Question

C PROGRAMMING ONLY: This program has to be unique and original, not plagarized. This should be made using only selection, assignments, variables, iteration, and arrays.

C PROGRAMMING ONLY:

This program has to be unique and original, not plagarized.

This should be made using only selection, assignments, variables, iteration, and arrays. Nothing more advanced.

Please do not use or any other abnormalalities for a intro level C student such as

This program has to be made in C and be compiled in gcc

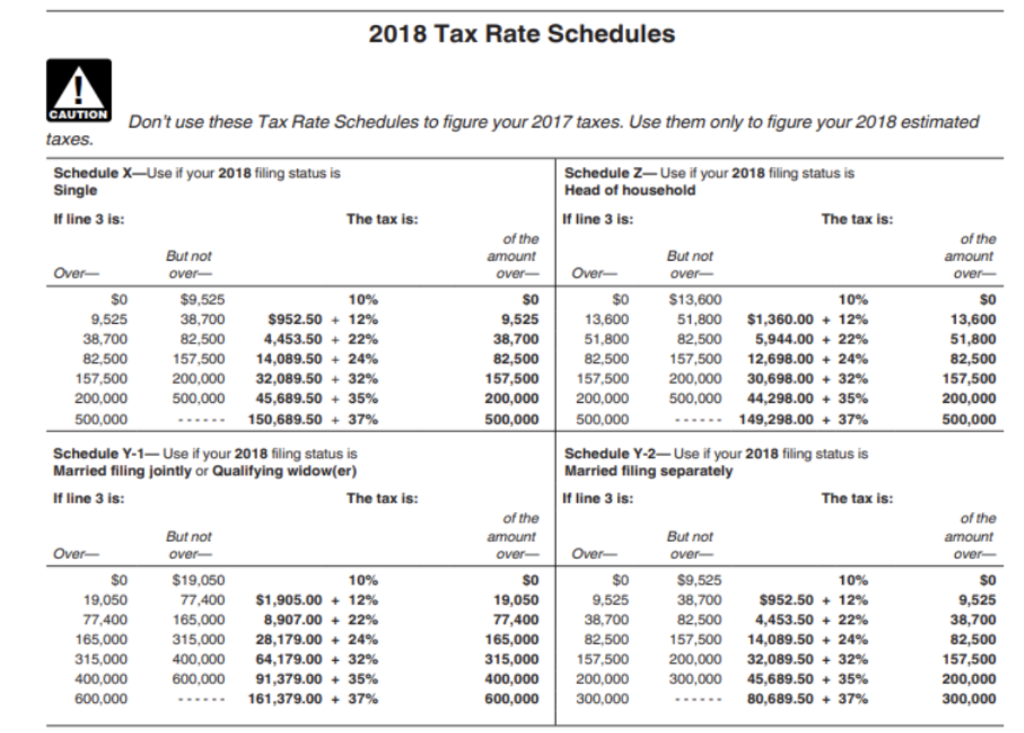

Project Overview: In this project, you will use your knowledge of selection and iteration to write a program to help tax payers to figure out their 2018 estimated taxes. The program will ask the user for the filing status and estimated taxable income, and then compute and print the estimated taxes using the tax rate schedules as shown below. (The line 3 mentioned in the tax rate schedules below is the estimated taxable income.)

The program will first prompt the user to enter an integer (1 through 5) that represents their filing status as shown below. If the user enters an invalid filing status, the program will print out an error message and ask for the filing status again. The program will keep asking the same question until the user enters a valid filing status.

1. Single

2. Married filing jointly

3. Married filing separately

4. Head of household

5. Qualifying widow(er)

The program will then prompt for their estimated taxable income (a real number). If the user enters a negative value, the program will print out an error message and change the income to be 0 (zero).

Based on the filing status and the taxable income, the program will compute and print the estimated tax. Please make sure that each output value be properly labeled and formatted. Otherwise you may not receive credit. For the tax amount in this project, you need to limit it two decimal places.

The program shall handle multiple tax payers. Once the program finishes with computing the tax for the first tax payer, it will ask for filing status and taxable income of the second tax payer. The process continues until the user enters 0 as the filing status. At that point, the program will say goodbye and terminate. A sample execution of the program is shown at the end of this document, with the program prompts/output in red and the user input in blue.

You need to test your program with every filing status and every tax bracket.

2018 Tax Rate Schedules CAUTION Don't use these Tax Rate Schedules to figure your 2017 taxes. Use them only to figure your 2018 estimated taxes Schedule X-Use if your 2018 filing status is Single Schedule Z-Use if your 2018 filing status is Head of household If line 3 is: The tax is: If line 3 is The tax is: of the amount of the But not But not Over- erOver $9,525 38,700 SO 9,525 38,700 82,500 57,500 200.000 500,000 10% 952.50 + 12% 82.500 4,453.50+22% 157,500 14,089.50+24% 200,000 32,089.50+32% 500.000 45,689.50+35% 150,689.50 + 37% $O 13,600 51,800 82,500 57,500157,500 SO 9,525 38,700 82,500 $13,600 10% 51,800 $1,360.00 + 12% 82.500 5,944.00 +22% 157,500 12,698.00+24% 200,000 30,698.00+32% 500,000 44,298.00 + 35% 149,298.00 + 37% So 13,600 51,800 157,500 200,000 500,000 200,000 200,000 500,000500,000 Schedule Y-1-Use if your 2018 filing status is Married filing jointly or Qualifying widow(er) Schedule Y-2-Use if your 2018 filing status is Married filing separately The tax is: If line 3 is The tax is: of the of the But not But not overOver SO 9.050 77,400 $19,050 10% 77,400 $1,905.00 + 12% 8,907.00 + 22% 315,000 28,179.00 +24% 400,000 64,179.00 + 32% 600.000 91,379.00 + 35% 161,379.00 + 37% S0 9.525 38,700 82.500 $9,525 38,700 82.500 157,500 200,000 300.000 SO 10% $952.50+12% 4,453.50+22% 14,089.50+24% 32,089.50+32% 45,689.50 + 35% 80,689.50 + 37% sO 9,050 77,400 165,000 15,000 157,5002 00,000200,000 600,000 300,000 165,000 315,000 400,000 600,000 38,700 82,500 157,500 200,000 300,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started