Answered step by step

Verified Expert Solution

Question

1 Approved Answer

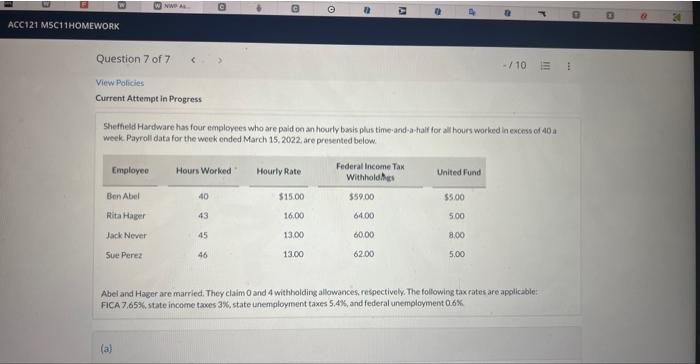

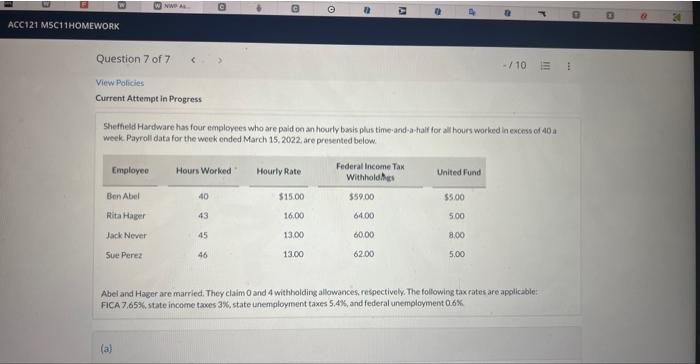

c Shetheld Hardware has four employees who are paid on an hourly basis plus time and-a-half for all hours worked in excens of 40 a

c

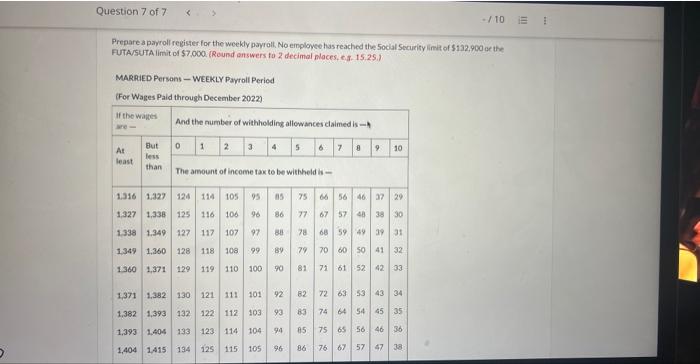

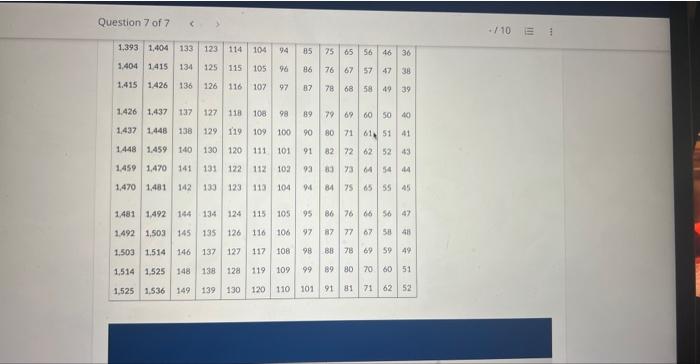

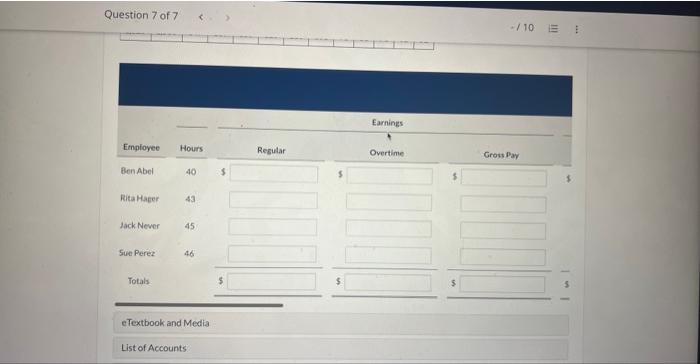

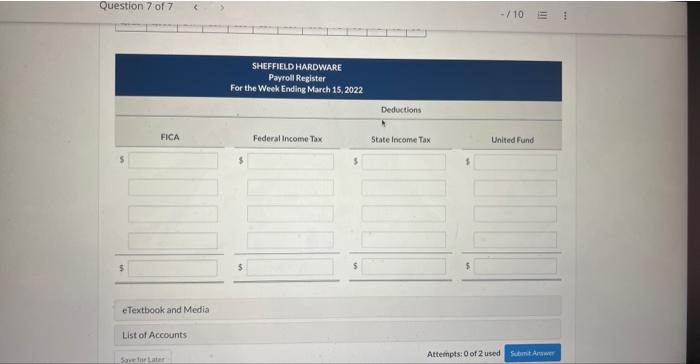

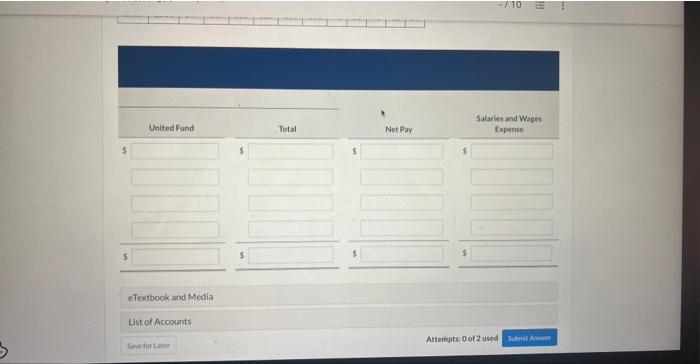

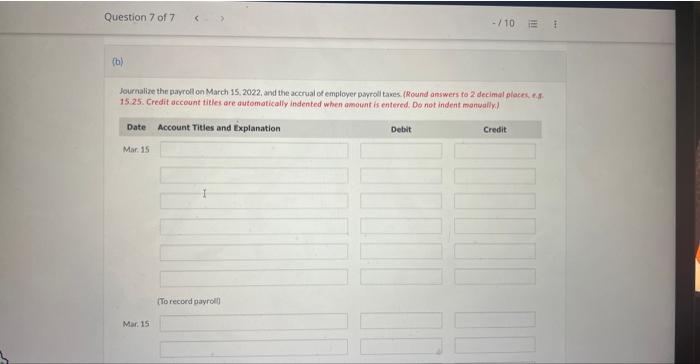

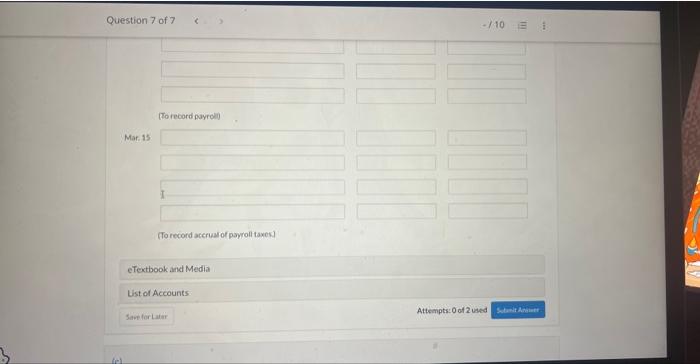

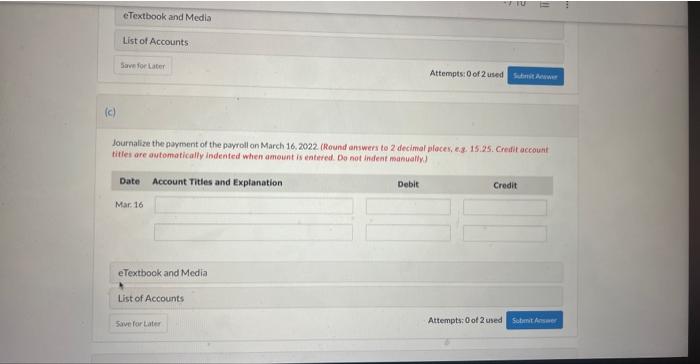

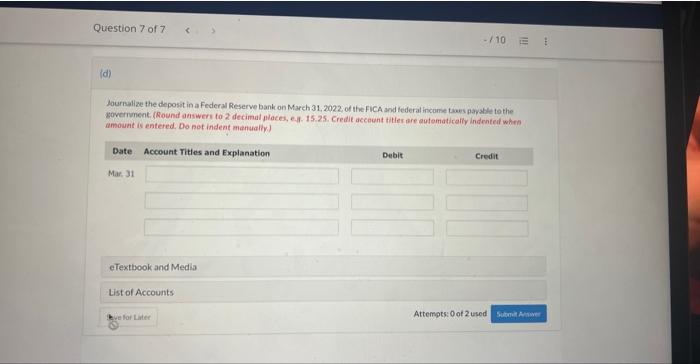

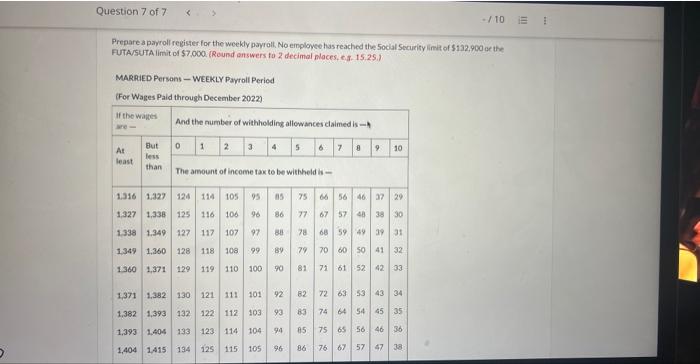

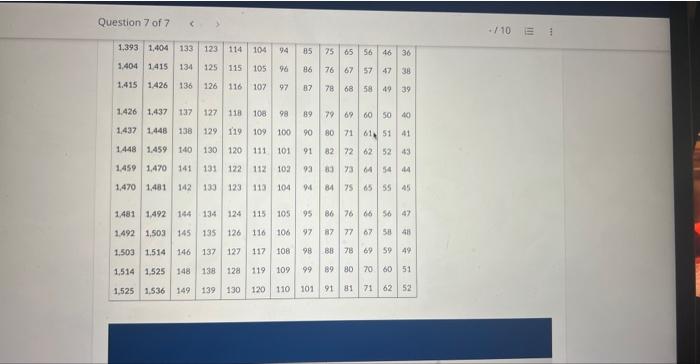

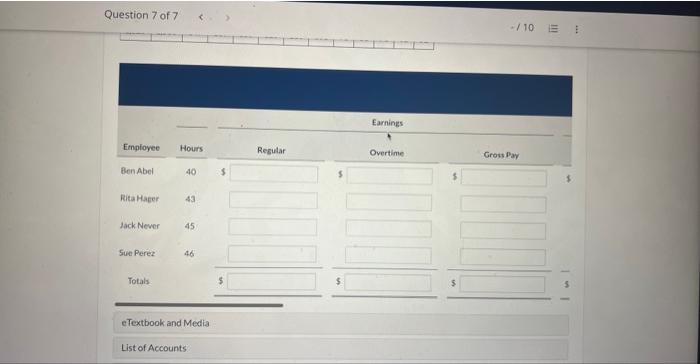

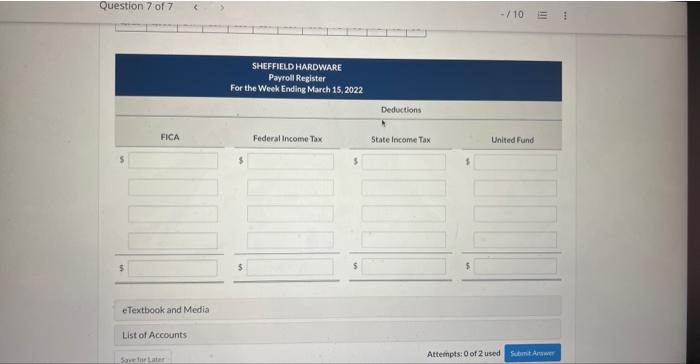

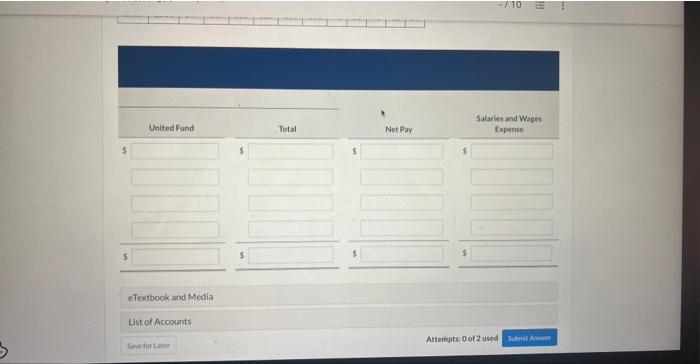

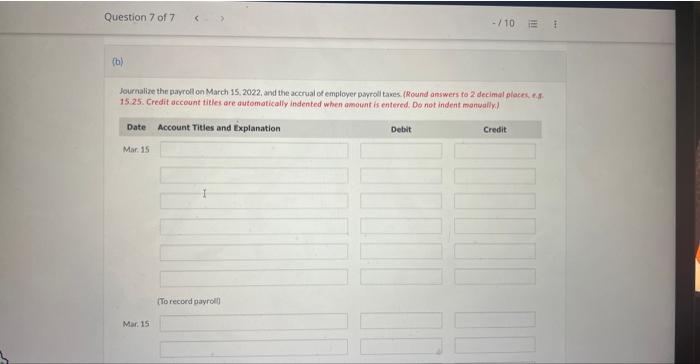

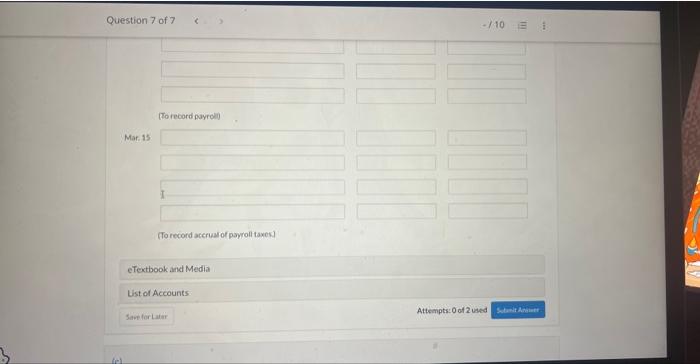

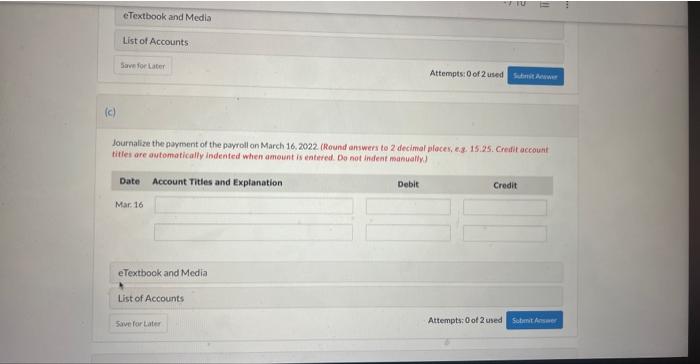

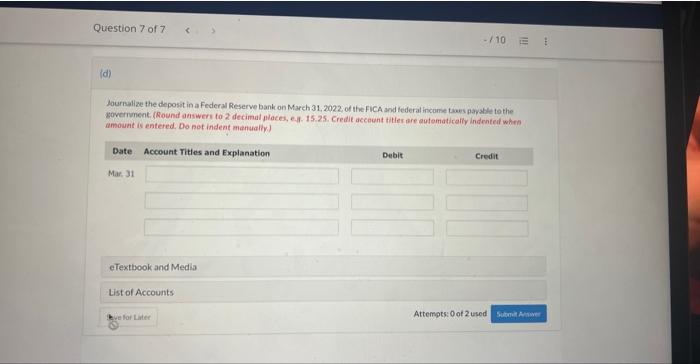

Shetheld Hardware has four employees who are paid on an hourly basis plus time and-a-half for all hours worked in excens of 40 a week. Payroll data for the week ended March 15, 2022 are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances respectively. The following tax rates are apolicable: FICA 7,65% state income taoes 3\%, state unemployment taxes 5.4%, and federal unemployment 0.6% Prepare a payroll register for the weekly payroll. No employee has reached the 50cial Security linit of $132,960 ae the FUTA/SUTA limit of $7,000. RReund answers fo 2 decimal naces, e. a. 15,25.. MARRIED Persans - WEEKLY Payroll Peried Fo Wages Paid through December inpza Question 7 of 7 +110 1 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|} \hline 1,393 & 1.404 & 133 & 123 & 114 & 104 & 94 & 85 & 75 & 65 & 56 & 46 & 36 \\ \hline 1,404 & 1.415 & 134 & 125 & 115 & 105 & 96 & 88 & 76 & 67 & 57 & 47 & 38 \\ \hline 1.415 & 1.426 & 136 & 126 & 116 & 107 & 97 & 87 & 78 & 68 & 58 & 49 & 39 \\ \hline 1.426 & 1,437 & 137 & 127 & 118 & 108 & 98 & 89 & 79 & 69 & 60 & 50 & 49 \\ \hline 1.437 & 1.448 & 138 & 129 & 119 & 109 & 100 & 90 & 80 & 71 & 61 & 51 & 41 \\ \hline 1.448 & 1.459 & 140 & 130 & 120 & 111 & 101 & 91 & 82 & 72 & 62 & 52 & 43 \\ \hline 1.459 & 1.470 & 141 & 133 & 122 & 112 & 102 & 93 & 63 & 73 & 64 & 54 & 44 \\ \hline 1,470 & 1.481 & 142 & 133 & 123 & 113 & 104 & 94 & 84 & 75 & 65 & 55 & 45 \\ \hline 1.481 & 1.492 & 144 & 134 & 124 & 115 & 105 & 95 & 86 & 76 & 66 & 56 & 47 \\ \hline 1.492 & 1,503 & 145 & 135 & 126 & 116 & 106 & 97 & 87 & 77 & 67 & 58 & 411 \\ \hline 1.503 & 1.514 & 146 & 137 & 127 & 117 & 108 & 98 & 88 & 78 & 69 & 59 & 49 \\ \hline 1.514 & 1,525 & 148 & 138 & 128 & 119 & 109 & 99 & 89 & 80 & 70 & 60 & 51 \\ \hline 1.525 & 1.536 & 149 & 139 & 130 & 120 & 110 & 101 & 91 & 81 & 71 & 62 & 52 \\ \hline \end{tabular} Journalize the payroll on March 15, 2022, and the accrial of employer payroll taks (Round answers fo 2 decimal places ef. 15.25. Credit account tielet are dutomaticalfy indented when amount is entered. Do not indent martwally.? Question 7 of 7 (To record payroli] Mar. 15 (To record acerua of payroll taxes] efextbook and Media List of Accounts Save foriare Attempts: 0 of 2 used Journalize the payment of the payroll on March 16. 2022 (Round answers to 2 decimal places, e. 15.25. Creifit account. tifles are aufomaficalfy indented when ameint is entered Do not indeat manually. lournalize the deposit in a Federal Reserve bank on March 31,2022, of the FiCA and federal incone taws payalle to the Government. (Round answer to 2 decimal glaces, e.j- 15.25. Credit account titler are dutamatically indented when amount is entered. Do not indent mannaliy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started