Question

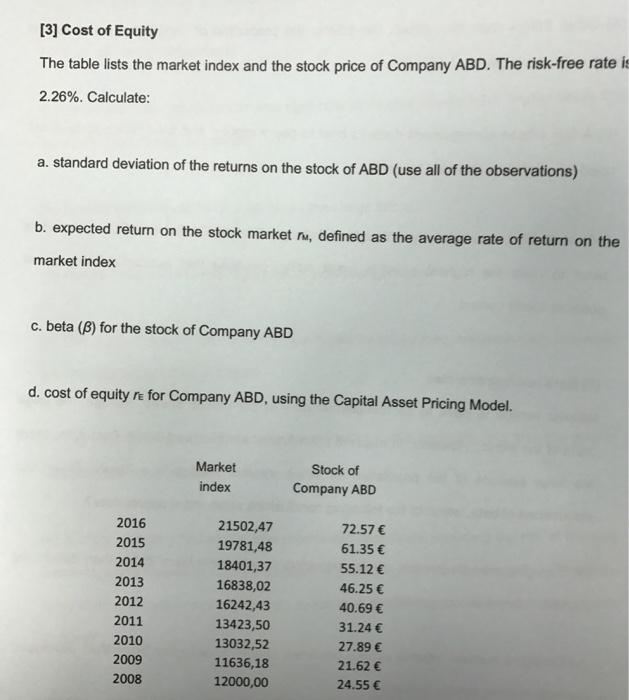

[3] Cost of Equity The table lists the market index and the stock price of Company ABD. The risk-free rate is 2.26%. Calculate: a.

[3] Cost of Equity The table lists the market index and the stock price of Company ABD. The risk-free rate is 2.26%. Calculate: a. standard deviation of the returns on the stock of ABD (use all of the observations) b. expected return on the stock market , defined as the average rate of return on the market index c. beta (3) for the stock of Company ABD d. cost of equity re for Company ABD, using the Capital Asset Pricing Model. 2016 2015 2014 2013 2012 2011 2010 2009 2008 Market index 21502,47 19781,48 18401,37 16838,02 16242,43 13423,50 13032,52 11636,18 12000,00 Stock of Company ABD 72.57 61.35 55.12 46.25 40.69 31.24 27.89 21.62 24.55

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Standard deviation of the returns on the stock of ABD Returns on stock Stock price at end of perio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management

Authors: Jay Heizer, Barry Render

11th edition

9780132921145, 132921146, 978-0133408010

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App