Answered step by step

Verified Expert Solution

Question

1 Approved Answer

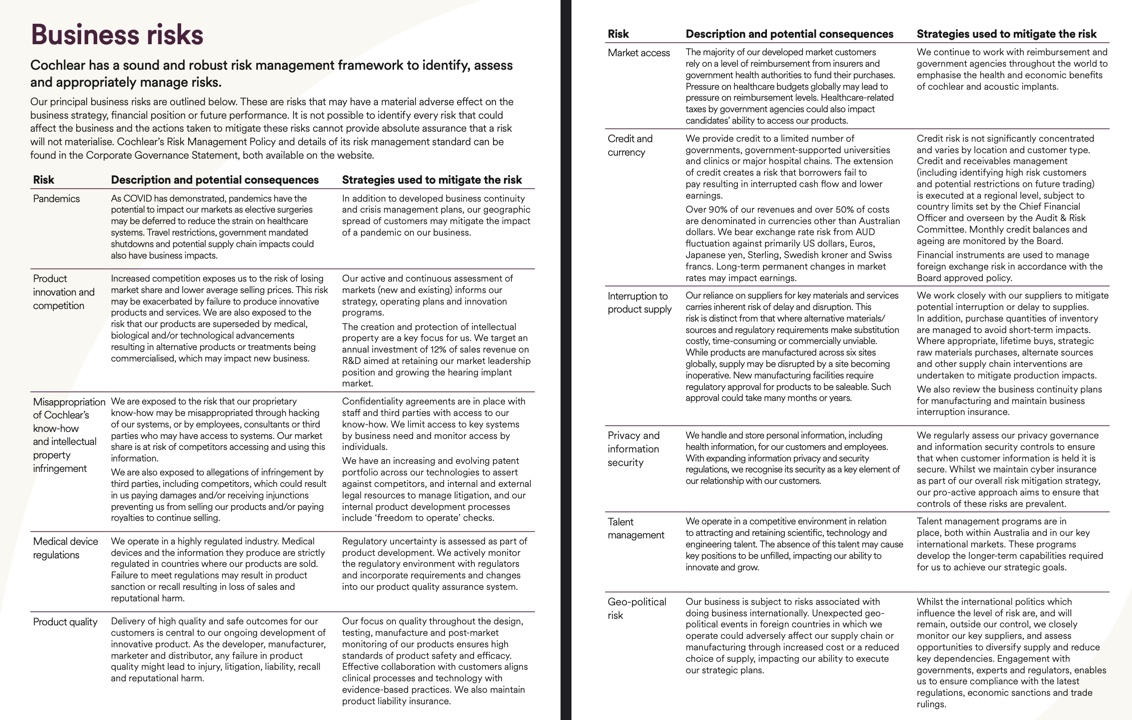

Which of the risks identified in COH's 2022 annual report (pages 52-53) will affect its beta? Which of the risks identified there will affect COH's

Which of the risks identified in COH's 2022 annual report (pages 52-53) will affect its beta? Which of the risks identified there will affect COH's unsystematic risks? Explain clearly.

Business risks Cochlear has a sound and robust risk management framework to identify, assess and appropriately manage risks. Our principal business risks are outlined below. These are risks that may have a material adverse effect on the business strategy, financial position or future performance. It is not possible to identify every risk that could affect the business and the actions taken to mitigate these risks cannot provide absolute assurance that a risk will not materialise. Cochlear's Risk Management Policy and details of its risk management standard can be found in the Corporate Governance Statement, both available on the website. Risk Pandemics Product innovation and competition Misappropriation of Cochlear's know-how and intellectual property infringement Medical device regulations Description and potential consequences As COVID has demonstrated, pandemics have the potential to impact our markets as elective surgeries may be deferred to reduce the strain on healthcare systems. Travel restrictions, government mandated shutdowns and potential supply chain impacts could also have business impacts. Increased competition exposes us to the risk of losing market share and lower average selling prices. This risk may be exacerbated by failure to produce innovative products and services. We are also exposed to the risk that our products are superseded by medical, biological and/or technological advancements resulting in alternative products or treatments being commercialised, which may impact new business. We are exposed to the risk that our proprietary know-how may be misappropriated through hacking of our systems, or by employees, consultants or third parties who may have access to systems. Our market share is at risk of competitors accessing and using this information. We are also exposed to allegations of infringement by third parties, including competitors, which could result in us paying damages and/or receiving injunctions preventing us from selling our products and/or paying royalties to continue selling. We operate in a highly regulated industry. Medical devices and the information they produce are strictly regulated in countries where our products are sold. Failure to meet regulations may result in product sanction or recall resulting in loss of sales and reputational harm. Product quality Delivery of high quality and safe outcomes for our customers is central to our ongoing development of innovative product. As the developer, manufacturer, marketer and distributor, any failure in product quality might lead to injury, litigation, liability, recall and reputational harm. Strategies used to mitigate the risk In addition to developed business continuity and crisis management plans, our geographic spread of customers may mitigate the impact of a pandemic on our business. Our active and continuous assessment of markets (new and existing) informs our strategy, operating plans and innovation programs. The creation and protection of intellectual property are a key focus for us. We target an annual investment of 12% of sales revenue on R&D aimed at retaining our market leadership position and growing the hearing implant market. Confidentiality agreements are in place with staff and third parties with access to our know-how. We limit access to key systems by business need and monitor access by individuals. We have an increasing and evolving patent portfolio across our technologies to assert against competitors, and internal and external legal resources to manage litigation, and our internal product development processes include 'freedom to operate' checks. Regulatory uncertainty is assessed as part of product development. We actively monitor the regulatory environment with regulators and incorporate requirements and changes into our product quality assurance system. Our focus on quality throughout the design, testing, manufacture and post-market monitoring of our products ensures high standards of product safety and efficacy. Effective collaboration with customers aligns clinical processes and technology with evidence-based practices. We also maintain product liability insurance. Risk Market access Credit and currency Privacy and information security Talent management Interruption to Our reliance on suppliers for key materials and services product supply carries inherent risk of delay and disruption. This risk is distinct from that where alternative materials/ sources and regulatory requirements make substitution costly, time-consuming or commercially unviable. While products are manufactured across six sites globally, supply may be disrupted by a site becoming inoperative. New manufacturing facilities require regulatory approval for products to be saleable. Such approval could take many months or years. Geo-political Description and potential consequences The majority of our developed market customers rely on a level of reimbursement from insurers and government health authorities to fund their purchases. Pressure on healthcare budgets globally may lead to pressure on reimbursement levels. Healthcare-related taxes by government agencies could also impact candidates' ability to access our products. risk We provide credit to a limited number of governments, government-supported universities and clinics or major hospital chains. The extension of credit creates a risk that borrowers fail to pay resulting in interrupted cash flow and lower earnings. Over 90% of our revenues and over 50% of costs are denominated in currencies other than Australian dollars. We bear exchange rate risk from AUD fluctuation against primarily US dollars, Euros, Japanese yen, Sterling, Swedish kroner and Swiss francs. Long-term permanent changes in market rates may impact earnings. We handle and store personal information, including health information, for our customers and employees. With expanding information privacy and security regulations, we recognise its security as a key element of our relationship with our customers. We operate in a competitive environment in relation to attracting and retaining scientific, technology and engineering talent. The absence of this talent may cause key positions to be unfilled, impacting our ability to innovate and grow. Our business is subject to risks associated with doing business internationally. Unexpected geo- political events in foreign countries in which wer operate could adversely affect our supply chain or manufacturing through increased cost or a reduced choice of supply, impacting our ability to execute our strategic plans. Strategies used to mitigate the risk We continue to work with reimbursement and government agencies throughout the world to emphasise the health and economic benefits of cochlear and acoustic implants. Credit risk is not significantly concentrated and varies by location and customer type. Credit and receivables management (including identifying high risk customers. and potential restrictions on future trading) is executed at a regional level, subject to country limits set by the Chief Financial Officer and overseen by the Audit & Risk Committee. Monthly credit balances and ageing are monitored by the Board. Financial instruments are used to manage foreign exchange risk in accordance with the Board approved policy. We work closely with our suppliers to mitigate potential interruption or delay to supplies. In addition, purchase quantities of inventory are managed to avoid short-term impacts. Where appropriate, lifetime buys, strategic raw materials purchases, alternate sources and other supply chain interventions are undertaken to mitigate production impacts. We also review the business continuity plans for manufacturing and maintain business interruption insurance. We regularly assess our privacy governance and information security controls to ensure that when customer information is held it is secure. Whilst we maintain cyber insurance as part of our overall risk mitigation strategy, our pro-active approach aims to ensure that controls of these risks are prevalent. Talent management programs are in place, both within Australia and in our key international markets. These programs develop the longer-term capabilities required for us to achieve our strategic goals. Whilst the international politics which influence the level of risk are, and will remain, outside our control, we closely monitor our key suppliers, and assess opportunities to diversify supply and reduce key dependencies. Engagement with governments, experts and regulators, enables us to ensure compliance with the latest regulations, economic sanctions and trade rulings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Beta measures the systematic risk of a stock which is the risk associated with the broader market fluctuations Its influenced by factors affecting the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started