Answered step by step

Verified Expert Solution

Question

1 Approved Answer

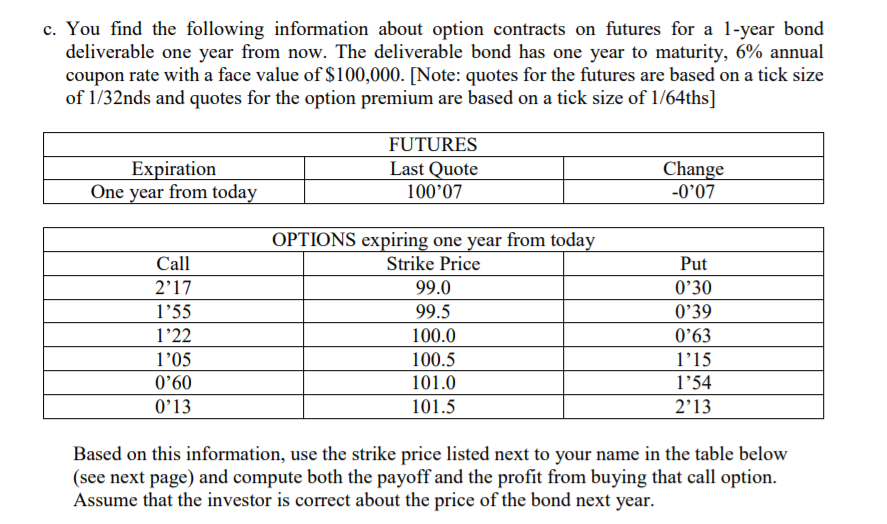

c. You find the following information about option contracts on futures for a 1-year bond deliverable one year from now. The deliverable bond has

c. You find the following information about option contracts on futures for a 1-year bond deliverable one year from now. The deliverable bond has one year to maturity, 6% annual coupon rate with a face value of $100,000. [Note: quotes for the futures are based on a tick size of 1/32nds and quotes for the option premium are based on a tick size of 1/64ths] Expiration One year from today Call 2'17 1'55 1'22 1'05 0'60 0'13 FUTURES Last Quote 100'07 OPTIONS expiring one year from today Strike Price 99.0 99.5 100.0 100.5 101.0 101.5 Change -0'07 Put 0'30 0'39 0'63 1'15 1'54 2'13 Based on this information, use the strike price listed next to your name in the table below (see next page) and compute both the payoff and the profit from buying that call option. Assume that the investor is correct about the price of the bond next year.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To compute the payoff and profit from buying a call option we need to determine the strike price and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started