Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C. N, married, resident citizen had the following for 2020: a.) Business Income a. Rental income from real property, net of 5% withholding tax

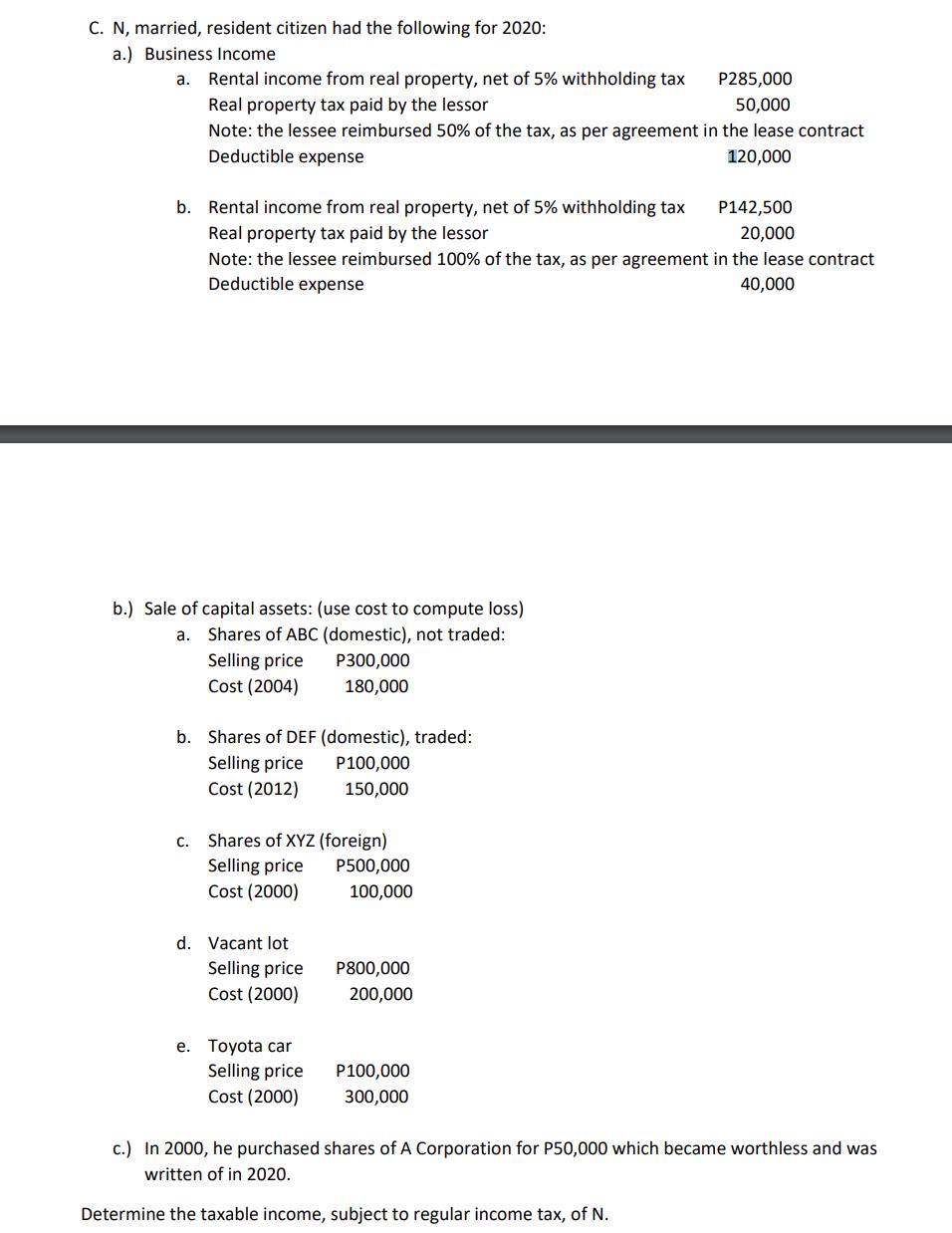

C. N, married, resident citizen had the following for 2020: a.) Business Income a. Rental income from real property, net of 5% withholding tax P285,000 Real property tax paid by the lessor 50,000 Note: the lessee reimbursed 50% of the tax, as per agreement in the lease contract Deductible expense 120,000 b. Rental income from real property, net of 5% withholding tax P142,500 Real property tax paid by the lessor 20,000 Note: the lessee reimbursed 100% of the tax, as per agreement in the lease contract Deductible expense 40,000 b.) Sale of capital assets: (use cost to compute loss) a. Shares of ABC (domestic), not traded: Selling price Cost (2004) P300,000 180,000 b. Shares of DEF (domestic), traded: Selling price Cost (2012) P100,000 150,000 C. Shares of XYZ (foreign) Selling price Cost (2000) P500,000 100,000 d. Vacant lot Selling price P800,000 Cost (2000) 200,000 e. Toyota car Selling price Cost (2000) P100,000 300,000 c.) In 2000, he purchased shares of A Corporation for P50,000 which became worthless and was written of in 2020. Determine the taxable income, subject to regular income tax, of N.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

N being a resident it is assumed he is normally resident and hence subject to the normal tax rates o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60990d58abd6e_210689.pdf

180 KBs PDF File

60990d58abd6e_210689.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started