Answered step by step

Verified Expert Solution

Question

1 Approved Answer

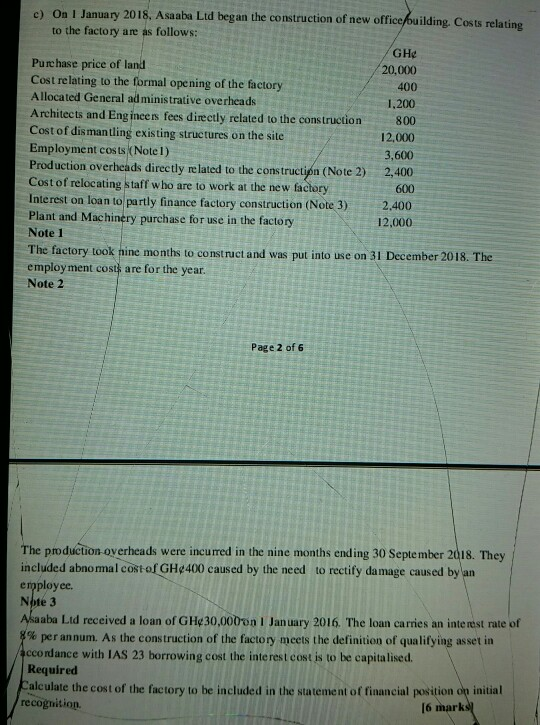

c) On 1 January 2018. Asaaba Ltd began the construction of new office building. Costs relating to the factory are as follows: GHe Purchase price

c) On 1 January 2018. Asaaba Ltd began the construction of new office building. Costs relating to the factory are as follows: GHe Purchase price of land 20.000 Cost relating to the formal opening of the factory 400 Allocated General administrative overheads 1,200 Architects and Engineers fees directly related to the construction 800 Cost of dismantling existing structures on the site 12,000 Employment costs (Notel) 3,600 Production overheads directly related to the construction (Note 2) 2,400 Cost of relocating staff who are to work at the new factory 600 Interest on loan to partly finance factory construction (Note 3) 2.400 Plant and Machinery purchase for use in the factory 12,000 Note 1 The factory took nine months to construct and was put into use on 31 December 2018. The employment costs are for the year. Note 2 Page 2 of 6 The production overheads were incurred in the nine months ending 30 September 2018. They included abnormal cost of GH 400 caused by the need to rectify damage caused by an employee. Note 3 Akaaba Ltd received a loan of GH430,000 on January 2016. The loan carries an interest rate of 8% per annum. As the construction of the factory meets the definition of qualifying as set in accordance with IAS 23 borrowing cost the interest cost is to be capitalised. Required Calculate the cost of the factory to be included in the statement of financial position on initial recognition 16 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started