Answered step by step

Verified Expert Solution

Question

1 Approved Answer

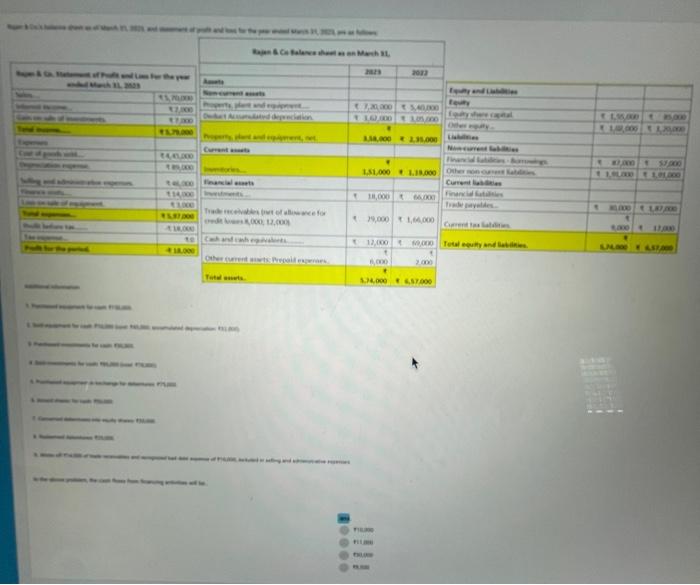

& C. Statement of Prof and Low For the year anded March 31, 2023 Finance Loss on sain of equipment Profit for the period of

& C. Statement of Prof and Low For the year anded March 31, 2023 Finance Loss on sain of equipment Profit for the period of March 31, 263 da 1 Pu Aug fm50.000. 4.Sot insener forca 3.000 78.000) 44 of 45,70,000 12,000 *7,000 aps, the c 14,45,000 89,000 hans 20.000 46,000 *14,000 3,000 *5.97,000 18,000 18,000 exchange for debetures: 75.000 2. Sot equipment sech (cost 45.000 accumulated depreciation: 32.000) Now current assets Property, plant and equipment... Deduct Accumulated depreciation. Rajan & Co Balance sheet as on March 31, Property, plant and equipment, net. Current assets Financial assets Investments.... Trade receivables (net of allowance for credit losses 8,000; 12,000). Cash and cash equivalents.... Other current assets: Prepaid expenses.. Total assets... debt expense of 10,000, included in selling and administrative expenses. ans 2023 7,20,000 3,62,000 3,58,000 2,35,000 1,51,000 * 1,19,000 18,000 66,000 12,000 X X 6,000 * 29,000 1,66,000 5,74,000 2022 $10,000 5,40,000 3,05,000 #11,000 30,000 8,500 Equity and Liabilities Equity Equity share capital Other equity.... Liabilities Non-current liabilities Financial liabilities-Borrowings * 6,57,000 Other non-current liabilities. Current liabilities Financial liabilities Trade payables... Current tax liabilities. 69,000 Total equity and liabilities. 2,000 1,55,000 1,02,000 * 87,000 * $5,000 1.20,000 $7,000 1,91,000 * 1,91,000 30,000 1,87,000 t 9,000 1- 17,000 5,74,000 # 6,57,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started