Answered step by step

Verified Expert Solution

Question

1 Approved Answer

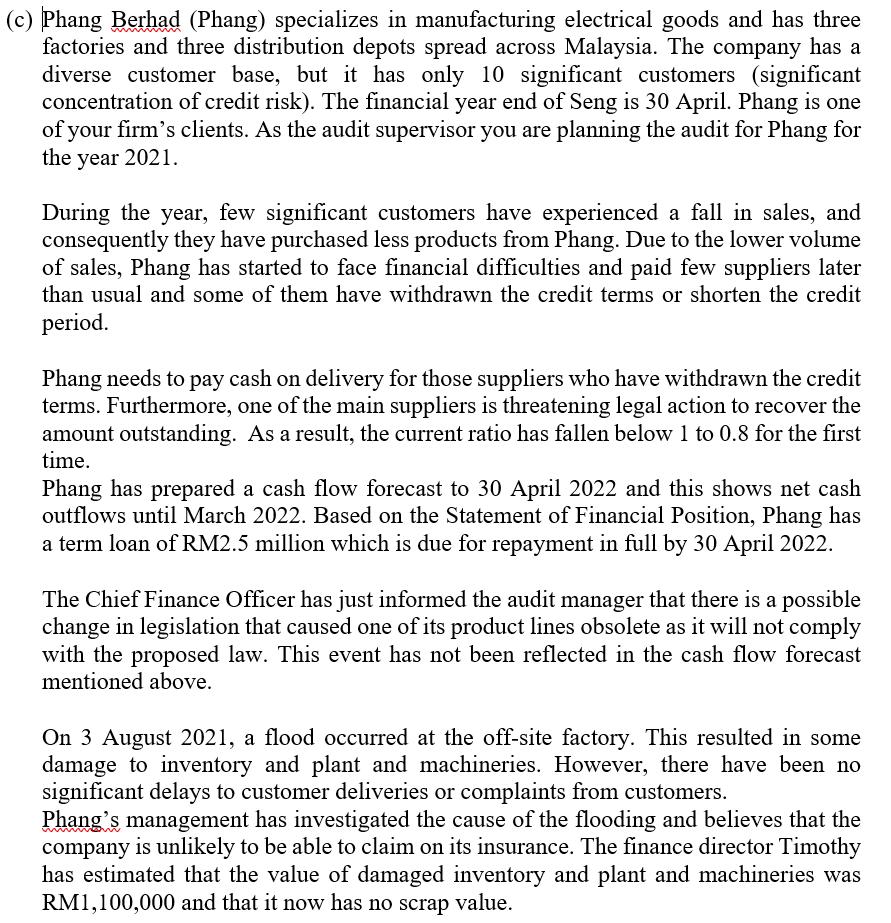

(c) Phang Berhad (Phang) specializes in manufacturing electrical goods and has three factories and three distribution depots spread across Malaysia. The company has a

(c) Phang Berhad (Phang) specializes in manufacturing electrical goods and has three factories and three distribution depots spread across Malaysia. The company has a diverse customer base, but it has only 10 significant customers (significant concentration of credit risk). The financial year end of Seng is 30 April. Phang is one of your firm's clients. As the audit supervisor you are planning the audit for Phang for the year 2021. During the year, few significant customers have experienced a fall in sales, and consequently they have purchased less products from Phang. Due to the lower volume of sales, Phang has started to face financial difficulties and paid few suppliers later than usual and some of them have withdrawn the credit terms or shorten the credit period. Phang needs to pay cash on delivery for those suppliers who have withdrawn the credit terms. Furthermore, one of the main suppliers is threatening legal action to recover the amount outstanding. As a result, the current ratio has fallen below 1 to 0.8 for the first time. Phang has prepared a cash flow forecast to 30 April 2022 and this shows net cash outflows until March 2022. Based on the Statement of Financial Position, Phang has a term loan of RM2.5 million which is due for repayment in full by 30 April 2022. The Chief Finance Officer has just informed the audit manager that there is a possible change in legislation that caused one of its product lines obsolete as it will not comply with the proposed law. This event has not been reflected in the cash flow forecast mentioned above. On 3 August 2021, a flood occurred at the off-site factory. This resulted in some damage to inventory and plant and machineries. However, there have been no significant delays to customer deliveries or complaints from customers. Phang's management has investigated the cause of the flooding and believes that the company is unlikely to be able to claim on its insurance. The finance director Timothy has estimated that the value of damaged inventory and plant and machineries was RM1,100,000 and that it now has no scrap value. Required: (1) Explain any THREE (3) potential indicators that Phang is NOT a going concern. (3 marks) (ii) Select any THREE (3) audit procedures which you should perform in assessing if Phang is a going concern or otherwise. (3 marks) (iii)Outline the additional audit procedures you will carry out on the damaged inventory and plant and machineries due to flood in August 2021. (4 marks) [Total: 25 Marks]

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i Potential Indicators of an entity is NOT a Going Concern inability to pay dividends to shareholde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started