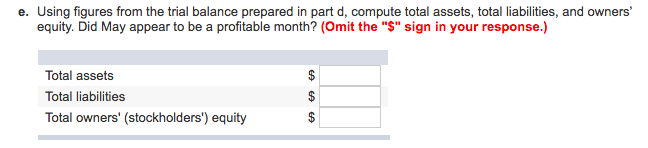

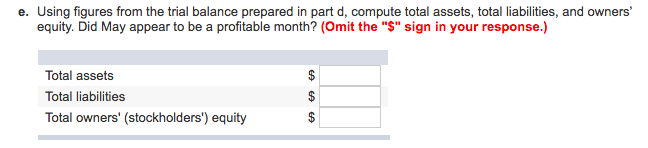

| c. | Post each transaction to the appropriate T account. | d. | Prepare a trial balance dated May 31, 2011.

| |

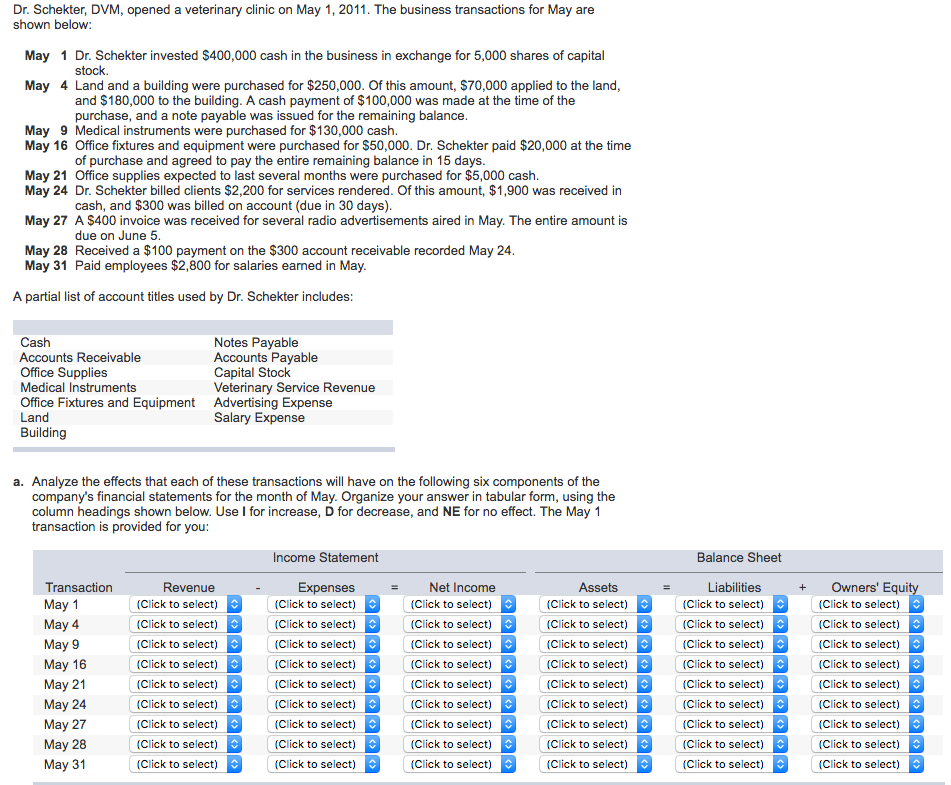

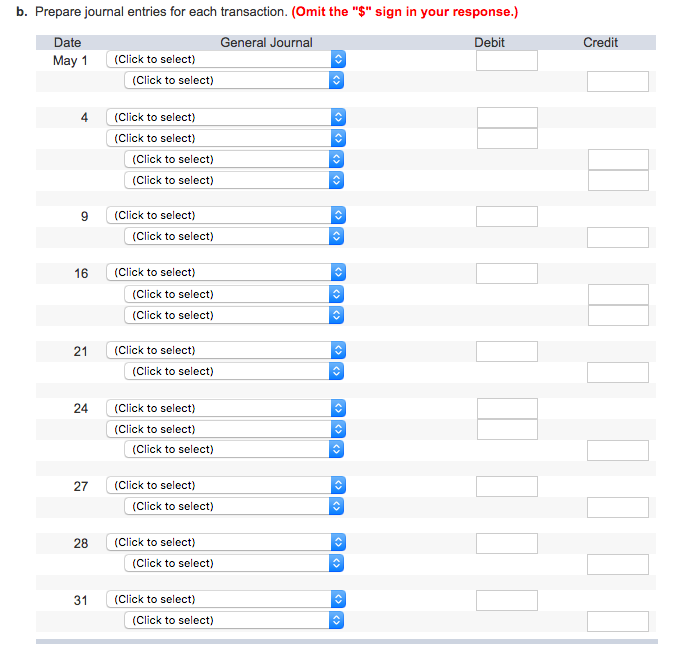

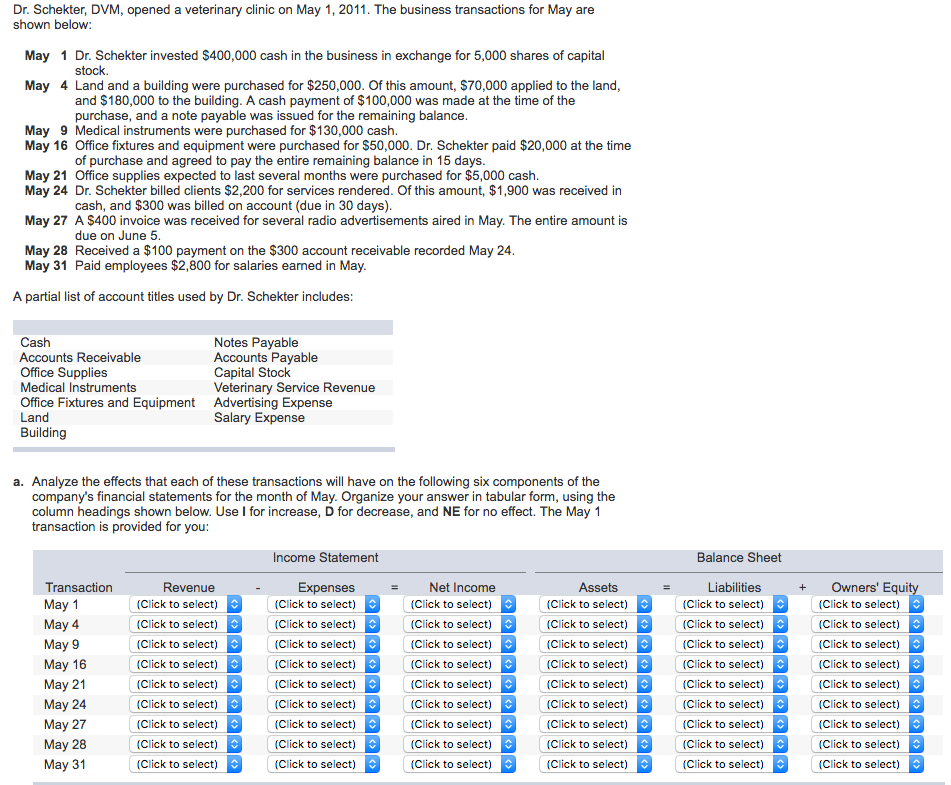

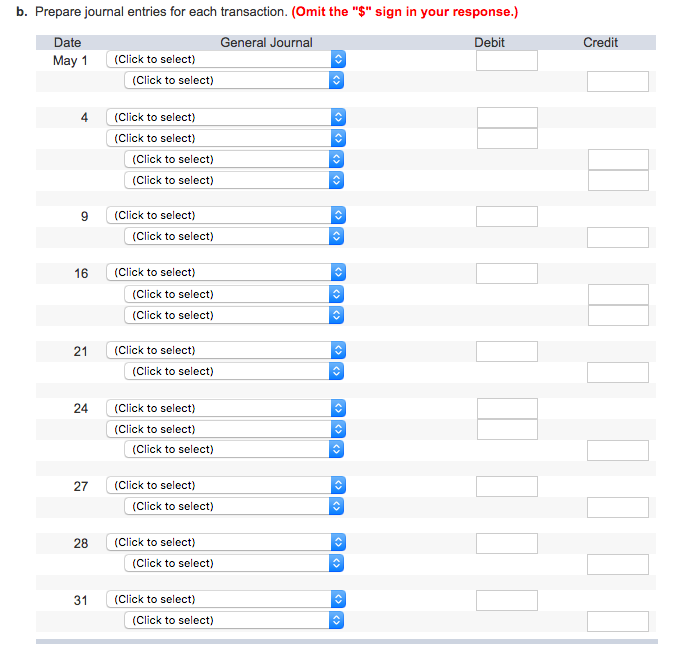

Dr. Schekter, DVM opened a veterinary clinic on May 1, 2011. The business transactions for May are n below: May 1 Dr. Schekter nvested $400,000 cash in the business in exchange for 5,000 shares of capital May 4 Land and a building were purchased for $250,000. Of this amount, $70,000 applied to the land and $180,000 to the building. A cash payment of $100,000 was made at the time of the purchase, and a note payable was issued for the remaining balance of purchase and agreed to pay the entire remaining balance in 15 days cash, and $300 was billed on account (due in 30 days). May 9 Medical instruments were purchased for $130,000 cash May 16 Office fixtures and equipment were purchased for $50,000. Dr. Schekter paid $20,000 at the time May 21 Office supplies expected to last several months were purchased for $5,000 cash. May 24 Dr. Schekter billed clients $2,200 for services rendered. Of this amount, $1,900 was received in May 27 A $400 invoice was received for several radio advertisements aired in May. The entire amount is May 28 Received a $100 payment on the $300 account receivable recorded May 24 due on June 5 May 31 Paid employees $2,800 for salaries earned in May A partial list of account titles used by Dr. Schekter includes Notes Payable Accounts Payable Capital Stock Veterinary Advertising Expense Salary Expense Accounts Receivable ice SupplieS Medical Instruments Office Fixtures and Equipment Service Revenue Building a. Analyze the effects that each of these transactions will have on the following six components of the company's financial statements for the month of May. Organize your answer in tabular form, using the column headings shown below. Use I for increase, D for decrease, and NE for no effect. The May 1 transaction is provided for you Income Statement Balance Sheet Equi Revenue (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) Liabilities (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) Transaction May Net Income (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) Assets enses (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) ay 27