Answered step by step

Verified Expert Solution

Question

1 Approved Answer

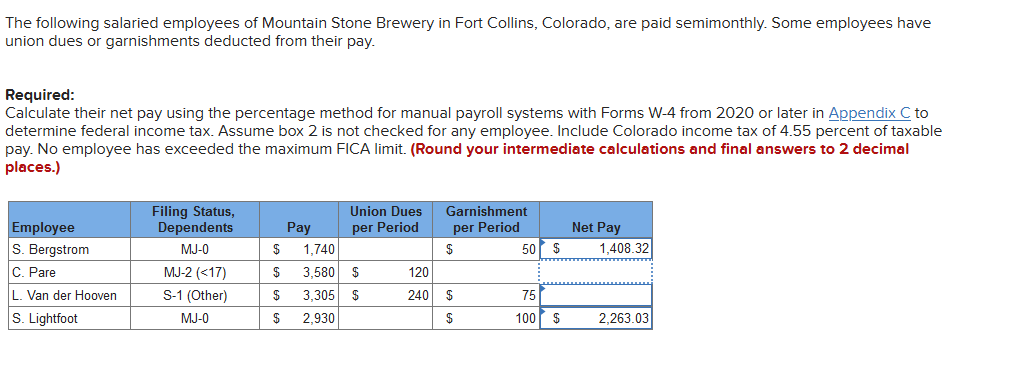

C. Pare and L. Van der Hooven I can't seem to get right now matter what I do! Please walk me through how to find

C. Pare and L. Van der Hooven I can't seem to get right now matter what I do! Please walk me through how to find their net pay!!

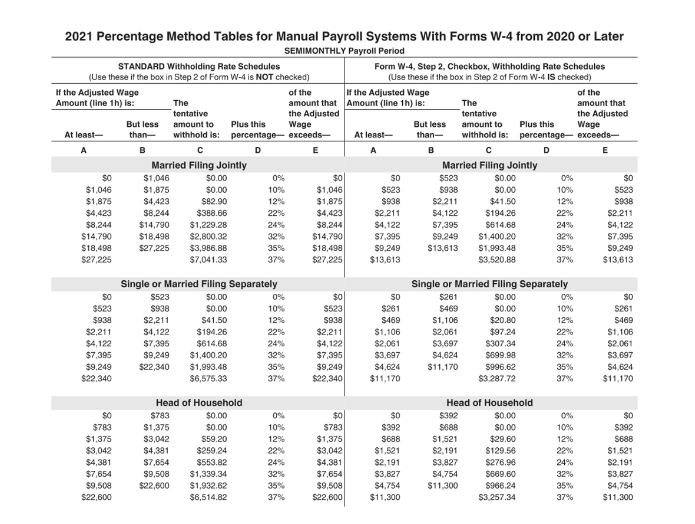

The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. (Round your intermediate calculations and final answers to 2 decimal places.) 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later SEMIMONTHLY Payroll Period The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. (Round your intermediate calculations and final answers to 2 decimal places.) 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later SEMIMONTHLY Payroll PeriodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started