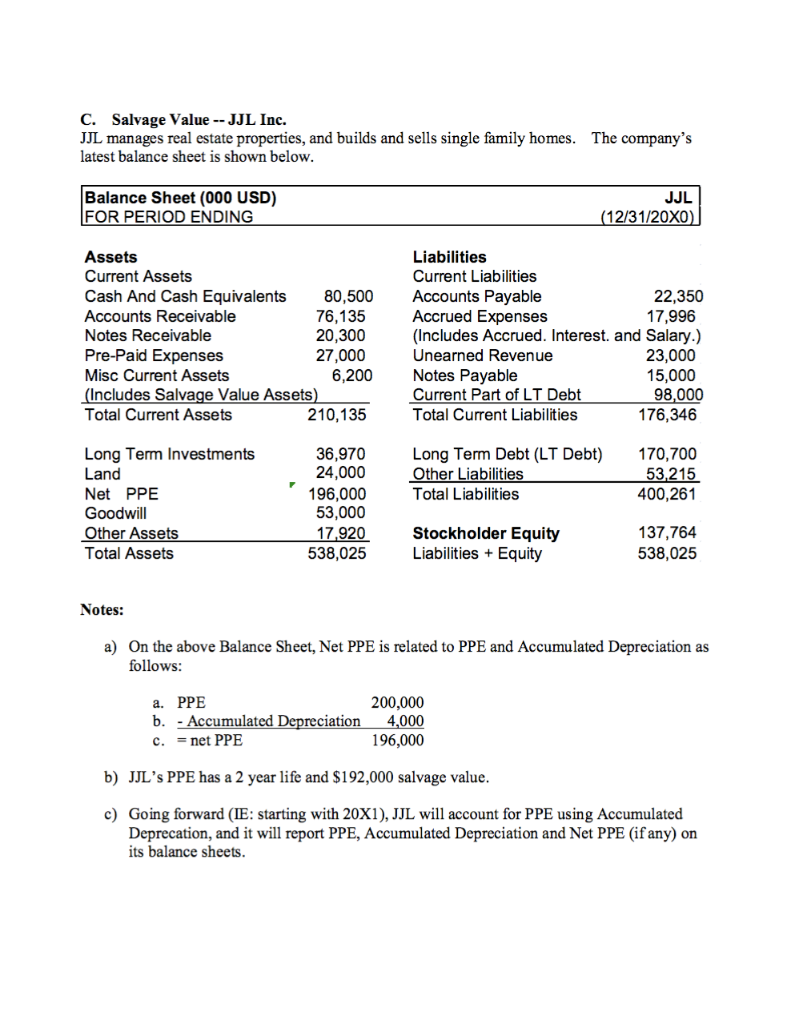

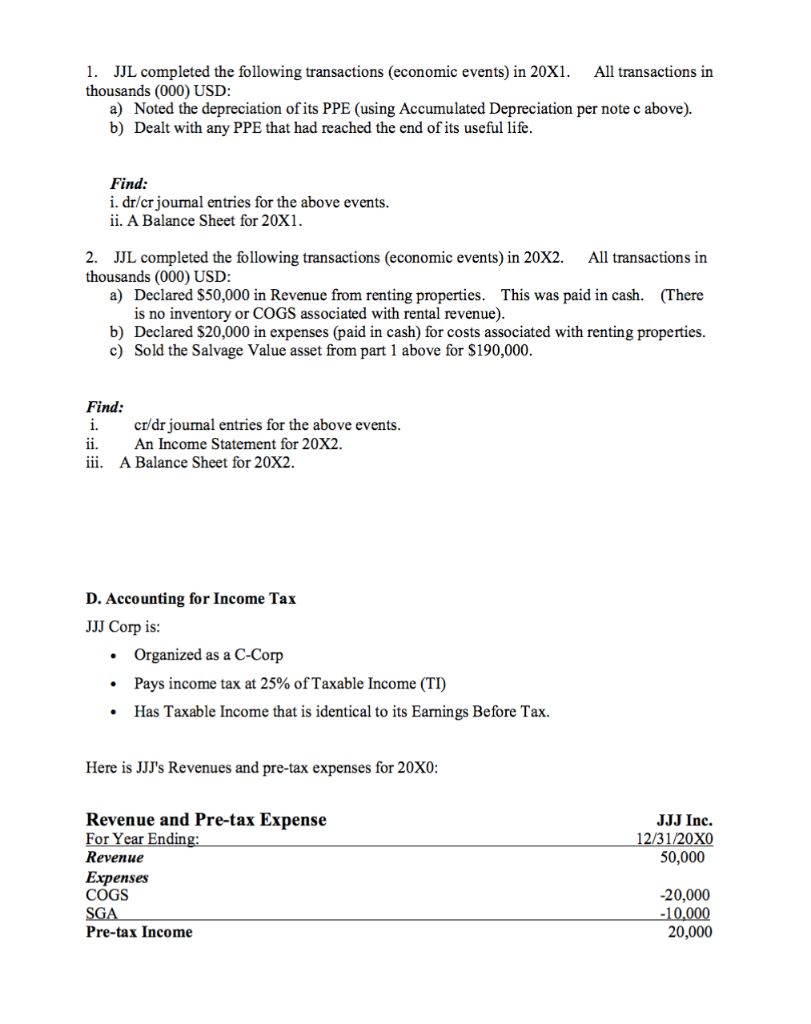

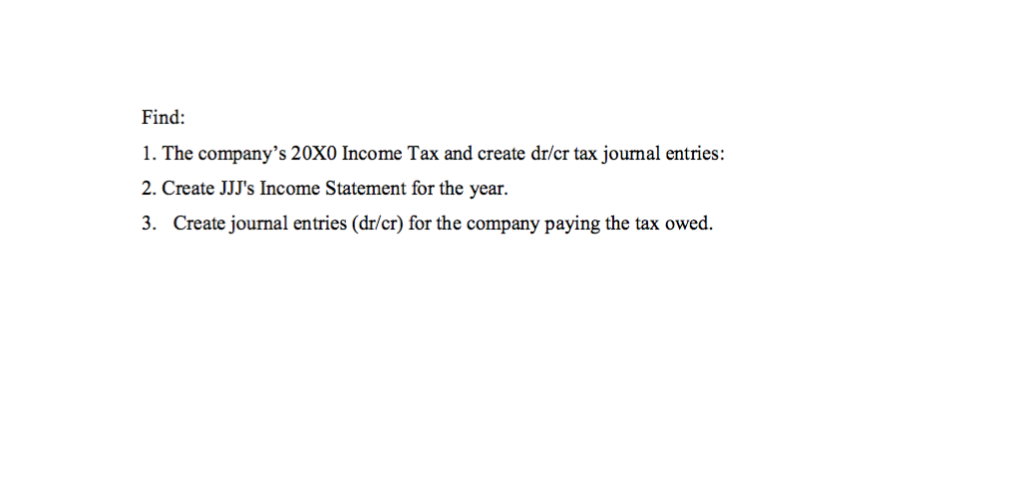

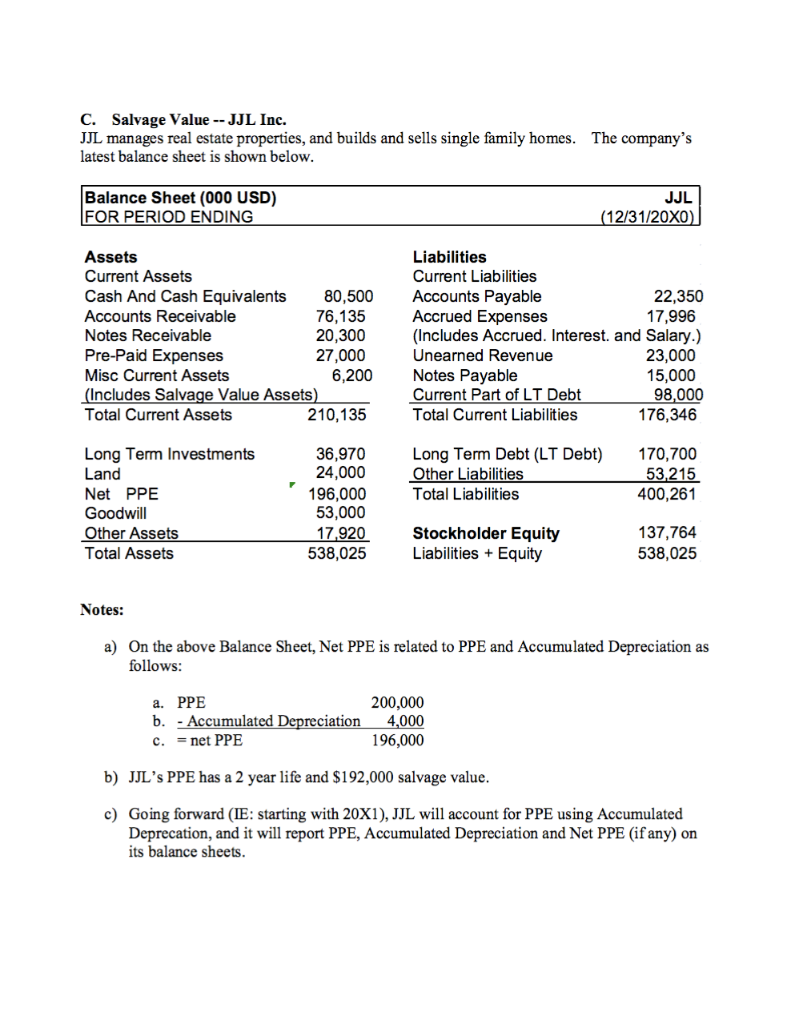

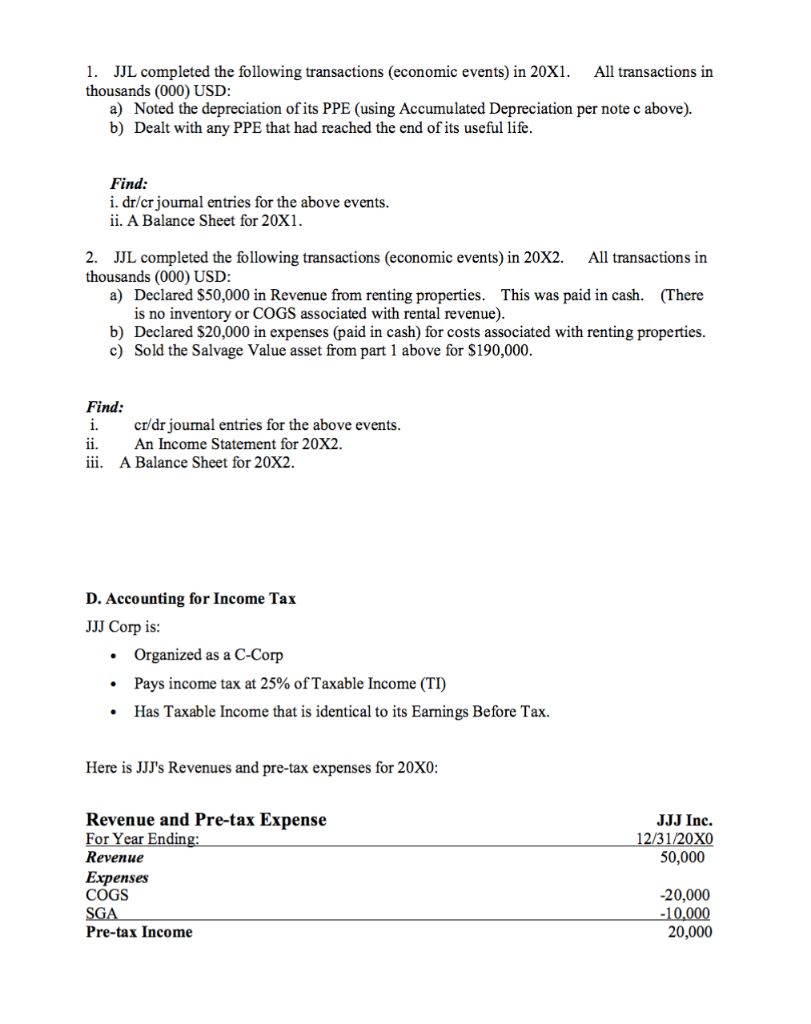

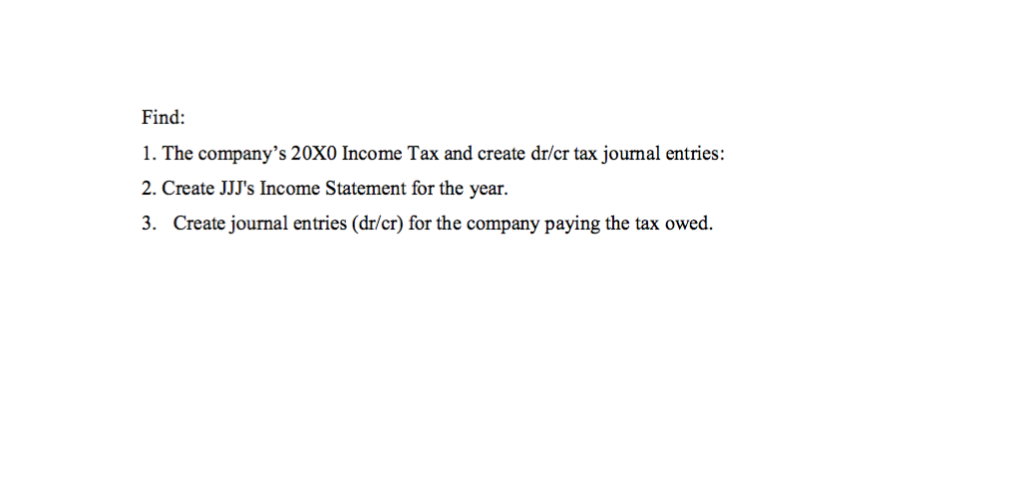

C. Salvage Value -- JJL Inc. JJL manages real estate properties, and builds and sells single family homes. The company's latest balance sheet is shown below Balance Sheet (000 USD) FOR PERIOD ENDING JJL (12/31/20xO Assets Current Assets Cash And Cash Equivalents 80,500 Accounts Receivable Notes Receivable Pre-Paid Expenses Misc Current Assets Includes Salvage Value Assets Total Current Assets Liabilities Current Liabilities Accounts Payable Accrued Expenses 22,350 76,135 20,300 27,000 17,996 (Includes Accrued. Interest. and Salary.) 23,000 15,000 Unearned Revenue 6,200 Notes Payable Current Part of LT Debt Total Current Liabilities 98,000 176,346 170,700 400,261 210,135 Long Term Investments Land Net PPE Goodwill Other Assets Total Assets 36,970Long Term Debt (LT Debt) 24,000 196,000 Other Liabilities Total Liabilities 53,000 17,920 Stockholder Equity Liabilities +Equity 137,764 538,025 538,025 Notes: a) On the above Balance Sheet, Net PPE is related to PPE and Accumulated Depreciation as follows: 200,000 4,0 196,000 a. PPE umulated atio c. = net PPE b) JJL's PPE has a 2 year life and $192,000 salvage value c) Going forward (IE: starting with 20X1), JJL will account for PPE using Accumulated Deprecation, and it will report PPE, Accumulated Depreciation and Net PPE (if any) on its balance sheets 1. JJL completed the following transactions (economic events) in 20X1. thousands (000) USD All transactions in a) Noted the depreciation of its PPE (using Accumulated Depreciation per note c above). b) Dealt with any PPE that had reached the end of its useful life Find: i. dr/cr jounal entries for the above events ii. A Balance Sheet for 20X1 2 JJL completed the following transactions (economic events) in 20X2. thousands (000) USD All transactions in a) Declared $50,000 in Revenue from renting properties. is no inventory or COGS associated with rental revenue) This was paid in cash. (There b) Declared $20,000 in expenses (paid in cash) for costs associated with renting properties. c) Sold the Salvage Value asset from part 1 above for $190,000 Find i.cr/dr journal entries for the above events ii.An Income Statement for 20X2. iii. A Balance Sheet for 20X2 D. Accounting for Income Tax JJJ Corp is Organized as a C-Corp Pays income tax at 25% of Taxable Income (TI) Has Taxable Income that is identical to its Earnings Before Tax. Here is JJJ's Revenues and pre-tax expenses for 20X0 Revenue and Pre-tax Expense JJJ Inc. 50,000 20,000 20,000 Revenue Expenses COGS Pre-tax Income Find 1. The company's 20X0 Income Tax and create dr/cr tax journal entries: 2. Create JJJ's Income Statement for the year. 3. Create journal entries (dr/cr) for the company paying the tax owed