Question

C- On January 1, 2018 Philly Corporation paid $40,500 for a 90% interest in Skelly Corporation. On that date Skelly capital stock was $25,000 and

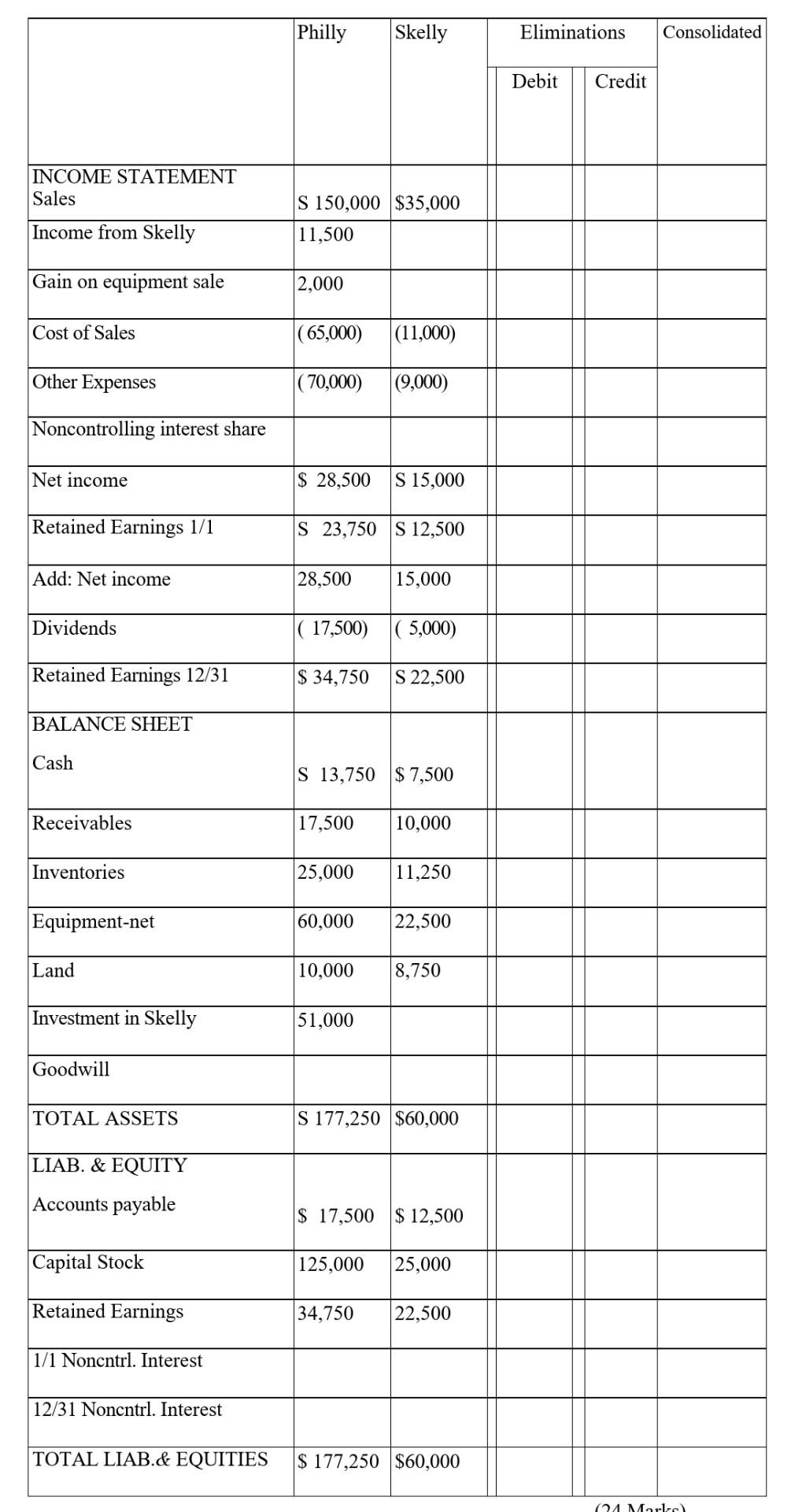

C- On January 1, 2018 Philly Corporation paid $40,500 for a 90% interest in Skelly Corporation. On that date Skelly capital stock was $25,000 and its Retained Earnings was $7,500. Any excess will be assigned to goodwill. Further information: 1. During 2018, Philly's sales to Skelly were $12,000, Skelly managed to sell 50% of this merchandise. (The other half was sold in 2019.) 2. During 2019, Philly's sales to Skelly were $15,000 of which Skelly managed to sell 40% of this merchandise. At year-end 2019, Skelly owed Philly $3,750 for the inventory purchased during 2019. Philly sells merchandise to Skelly at 120% of Philly's cost. 3. On January 1, 2019, Philly sold equipment with a book value of $5,000 and a remaining useful life of four years and no salvage value to Skelly for $7,000. Straight-line depreciation is used. 4. Skelly's income for 2018 was $10,000 and Skelly's dividends received by Philly was $4,500 5. Separate company financial statements for Philly Corporation and Subsidiary at December 31, 2019 are summarized in the first two columns of the consolidation working papers. Required: 1) Prepare all elimination entries in 2019 (Inc

luding the entries not affecting the consolidated Income statement). Show all your calculations. 2) Complete the working papers to consolidate the financial statements of Philly Corporation and subsidiary for the year ended December 31, 2019.

Philly Skelly Eliminations Consolidated Debit Credit INCOME STATEMENT Sales S 150,000 $35,000 11,500 Income from Skelly Gain on equipment sale 2,000 Cost of Sales (65,000) (11,000) Other Expenses (70,000) (9,000) Noncontrolling interest share Net income $ 28,500 S 15,000 Retained Earnings 1/1 S 23,750 S 12,500 Add: Net income 28,500 15,000 Dividends ( 17,500) (5,000) Retained Earnings 12/31 $ 34,750 S 22,500 BALANCE SHEET Cash S 13,750 $ 7,500 Receivables 17,500 10,000 Inventories 25,000 11,250 Equipment-net 60,000 22,500 Land 10,000 8,750 Investment in Skelly 51,000 Goodwill TOTAL ASSETS S 177,250 $60,000 LIAB. & EQUITY Accounts payable $ 17,500 $ 12,500 Capital Stock 125,000 25,000 Retained Earnings 34,750 22,500 1/1 Noncntrl. Interest 12/31 Noncntrl. Interest TOTAL LIAB.& EQUITIES $ 177,250 $60,000 (21 MarieStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started