Answered step by step

Verified Expert Solution

Question

1 Approved Answer

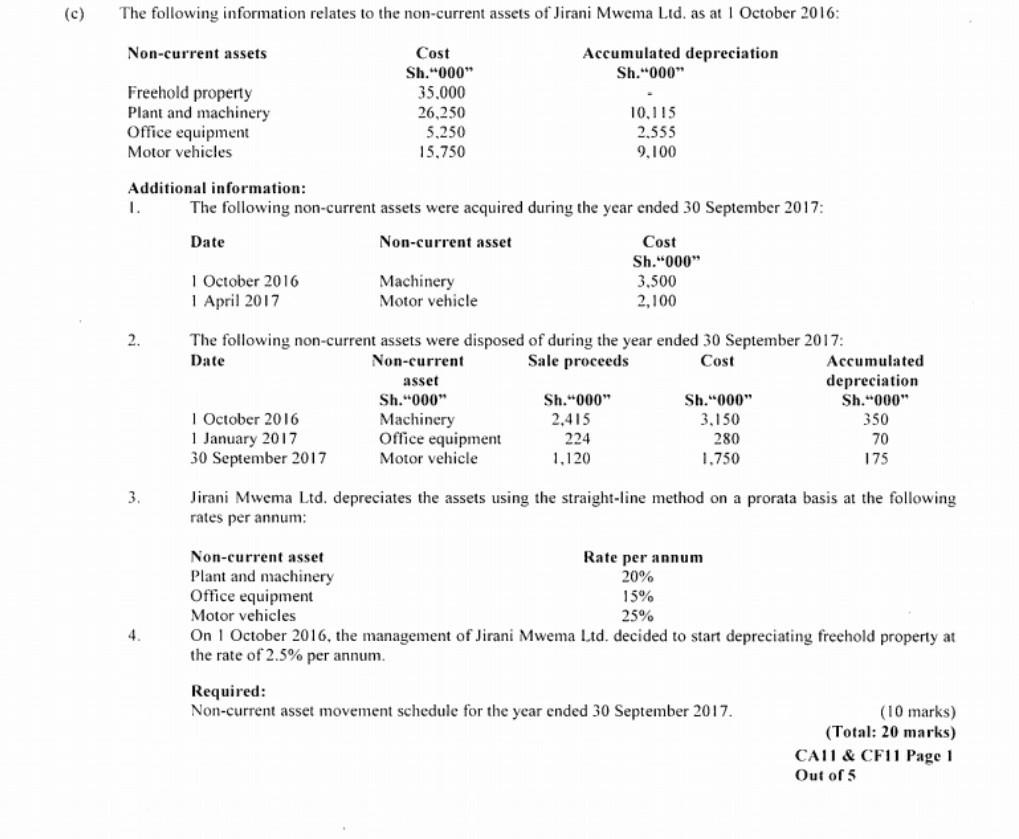

(c) The following information relates to the non-current assets of Jirani Mwema Ltd. as at 1 October 2016: Non-current assets Accumulated depreciation Sh.000 Freehold property

(c) The following information relates to the non-current assets of Jirani Mwema Ltd. as at 1 October 2016: Non-current assets Accumulated depreciation Sh."000" Freehold property Plant and machinery Office equipment Motor vehicles Cost Sh."000" 35.000 26,250 5.250 15.750 10,115 2.555 9,100 Additional information: 1. The following non-current assets were acquired during the year ended 30 September 2017: Date Non-current asset Cost Sh."000" 1 October 2016 Machinery 3.500 1 April 2017 Motor vehicle 2,100 2. The following non-current assets were disposed of during the year ended 30 September 2017: Date Non-current Sale proceeds Cost Accumulated asset depreciation Sh."000" Sh."000" Sh."000" Sh."000" 1 October 2016 Machinery 2,415 3,150 350 1 January 2017 Office equipment 224 280 70 30 September 2017 Motor vehicle 1.120 1.750 175 3 Jirani Mwema Ltd. depreciates the assets using the straight-line method on a prorata basis at the following rates per annum: 15% Non-current asset Rate per annum Plant and machinery 20% Office equipment Motor vehicles 25% On 1 October 2016, the management of Jirani Mwema Ltd. decided to start depreciating freehold property at the rate of 2.5% per annum. 4 Required: Non-current asset movement schedule for the year ended 30 September 2017. (10 marks) (Total: 20 marks) CAII & CF11 Page 1 Out of 5 (c) The following information relates to the non-current assets of Jirani Mwema Ltd. as at 1 October 2016: Non-current assets Accumulated depreciation Sh."000" Freehold property Plant and machinery Office equipment Motor vehicles Cost Sh."000" 35.000 26,250 5.250 15.750 10,115 2.555 9,100 Additional information: 1. The following non-current assets were acquired during the year ended 30 September 2017: Date Non-current asset Cost Sh."000" 1 October 2016 Machinery 3.500 1 April 2017 Motor vehicle 2,100 2. The following non-current assets were disposed of during the year ended 30 September 2017: Date Non-current Sale proceeds Cost Accumulated asset depreciation Sh."000" Sh."000" Sh."000" Sh."000" 1 October 2016 Machinery 2,415 3,150 350 1 January 2017 Office equipment 224 280 70 30 September 2017 Motor vehicle 1.120 1.750 175 3 Jirani Mwema Ltd. depreciates the assets using the straight-line method on a prorata basis at the following rates per annum: 15% Non-current asset Rate per annum Plant and machinery 20% Office equipment Motor vehicles 25% On 1 October 2016, the management of Jirani Mwema Ltd. decided to start depreciating freehold property at the rate of 2.5% per annum. 4 Required: Non-current asset movement schedule for the year ended 30 September 2017. (10 marks) (Total: 20 marks) CAII & CF11 Page 1 Out of 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started