 gains 40% in a year, GHK is expected to lose an estimated 1% Click to select and enter your answer(s) and then click Check Answer 6:06 PM 4/10/2019 &12.7.50 Question Help Index funds are mutual funds that try to mimic the movement of leading market indexes. Company Y is a leading provider of leveraged index funds, which are designed to magnify the movement of major indexes. Complete (a) through (d) below Click the icon to y Y's leveraged index funds Click the icon to Index Funds a. Company Y has a (96 weekly change in bo nd b 5 Two of company Y's leveraged index funds are shown in the table below Name Daily Small The volatility of a stock is often measured by its beta value. The beta value can be estimated by developing a simple linear regression model, using the percentage weekly change in the stock as the dependent variable and the percentage weekly change in a market index as the independent variable. For example, if you wanted to estimate the beta for some company X you could use the following model, which is sometimes referred to as a market model Ticker Symbol Description 300% of Index 1 200% of Index 2 ABC Cap 3x Fund Type integers or b. If Index 3 gains 40 O A. If Index 3 gain O B. If Index 3 gai Daily Large Bull 2x Fund (96 weekly change in company X stock-Po + 1 (% weekly change in the major index) The estimated market models for these funds are approximated by the equations shown below The least-squares regression estimate of the slope b1 is the estimate of the beta value for company X. Because index funds try to mimic the movement of leading indexes, the beta values for these index funds are approximately 1.0, and the estimated market models for these funds are approximated by the equation shown below. (96 weekly change in ABC-0 0 + 3 01% weekly change in Index 1) (96 weekly change in DEF)-0 0 + 2 01% weekly change in Index 2) Thus, if Index 1 gains 10% over a period of time, the leveraged mutual fund ABC gains approximately 30% On the downside, if the same index loses 20%, ABC loses approximately 60% (96 weekly change in index fund):00+10(% weekly change in the major index) PrintDone Click to select and Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started