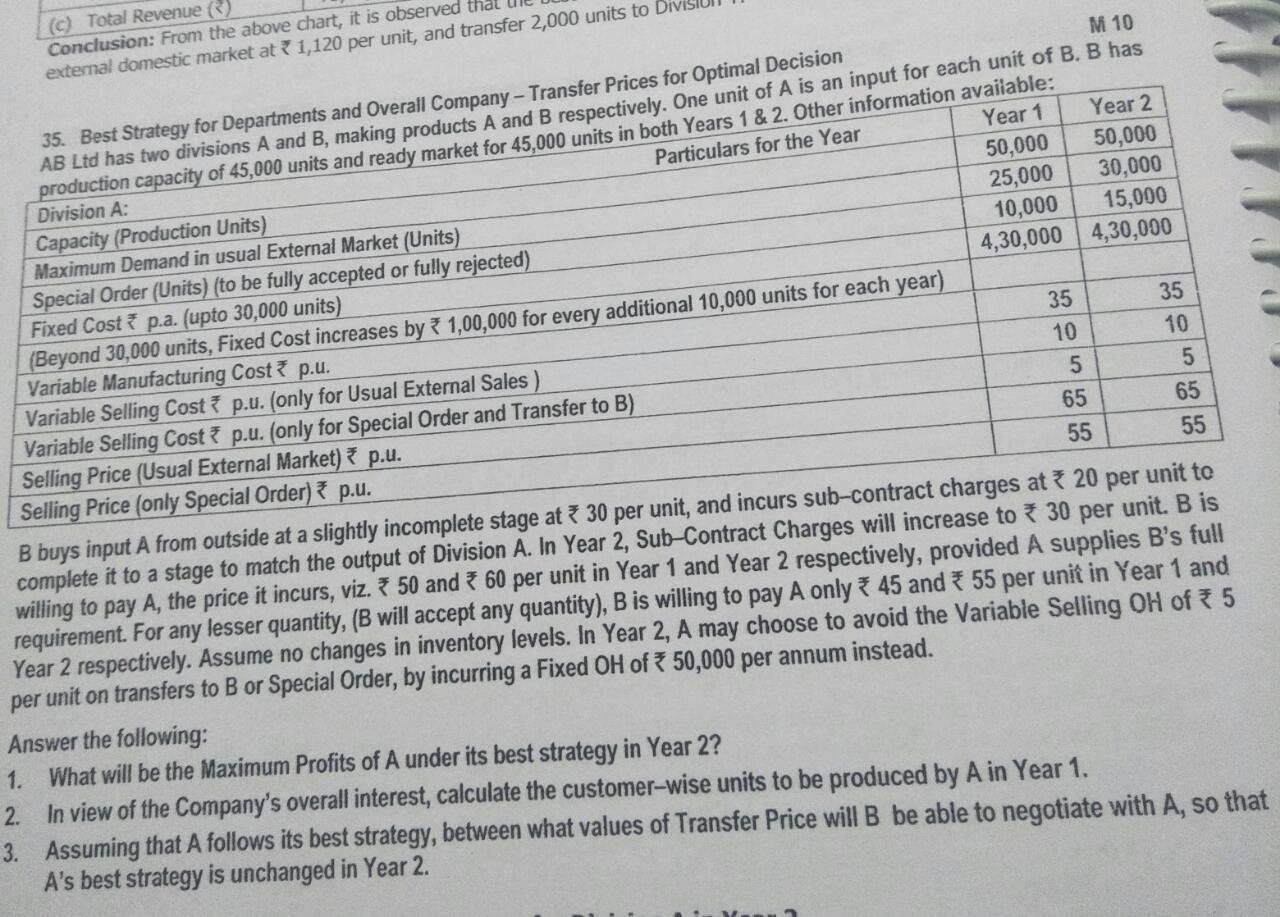

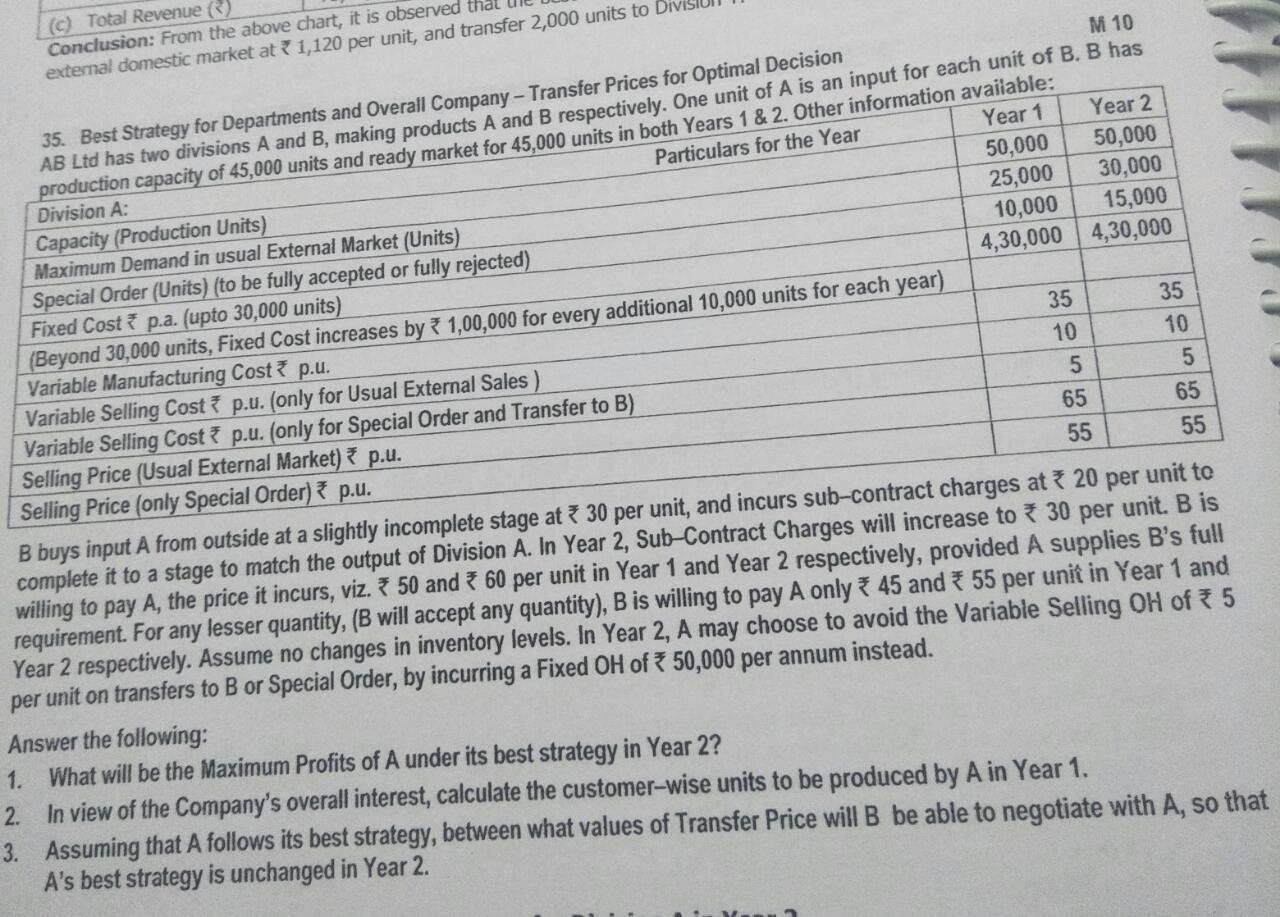

(c) Total Revenue (*) Conclusion: From the above chart, it is observed extemal domestic market at 1,120 per unit, and transfer 2,000 units to 50,000 M 10 35. Best Strategy for Departments and Overall Company - Transfer Prices for Optimal Decision AB Ltd has two divisions A and B, making products A and B respectively. One unit of A is an input for each unit of B. B has Year 2 Year 1 production capacity of 45,000 units and ready market for 45,000 units in both Years 1 & 2. Other information available: Particulars for the Year Division A: 50,000 Capacity (Production Units) 25,000 30,000 Maximum Demand in usual External Market (Units) 10,000 15,000 Special Order (Units) (to be fully accepted or fully rejected) 4,30,000 4,30,000 Fixed Cost * p.a. (upto 30,000 units) (Beyond 30,000 units, Fixed Cost increases by 31,00,000 for every additional 10,000 units for each year) 35 35 Variable Manufacturing Costp.u. 10 10 Variable Selling Cost p.u. (only for Usual External Sales ) 5 5 Variable Selling Cost* p.u. (only for Special Order and Transfer to B) Selling Price (Usual External Market) p.u. 65 65 Selling Price (only Special Order) ? p.u. 55 55 B buys input A from outside at a slightly incomplete stage at * 30 per unit, and incurs sub-contract charges at 20 per unit to complete it to a stage to match the output of Division A. In Year 2, Sub-Contract Charges will increase to 30 per unit. B is willing to pay A, the price it incurs, viz. * 50 and 60 per unit in Year 1 and Year 2 respectively, provided A supplies B's full requirement. For any lesser quantity, (B will accept any quantity), B is willing to pay A only * 45 and 55 per unit in Year 1 and Year 2 respectively. Assume no changes in inventory levels. In Year 2, A may choose to avoid the Variable Selling OH of 5 per unit on transfers to B or Special Order, by incurring a Fixed OH of 50,000 per annum instead. Answer the following: 1. What will be the Maximum Profits of A under its best strategy in Year 2? 2. In view of the Company's overall interest, calculate the customer-wise units to be produced by A in Year 1. 3. Assuming that A follows its best strategy, between what values of Transfer Price will B be able to negotiate with A, so that A's best strategy is unchanged in Year 2. (c) Total Revenue (*) Conclusion: From the above chart, it is observed extemal domestic market at 1,120 per unit, and transfer 2,000 units to 50,000 M 10 35. Best Strategy for Departments and Overall Company - Transfer Prices for Optimal Decision AB Ltd has two divisions A and B, making products A and B respectively. One unit of A is an input for each unit of B. B has Year 2 Year 1 production capacity of 45,000 units and ready market for 45,000 units in both Years 1 & 2. Other information available: Particulars for the Year Division A: 50,000 Capacity (Production Units) 25,000 30,000 Maximum Demand in usual External Market (Units) 10,000 15,000 Special Order (Units) (to be fully accepted or fully rejected) 4,30,000 4,30,000 Fixed Cost * p.a. (upto 30,000 units) (Beyond 30,000 units, Fixed Cost increases by 31,00,000 for every additional 10,000 units for each year) 35 35 Variable Manufacturing Costp.u. 10 10 Variable Selling Cost p.u. (only for Usual External Sales ) 5 5 Variable Selling Cost* p.u. (only for Special Order and Transfer to B) Selling Price (Usual External Market) p.u. 65 65 Selling Price (only Special Order) ? p.u. 55 55 B buys input A from outside at a slightly incomplete stage at * 30 per unit, and incurs sub-contract charges at 20 per unit to complete it to a stage to match the output of Division A. In Year 2, Sub-Contract Charges will increase to 30 per unit. B is willing to pay A, the price it incurs, viz. * 50 and 60 per unit in Year 1 and Year 2 respectively, provided A supplies B's full requirement. For any lesser quantity, (B will accept any quantity), B is willing to pay A only * 45 and 55 per unit in Year 1 and Year 2 respectively. Assume no changes in inventory levels. In Year 2, A may choose to avoid the Variable Selling OH of 5 per unit on transfers to B or Special Order, by incurring a Fixed OH of 50,000 per annum instead. Answer the following: 1. What will be the Maximum Profits of A under its best strategy in Year 2? 2. In view of the Company's overall interest, calculate the customer-wise units to be produced by A in Year 1. 3. Assuming that A follows its best strategy, between what values of Transfer Price will B be able to negotiate with A, so that A's best strategy is unchanged in Year 2