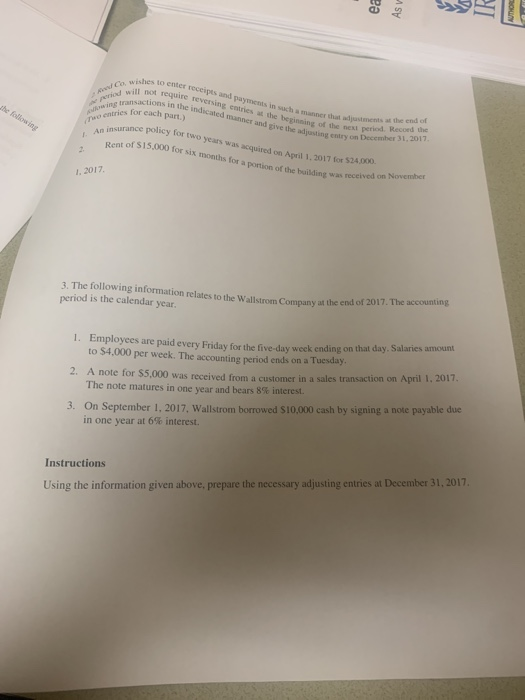

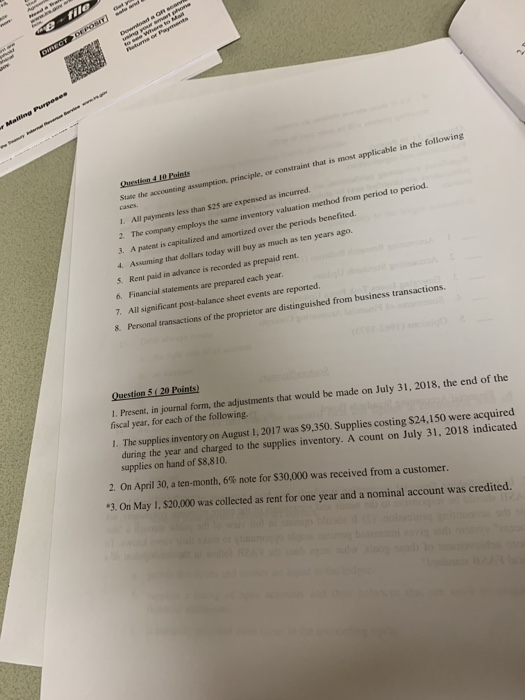

C riod will not wishes to enter receipts and payments in all not require reversing entries the Cated manner and give the d ons in the entries for each part auch a manner thaiments at the end of The next period. Record the 1. An insuran insurance policy for years was acquired on April 1, 2017 for $24.00 Rent of $15.000 for six months for a par t e b ine was received the next r y Dec 1.2017 1. 2017 Toon of the building was meceived on November 3. The following information rela mation relates to the Wallst period is the calendar year. i he end of 2017. The accounting 1. Employees are paid every Friday for the five day week ending on that day. Salaries amount to $4.000 per week. The accounting period ends on a Tuesday. 2. A note for S5,000 was received from a customer in a sales transaction on April 1, 2017. The note matures in one year and bears 8% interest. 3. On September 1, 2017. Wallstrom borrowed $10,000 cash by signing a note payable due in one year at 6% interest. Instructions Using the information given above, prepare the necessary adjusting entries at December 31, 2017 erile Owestien Points State the accounting assumption, principle, or constraint that is most applicable in the following 1. All payments less than $25 are expensed as incurred. 2. The company employs the same inventory valuation method from period to period. 3. A patent is capitalized and amortired over the periods benefited. 4. Assuming that dollars today will buy as much as ten years ago 5. Rent paid in advance is recorded as prepaid rent. 6. Financial statements are prepared each year. 7. All significant post-balance sheet events are reported. & Personal transactions of the proprietor are distinguished from business transactions Question 520 Points 1. Present, in journal form, the adjustments that would be made on July 31, 2018, the end of the fiscal year, for each of the following. 1. The supplies inventory on August 1, 2017 was $9,350. Supplies costing $24.150 were acquired during the year and charged to the supplies inventory. A count on July 31, 2018 indicated supplies on hand of $8,810. 2. On April 30, a ten-month, 6% note for $30,000 was received from a customer. 3. On May I. $20,000 was collected as rent for one year and a nominal account was credited