Answered step by step

Verified Expert Solution

Question

1 Approved Answer

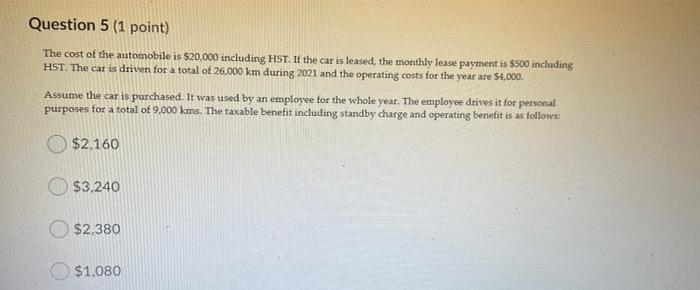

c Question 5 (1 point) The cost of the automobile is $20,000 including HST. If the car is leased, the monthly lease payment is $500

c

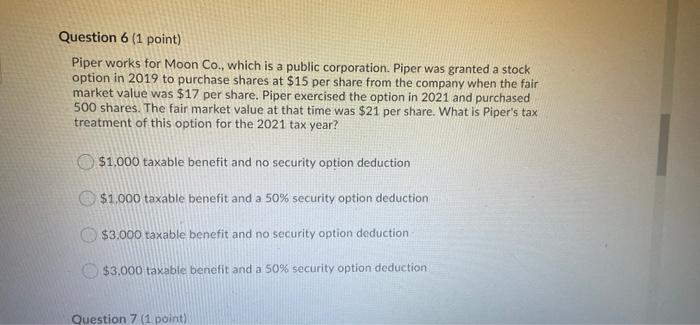

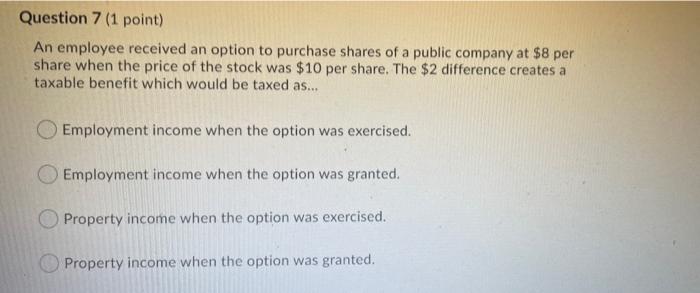

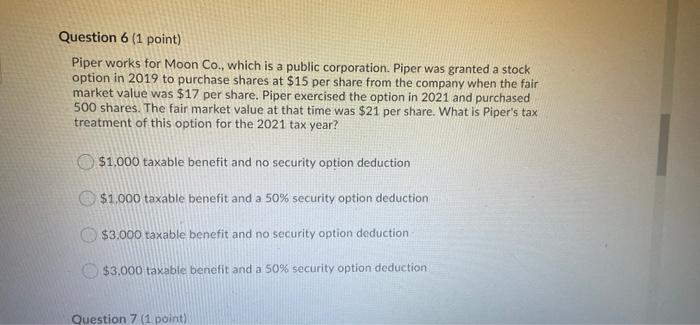

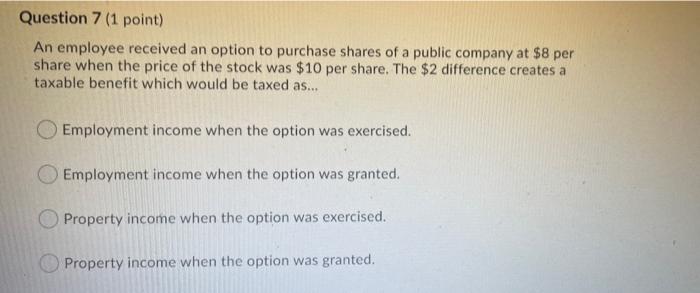

Question 5 (1 point) The cost of the automobile is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26.000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000 kms. The taxable benefit including standby charge and operating benefit is as follows: $2,160 $3.240 $2,380 $1,080 Question 6 (1 point) Piper works for Moon Co., which is a public corporation. Piper was granted a stock option in 2019 to purchase shares at $15 per share from the company when the fair market value was $17 per share. Piper exercised the option in 2021 and purchased 500 shares. The fair market value at that time was $21 per share. What is Piper's tax treatment of this option for the 2021 tax year? $1,000 taxable benefit and no security option deduction $1.000 taxable benefit and a 50% security option deduction $3,000 taxable benefit and no security option deduction $3.000 taxable benefit and a 50% security option deduction Question 7 (1 point) Question 7 (1 point) An employee received an option to purchase shares of a public company at $8 per share when the price of the stock was $10 per share. The $2 difference creates a taxable benefit which would be taxed as... Employment income when the option was exercised. Employment income when the option was granted. Property income when the option was exercised. Property income when the option was granted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started