Answered step by step

Verified Expert Solution

Question

1 Approved Answer

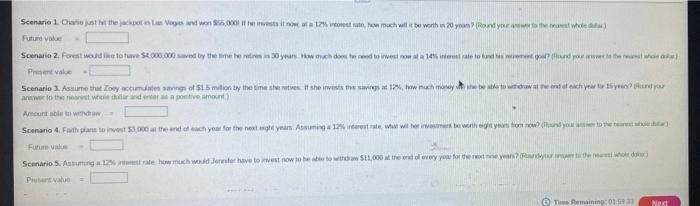

c Scenario 1 Charlie just hit the jackpot in Las Vegas and won $55,000 If he invests it now at a 12% intorest sate, how

c

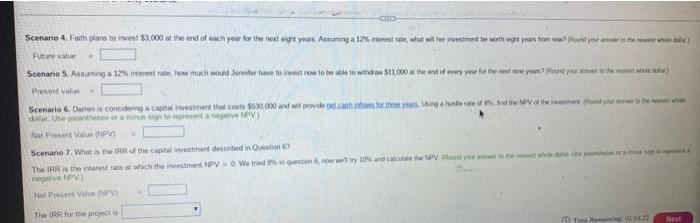

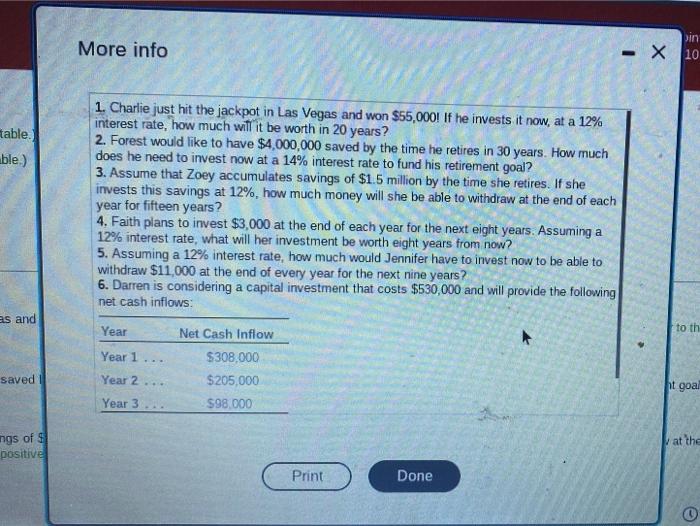

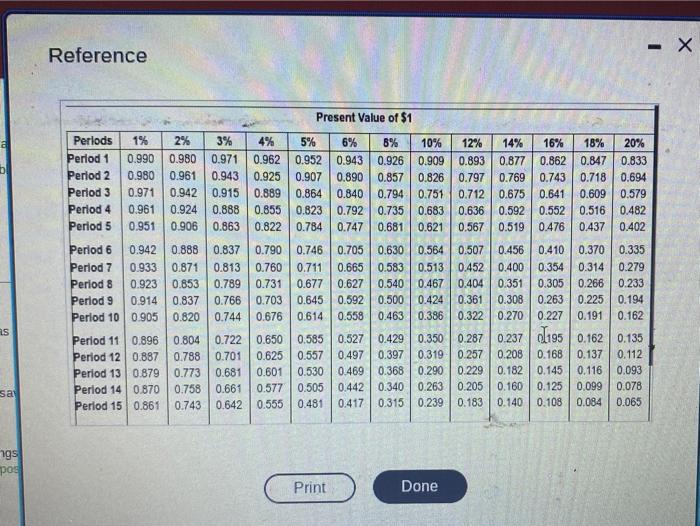

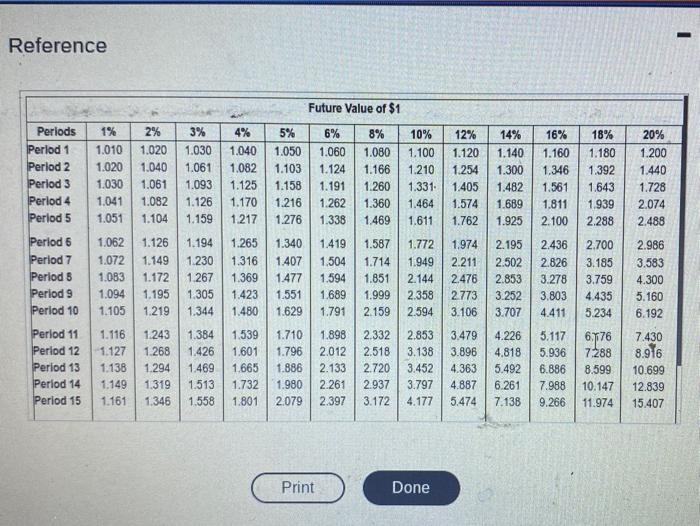

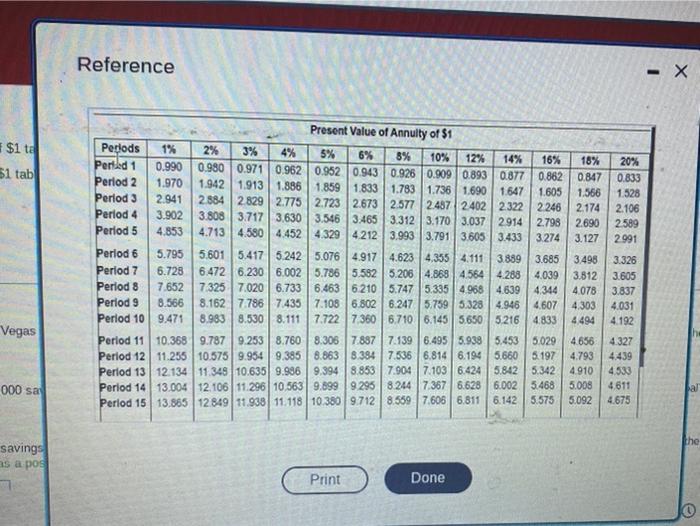

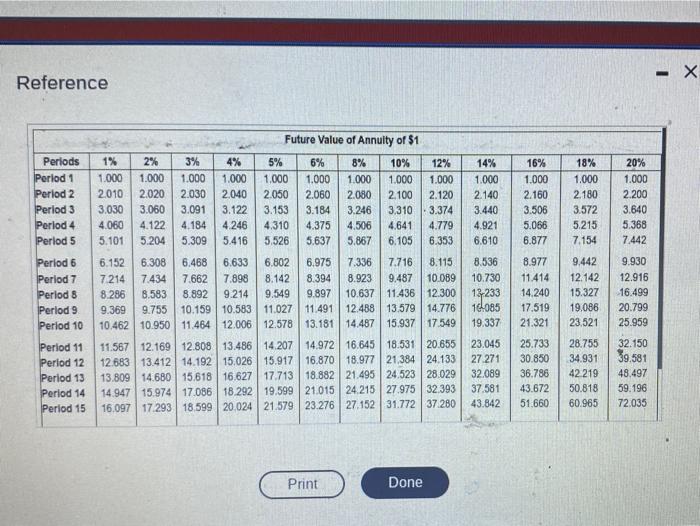

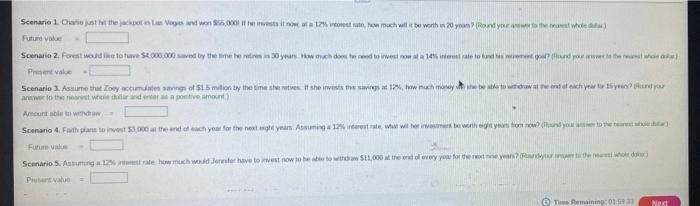

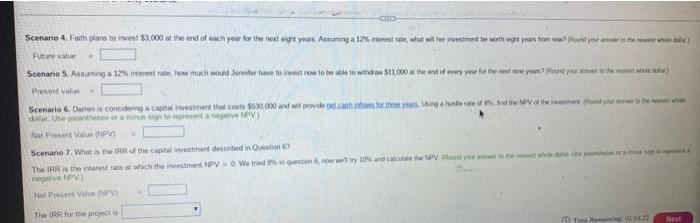

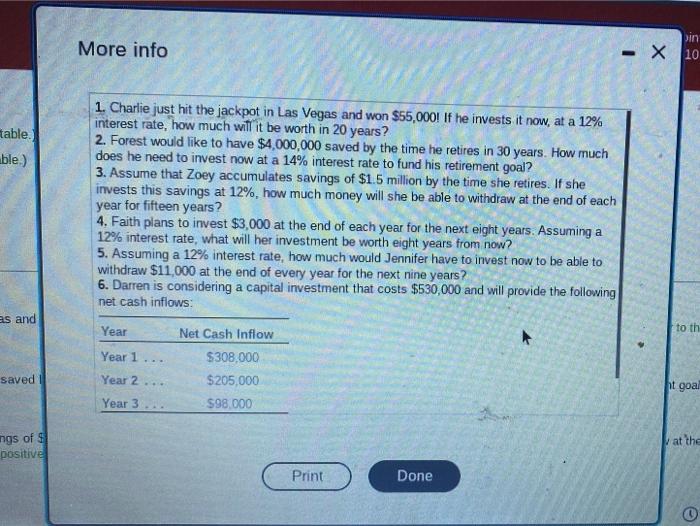

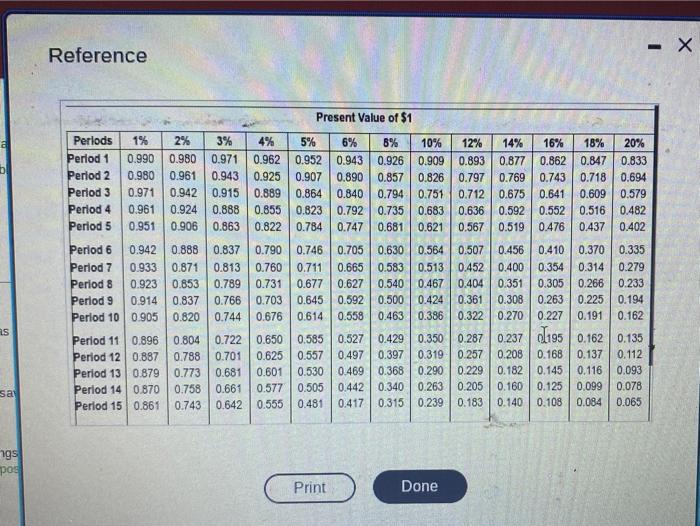

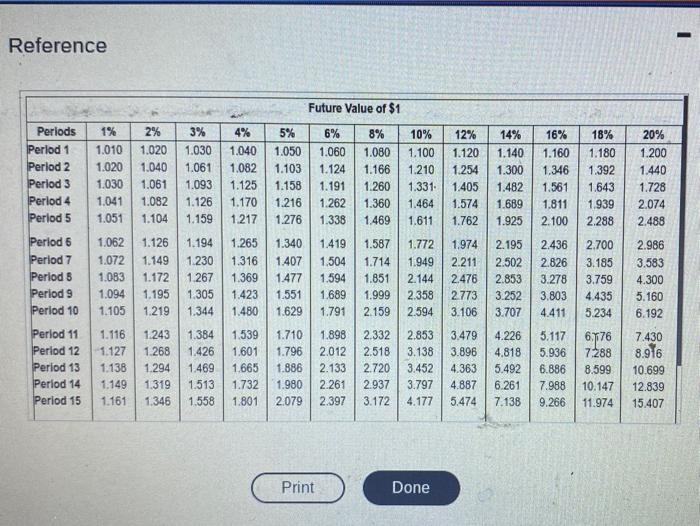

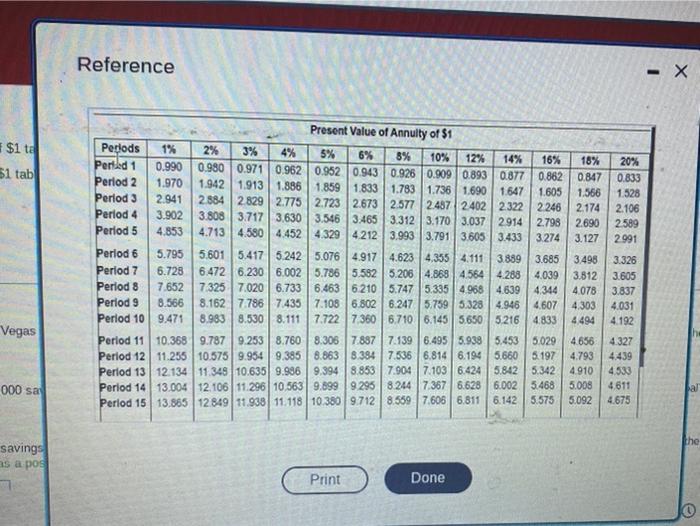

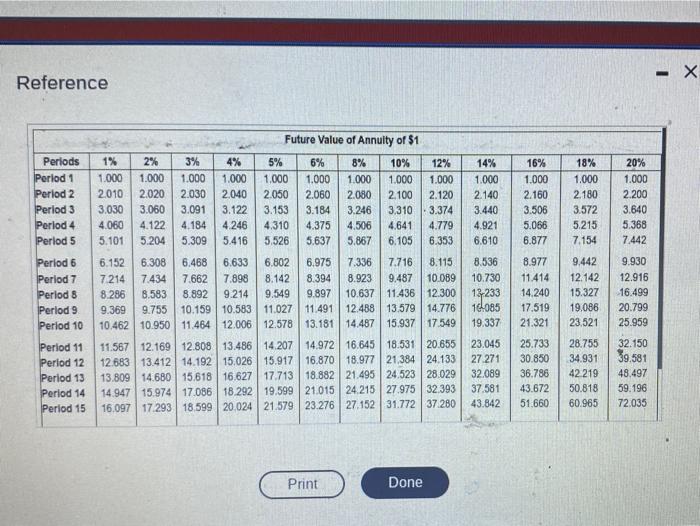

Scenario 1 Charlie just hit the jackpot in Las Vegas and won $55,000 If he invests it now at a 12% intorest sate, how much will it be worth in 20 yeam? (Round your answer to the eastwhole) Future value the rest whole d Scenaria 2. Forest would like to have $4,000,000 saved by the time he retires in 30 years. How much does he need to invest now at a 14% interest rate to fund has netement goal? (found your art Prement value Scenario 3. Assume that Zoey accumdates savings of $1.5 million by the time she retires. If she invests the savings at 12%, how much money he be able to withdraw at the end of each year to 15 year and you answer to the nearest whole dollar and enter as a positive amount) Amountable withdraw Scenario 4. Faith plans to invest $3,000 at the end of each year for the next eight years. Assuming a 12% interest rate, what will her investment be worth eight years from now? (hurd you to the earth) Future value Scenario 5. Assuming a 12% interest rate how much would Jensfer have to invest now to be able to withdraw $11,000 at the end of every year for the next nine years? (Randy at the whole dow) Punt value Time Remaining: 01 5923 Next Came Scenario 4. Faith plans to invest $3,000 at the end of each year for the next eight years. Assuming a 12% interest rate, what will her investment be worth eight years from now? (Round your ain the nearest whose dolar) Future value Scenario 5, Assuming a 12% interest rate, how much would Jenniter have to invest now to be able to withdraw $11,000 at the end of year for the nest nine years? (art your aw to the rest of d Present value NV of the westment and your a Scenario 6. Damen is considering a capital investment that costs $530,000 and will provide canhatows.farmers. Using a hundle rate of dollar Use parentheses or a minus sign to represent a negative NPV) Not Present Valu (NPV) Scenario 7. What is the IRR of the capital investment described in Question 67 The IRR is the interest rate at which the investment NPV 0 We tried 6 in question 6, now we'll try 10% and calculate the NPV. Round your aw to the east whole dolar De po gative NPV) Net Present Value (NPV) The IRR for the project is Time Remaining:01 5 22 the wh Next table. ble.) as and saved ngs of S positive More info 1. Charlie just hit the jackpot in Las Vegas and won $55,000! If he invests it now, at a 12% interest rate, how much will it be worth in 20 years? 2. Forest would like to have $4,000,000 saved by the time he retires in 30 years. How much does he need to invest now at a 14% interest rate to fund his retirement goal? 3. Assume that Zoey accumulates savings of $1.5 million by the time she retires. If she invests this savings at 12%, how much money will she be able to withdraw at the end of each year for fifteen years? 4. Faith plans to invest $3,000 at the end of each year for the next eight years. Assuming a 12% interest rate, what will her investment be worth eight years from now? 5. Assuming a 12% interest rate, how much would Jennifer have to invest now to be able to withdraw $11,000 at the end of every year for the next nine years? 6. Darren is considering a capital investment that costs $530,000 and will provide the following net cash inflows: Year Net Cash Inflow Year 1 $308,000 Year 2 $205,000 Year 3 $98.000 Done ... ... Print in X 10 to th ht goal at the e a b as sa ngs pos Reference Periods - X Present Value of $1 18% 20% 1% 2% 3% 0.990 0.980 0.971 10% 12% 14% 16% 0.893 0.877 0.862 Period 1 0.847 0.833 Period 2 4% 5% 6% 8% 0.962 0.952 0.943 0.926 0.909 0.925 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402 0.980 0.961 0.943 0.971 0.942 0.915 0.961 0.951 Period 3 Period 4 0.924 0.888 Period 5 0.906 0.863 Period 6 0.942 0.888 0.564 0.507 0.456 0.410 0.370 0.335 Period 7 0.933 0.871 0.837 0.813 0.760 0.731 Period 8 0.923 0.853 0.789 0.351 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.263 0.225 0.194 0.227 0.191 0.162 Period 10 0.905 0.820 0.744 0.676 0.790 0.746 0.705 0.630 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 0.677 0.627 0.540 0.467 0.404 0.645 0.592 0.500 0.424 0.361 0.308 0.614 0.558 0.463 0.386 0.322 0.270 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.108 0.084 Period 11 0.896 195 0.162 0.135 0.168 0.137 0.112 0.093 Period 12 0.887 Period 13 0.879 Period 14 0.870 0.758 0.078 0.065 Period 15 0.861 0.743 Print Done Reference Periods Period 1 Period 2 Period 3 Perlod 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Future Value of $1 2% 3% 4% 5% 12% 14% 16% 18% 20% 1.180 1.200 1.392 1.440 1.728 6% 8% 10% 1.010 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.140 1.160 1.020 1.040 1.061 1.082 1.103 1.124 1.166 1.210 1.254 1.300 1.346 1.030 1.061 1.093 1.125 1.158 1.191 1.260 1.331- 1.405 1.482 1.561 1.643 1.041 1.082 1.126 1.170 1.216 1.262 1.360 1.464 1.574 1.689 1.051 1.104 1.159 1.217 1.276 1.338 1.469 1.611 1.762 1.925 1.419 1.587 1.504 1.714 1.811 1.939 2.074 2.100 2.288 2.488 1.126 1.194 1.265 1.974 2.195 2.436 2.700 2.986 1.062 1.072 1.149 1.340 1.230 1.316 1.407 3.583 1.772 1.949 2.211 2.502 2.826 3.185 1.851 2.144 2.476 2.853 3.278 3.759 1.999 2.358 2.773 3.252 3.803 4.435 1.083 1.172 4.300 1.094 1.195 5.160 3.106 3.707 4.411 5.234 6.192 6.176 7.430 1.267 1.369 1.477 1.594 1.305 1.423 1.551 1.689 1.105 1.219 1.344 1.480 1.629 1.791 2.159 2.594 1.243 1.384 1.539 1.710 1.898 2.332 2.853 3.479 4.226 5.117 1.268 1.426 1.601 1.796 2.012 2.518 3.138 3.896 4.818 5.936 7288 1.294 1.469 1.665 1.886 2.133 2.720 3.452 4.363 5.492 6.886 8.599 1.149 1.319 1.513 1.732 1.980 2.261 2.937 3.797 4.887 6.261 7.988 10.147 1.161 1.346 1.558 1.801 2.079 2.397 3.172 4.177 5.474 7.138 9.266 1.116 1.127 1.138 8.916 10.699 12.839 11.974 15.407 Print Done $1 ta 51 tab Vegas 000 say savings as a pos Reference Present Value of Annuity of $1 Periods 1% 2% 3% 4% 12% 14% 20% Perted 1 0.833 Period 2 5% 6% 8% 10% 16% 18% 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.736 1.690 1.647 1.605 1.566 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 2.174 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 2.690 4.212 3.993 3.791 3.605 3.433 3.274 3.127 1.528 Period 3 2.106 Period 4 3.902 2.589 Period 5 4.853 4.713 4.580 4.452 4.329 2.991 Period 6 5.795 5.601 3.326 Period 7 6.728 6.472 3.605 Period 8 7.652 4.344 4.078 7.325 8.162 7.786 7.435 3.837 4.031 Period 9 8.566 Period 10 9.471 8.983 8.530 8.111 4.192 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.685 3.498 6.230 6.002 5.786 5.582 5.206 4.868 4.564 4.288 4.039 3.812 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 7.108 6.802 6.247 5.759 5.328 4.946 4.607 4.303 7.722 7,360 6.710 6.145 5.650 5216 4.833 4,494 7.139 6.495 5.938 5.453 5.029 4.656 8.384 7.536 6.814 6.194 5.660 5.197 4.793 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 4.910 5.008 12.106 11.296 10.563 9.899 9.295 8.244 7.367 6.628 6.002 5.468 12.849 11.938 11.118 10.380 9.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 Period 11 7.887 9.787 9.253 8.760 8.306 10.575 9.954 9.385 8.863 4.327 4.439 Period 12 10.368 11.255 12.134 13.004 4.533 Perlod 13 4.611 Period 14 Period 15 13.865 Print Done .X pal the Reference Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 14% 16% 18% 1.000 1.000 1.000 2.120 2.140 2.160 2.180 6% 8% 10% 12% 1.000 1.000 1.000 1.000 1,000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.080 2,100 3.030 3.060 3.091 3.122 3.153 3.184 3.246 4.060 4.122 4.184 4.246 4.310 4.375 4.506 5.101 5.204 5.309 5.416 5.526 5.637 5.867 3.506 3.572 3.310 3.374 3.440 4.641 4.779 4.921 6.105 6.353 6.610 5.066 5.215 6.877 7.154 6.152 6.308 6.468 6.633 6.802 6.975 8.977 9.442 7.336 7.716 8.115. 8.536 8.923 9.487 10.089 10.730 7.214 7.434 7.662 7.898 8.142 8.394 11.414 12.142 8.286 8.892 9.214 9.897 10.637 11.436 12.300 13-233 14.240 15.327 12.488 13.579 14.776 16.085 17.519 19.086 14.487 15.937 17.549 19.337 21.321 23,521 25.733 28.755 8.583 9.549 9.369 9.755 10.159 10.583 11.027 11.491 10.462 10.950 11.464 12.006 12.578 13.181 11.567 12.169 12.808 13.486 14.207 14.972 16.645 18.531 20.655 12.683 13.412 14.192 15.026 15.917 16.870 18.977 21.384 24.133 13.809 14.680 15.618 16.627 17.713 18.882 21.495 24.523 28.029 14.947 15.974 17.086 18.292 19.599 21.015 24.215 27.975 32.393 16.097 17.293 18.599 20.024 21.579 23.276 27.152 31.772 37.280 23.045 27.271 30.850 34.931 32.089 36.786 42.219 37.581 43.672 50.818 43.842 51.660 60.965 Print Done Period 1 Period 2 Period 3 Period 4 Perlod 5 Period 6 Period 7 Period S Perlod 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 20% 1.000 2.200 3.640 5.368 7.442 9.930 12.916 16.499 20.799 25.959 32.150 39.581 48.497 59.196 72.035 - X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started