Answered step by step

Verified Expert Solution

Question

1 Approved Answer

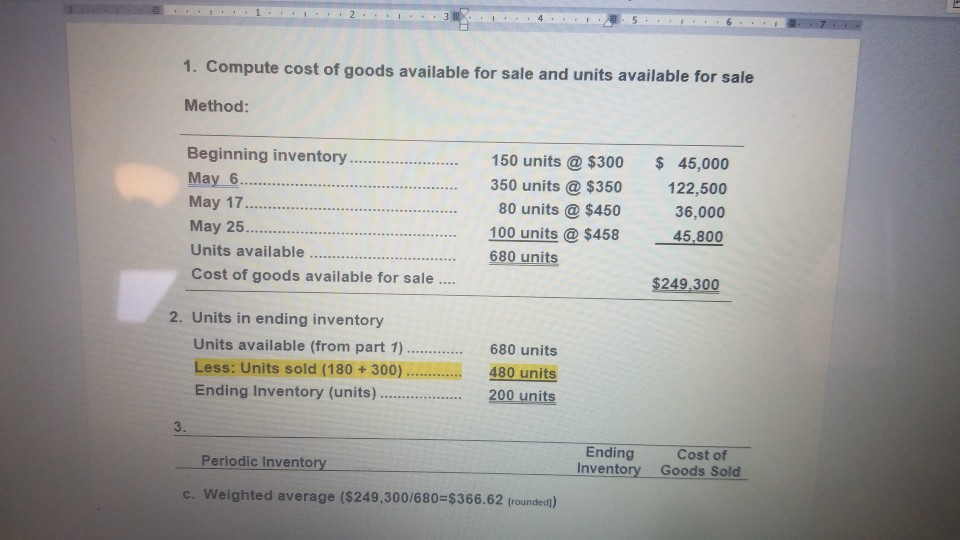

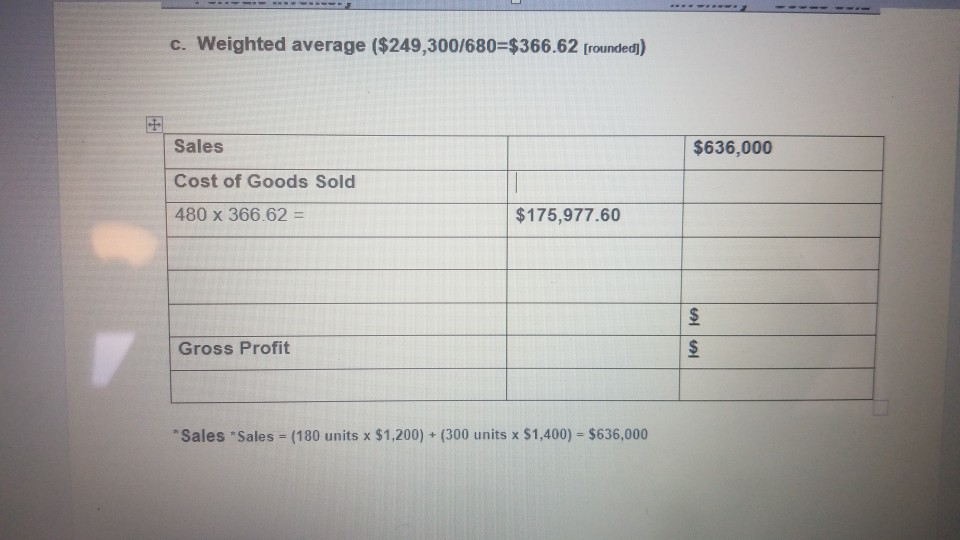

c. Weighted average ($249,300/680=$366.62 (rounded) Sales $636,000 Cost of Goods Sold 480 x 366.62 = $175,977.60 Gross Profit Ion *Sales Sales = (180 units x

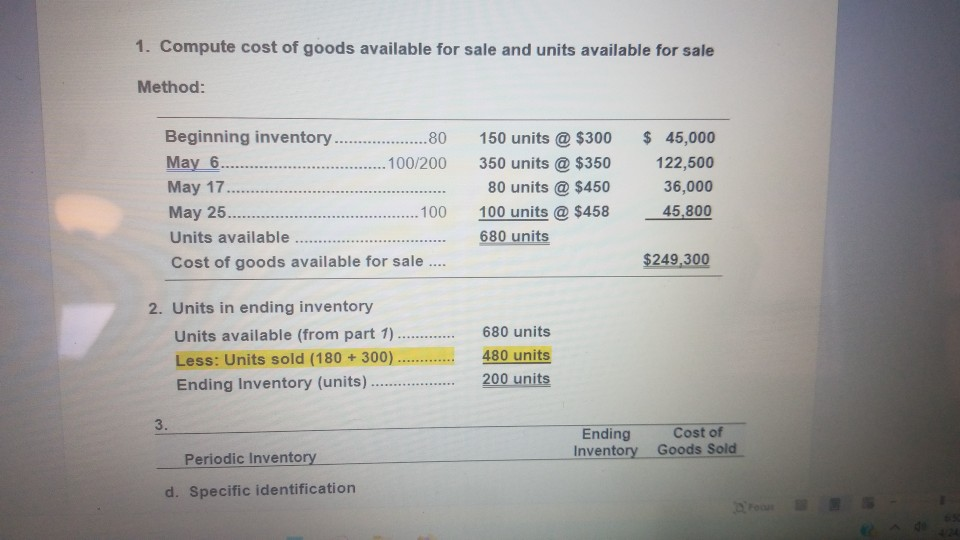

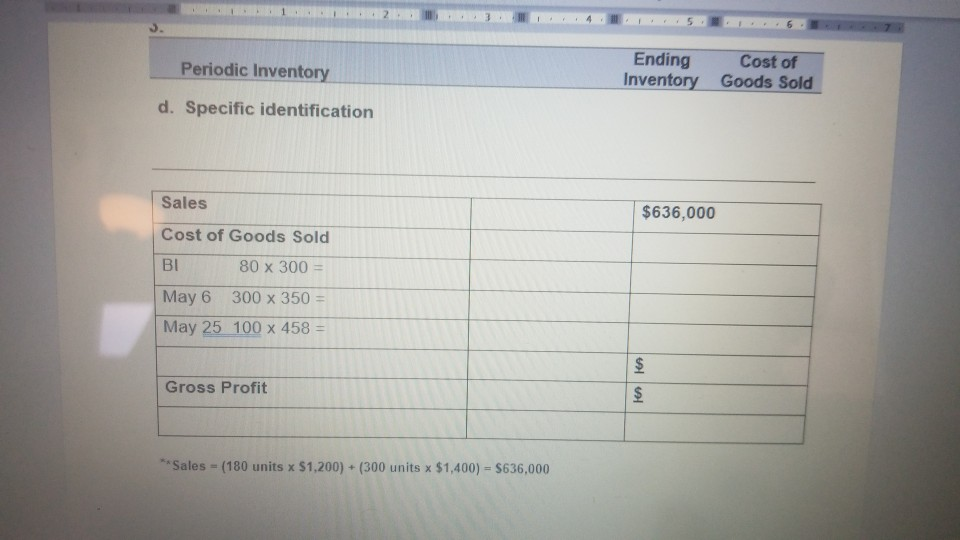

c. Weighted average ($249,300/680=$366.62 (rounded) Sales $636,000 Cost of Goods Sold 480 x 366.62 = $175,977.60 Gross Profit Ion *Sales Sales = (180 units x $1,200) + (300 units x 51,400) - $636,000 1. Compute cost of goods available for sale and units available for sale Method: Beginning inventory ....................80 May 6. ........ 100/200 May 17 ....... May 25. ................ 100 Units available ......... Cost of goods available for sale .... 150 units @ $300 350 units @ $350 80 units @ $450 100 units @ $458 680 units $ 45,000 122,500 36,000 45,800 36 $249,300 2. Units in ending inventory Units available (from part 1)....... Less: Units sold (180 + 300).. Ending Inventory (units). 680 units 480 units 200 units Ending Inventory Cost of Goods Sold Periodic Inventory d. Specific identification 2 Periodic Inventory Ending Inventory Cost of Goods Sold d. Specific identification Sales $636,000 Cost of Goods Sold BI 80 x 300 = May 6 300 x 350 May 25 100 x 458 = le Gross Profit **Sales - (180 units x $1,200) + (300 units x $1,400) - $636,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started