Answered step by step

Verified Expert Solution

Question

1 Approved Answer

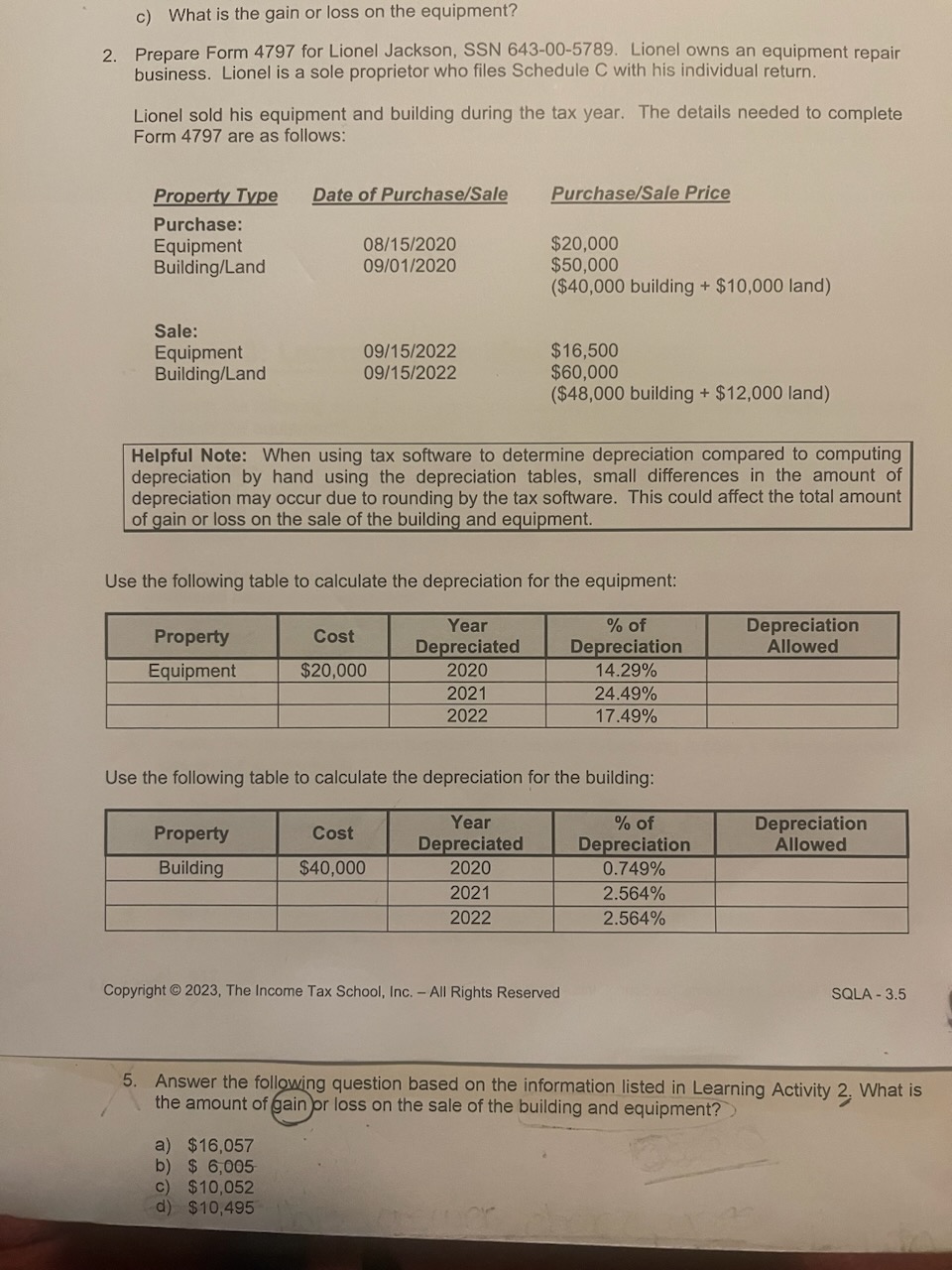

c) What is the gain or loss on the equipment? 2. Prepare Form 4797 for Lionel Jackson, SSN 643-00-5789. Lionel owns an equipment repair

c) What is the gain or loss on the equipment? 2. Prepare Form 4797 for Lionel Jackson, SSN 643-00-5789. Lionel owns an equipment repair business. Lionel is a sole proprietor who files Schedule C with his individual return. Lionel sold his equipment and building during the tax year. The details needed to complete Form 4797 are as follows: Property Type Date of Purchase/Sale Purchase: Equipment Building/Land Sale: Equipment Building/Land Property Equipment 08/15/2020 09/01/2020 09/15/2022 09/15/2022 Property Building Helpful Note: When using tax software to determine depreciation compared to computing depreciation by hand using the depreciation tables, small differences in the amount of depreciation may occur due to rounding by the tax software. This could affect the total amount of gain or loss on the sale of the building and equipment. Use the following table to calculate the depreciation for the equipment: % of Year Depreciated 2020 Depreciation 14.29% Cost $20,000 a) $16,057 b) $ 6,005- c) $10,052 d) $10,495 Purchase/Sale Price $20,000 $50,000 ($40,000 building + $10,000 land) 2021 2022 Cost $40,000 $16,500 $60,000 ($48,000 building + $12,000 land) Use the following table to calculate the depreciation for the building: Year Depreciated 2020 2021 2022 Copyright 2023, The Income Tax School, Inc. - All Rights Reserved 24.49% 17.49% % of Depreciation 0.749% 2.564% 2.564% Depreciation Allowed Depreciation Allowed SQLA -3.5 5. Answer the following question based on the information listed in Learning Activity 2. What is the amount of gain or loss on the sale of the building and equipment?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the gain or loss on the sale of the building and equipment for Lionel Jackson we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started